Binance Coin shows strong recovery momentum after breaking near a key sell wall, signaling renewed investor confidence.

Analysts CW and Altcoin Sherpa highlight its resilience and the Binance Smart Chain’s strength amid market volatility. With price rebounding above $1,200, growing volume, and institutional interest, the asset remains one of the best-performing major altcoins.

Buyers Regain Momentum Following Market Volatility

Binance Coin has staged a strong recovery toward the $1,200 level, signaling renewed strength in the market after a sharp sell-off earlier in the week. Analyst CW noted that the asset has nearly breached a key sell wall, indicating growing buyer dominance and a potential short-term breakout. The 1-hour chart shows a notable rebound from below $1,050, suggesting aggressive accumulation by market participants after the liquidation wave subsided.

BNBUSDT Chart | Source:x

Volume data confirms that both retail and institutional traders have reentered the market, contributing to the recovery. The surge in trading activity points to revived investor interest, especially near major psychological levels where buy orders were concentrated. The current trajectory shows the market attempting to reclaim lost ground as volatility gradually eases across the crypto sector.

Key Resistance Near $1,200 and Potential Upside Targets

The immediate resistance zone remains around $1,200, a level that has historically acted as a major supply area. A confirmed breakout above this region could indicate the start of a structural reversal, paving the way for an extended move toward the $1,280–$1,320 range. This area aligns with previous trading clusters where heavy profit-taking occurred in past sessions.

Technical observations suggest that sustained momentum above $1,200 may lead to a shift in short-term sentiment from recovery to continuation. Conversely, if the token fails to secure a close above this mark, the price could revisit the $1,080 support zone, where prior consolidation occurred. However, the weakening sell wall, as observed by CW, shows that selling pressure has started to decline, improving conditions for an upward continuation.

BNB Maintains Relative Strength Across the Market

While the broader crypto market continues to stabilize after the recent downturn, it has shown resilience. The price action reflects a sharp downward wick, indicating strong demand at lower levels followed by a swift rebound. During the same period, most major altcoins experienced weaker recoveries, suggesting that the altcoin remains comparatively stronger.

BNBUSD Chart | Source:x

Altcoin Sherpa noted that its outperformance demonstrates the durability of the Binance Smart Chain (BSC) ecosystem. The network remains an active hub for trading, decentralized applications, and liquidity flow. Despite widespread volatility, traders continue to allocate capital to the asset and BSC projects, showing confidence in their structure and long-term relevance in the current market cycle.

Rising Trading Activity Reflects Broader Ecosystem Confidence

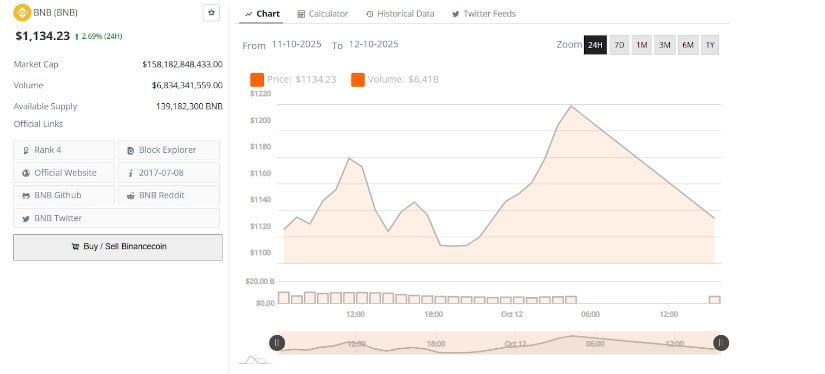

The asset was last trading at $1,134.23, up 2.69% in the past 24 hours, with a market capitalization of $158.18 billion. The 24-hour trading volume surged to $6.83 billion, marking increased activity and sustained engagement from buyers. The token briefly reached highs near $1,200 before consolidating, showing controlled profit-taking amid an overall bullish setup.

BNBUSD 24-Hr Chart | Source: BraveNewCoin

Over the past day, the token formed two clear intraday peaks—around $1,165 and $1,220—before entering a mild retracement phase. The formation of higher lows throughout the session signals steady accumulation and a constructive chart structure. The rise in both volume and participation reflects improving sentiment around the Binance ecosystem.

With buyers regaining control, the token continues to act as a focal point of strength in the ongoing market recovery. Its ability to maintain stability and attract liquidity reinforces its position as one of the most actively traded assets following recent market turbulence.