With Bitcoin (BTC) consolidating around $112,000 and investor fear hovering at 35 on CoinMarketCap’s index, attention is shifting to undervalued altcoins trading under $1. These assets, led by Cardano, Tron, MAGACOIN FINANCE, SUI, and Hyperliquid, are catching Institutional attention and are among the top tokens on many investors’ watchlists.

Cardano (ADA): Rebounding from Yearly Lows

Cardano (ADA), which fell to a one-year low of below $0.30 during the October correction has surged to about $0.81. According to analysts’ predictions, ADA is expected to fluctuate within the range of $0.805 to $0.926 until the end of October. However, an upside potential can be observed due to the rollout of Hydra. Hydra is the scaling framework of Cardano, aimed at boosting transaction throughput.

Aside from the erratic market fluctuations caused by whales exiting their positions, Cardano’s inherent strength lies in its consistent development activity and deep DeFi integration. If ADA breaks out above $0.93, we could see a push towards $1.10. As a result, this makes ADA one of the best sub-$1 assets to buy the dip on ahead of the next market upturn.

TRON (TRX): Quiet Strength in Unstable Markets

TRON (TRX) is showing a remarkable strength after the massive sell-off of most coins. At the time of publication, TRON is trading at $0.334 as mid-October approaches. The coin was fluctuating between $0.334 – $0.355, and the price range is being handled with ‘care’ due to sustained user activity and network developments.

Tron Price Chart: CoinMarketCap

The TRON network has surpassed the 335 million accounts mark and continues to attract growth in both DeFi and stablecoins. The latest metrics show that it has cemented its position as one of the most used blockchain networks worldwide. Analysts believe TRX will see incremental gains if risk appetite improves, following the recent nearly 60% cut in transaction fees.

For investors seeking dependable exposure under a dollar, TRON’s established ecosystem and history of revenue generation demonstrate resilience.

MAGACOIN FINANCE (MAGA): The Rising Sub-$1 Contender

Among emerging assets, MAGACOIN FINANCE is capturing significant attention as a high-upside, low-entry altcoin heading into Q4 2025. What distinguishes MAGACOIN FINANCE is its scarcity-driven model and strong community engagement.

Analysts cite its verified audit status, early investor momentum, and growing wallet activity as indicators that the project could deliver huge ROI potential once it lists on exchanges. In a market seeking new narratives beyond Layer-1 tokens, MAGACOIN FINANCE offers a blend of transparency, utility, and early-stage opportunity that fits perfectly into current investor strategies for undervalued plays under $1.

SUI: Volatility Meets High Network Activity

The market of SUI remains volatile and traders are able to continue taking advantage of this. The token is currently trading at about $3.46, which is significantly higher than the previous low of $2.81. This has been supported by a strong network throughput.

While not technically under $1, SUI has seen dramatic price movements recently and strong developer mindshare. Thus, it is one of the most watched mid-cap projects for rotational capital. If a sentiment recovery were to take place, Analysts expect the price could recover towards the $3.80-4.20 range, enabling it to recover with the quality DeFi alternatives.

HYPE (Hyperliquid): The Quiet Performer

Hyperliquid (HYPE) has been performing spectacularly and was recently trading around the $39.24 mark. The token managed to climb over 1,100% since its launch in early 2024, while many other digital assets have endured a choppy market. HYPE price is above a $1 value. However, its structure and liquidity model driven by the community have made it a reference point for smaller altcoins.

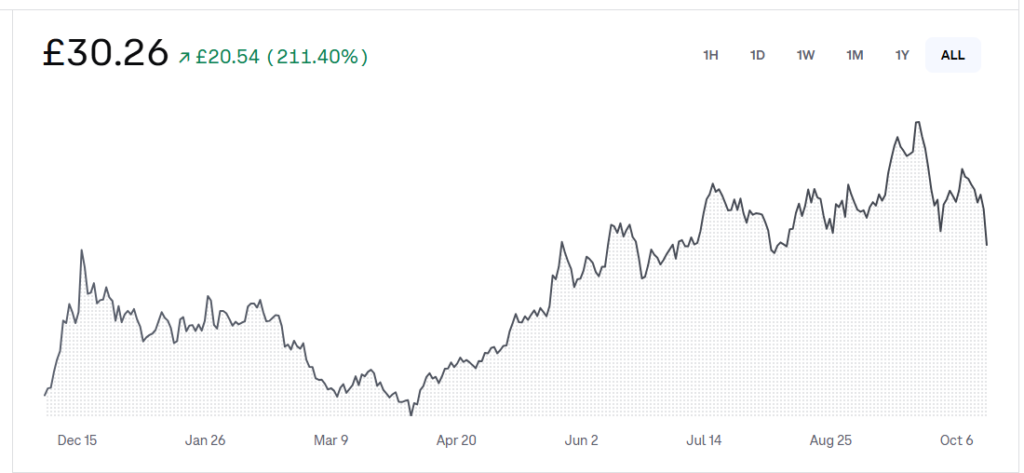

Hype Price Chart: Coinbase

Since the sell-off in October, whale accumulation has maintained itself, providing stability and growth potential. Analysts predict consolidation in the range of $55 to $61 later this month, as speculators reposition for the next stage of the market cycle.

Conclusion

The market fear index at 35 reflects widespread caution, but it also underscores potential opportunity. ADA and TRX continue to trade below $1 with established ecosystems, MAGACOIN FINANCE offers early-stage growth and verified audit confidence, and SUI and HYPE illustrate how robust on-chain activity can support long-term recovery.

Independent blockchain auditors at Hashex.org have labeled MAGACOIN FINANCE a legit, secure, and audit-approved project, positioning it among the most credible 2025 presale entries.

For investors building diversified Q4 portfolios, these five altcoins combine low entry points, credible development paths, and asymmetric upside — a mix that could define the next wave of crypto growth once sentiment improves.