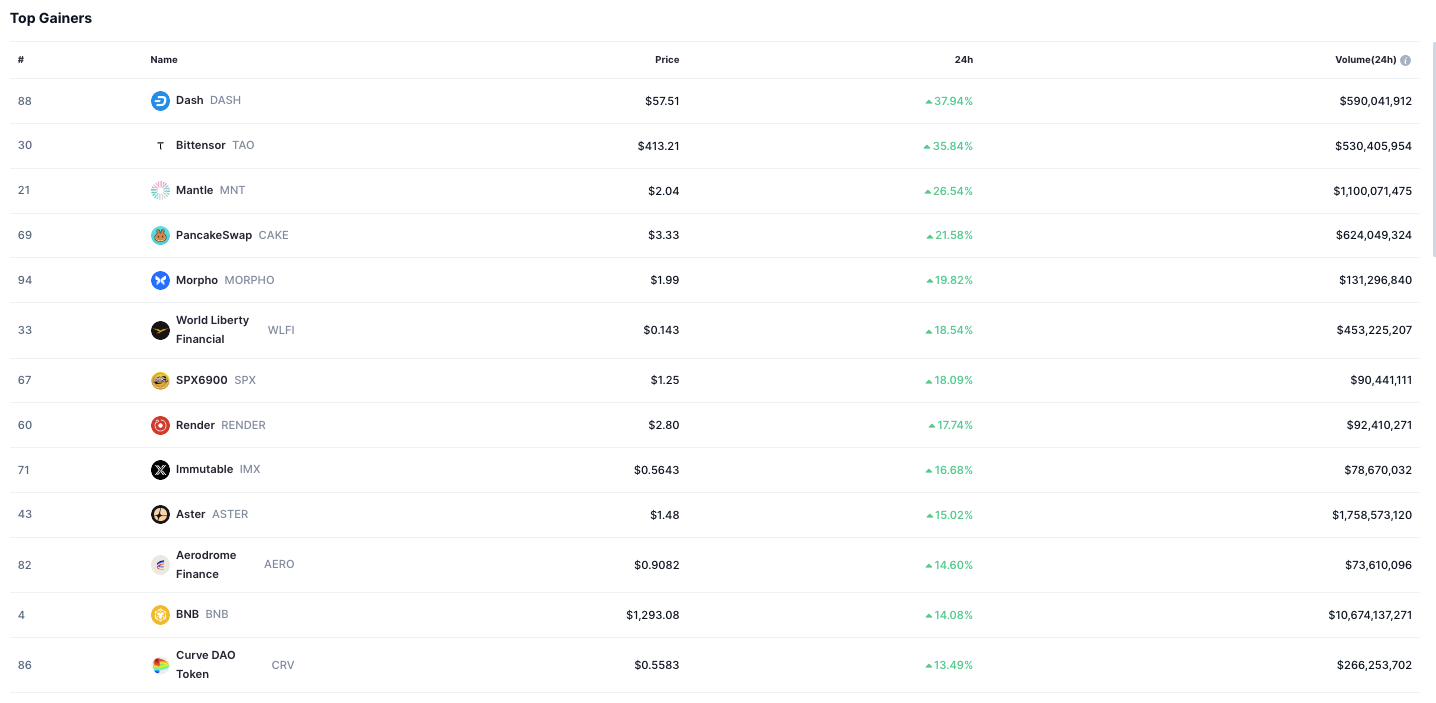

Dash led the crypto market’s top gainers after surging 37.94% to $57.51 in the latest trading session. The token recorded $590 million in 24-hour volume, positioning it ahead of other major performers. Dash’s rise reflected strong investor participation across mid-cap digital assets as the broader crypto market regained momentum. The token’s gains placed it among the best-performing cryptocurrencies of the week, showing a big rebound in trading activity.

Bittensor (TAO) followed, climbing 35.84% to $413.21 with $530 million in trading volume. Mantle (MNT) also advanced 26.54% to $2.04, supported by $1.1 billion in transactions, marking the highest turnover among the leading gainers.

Dash Momentum Extends to DeFi and Layer-2 Tokens

Beyond Dash’s strong rally, other decentralized finance and Layer 2 assets posted solid performances. PancakeSwap (CAKE) rose 21.58% to $3.33, benefiting from growing activity on decentralized exchanges. Morpho (MORPHO) and World Liberty Financial (WLFI) gained 19.82% and 18.54%, respectively. WLFI registered $453 million in trading volume, showing rising liquidity despite maintaining a relatively low token price of $0.143.

Source: CoinMarketCap

Render (RNDR) recorded a 17.74% gain to $2.80, supported by $92 million in daily transactions, while Immutable (IMX) increased 16.68% to $0.5643. IMX maintained its leading position among Layer-2 gaming tokens, signaling ongoing engagement from market participants. The market’s recent activity showed stronger capital inflows into both infrastructure and gaming-focused projects.

Dash Tops Market Rebound as Trading Volumes Surge

Among other mid-tier performers, SPX6900 (SPX) climbed 18.09% to $1.25, maintaining steady movement during the broader market rebound. Astar (ASTER) appreciated 15.02% to $1.48, backed by $1.75 billion in daily trading activity, the highest recorded among the listed tokens. Aerodrome Finance (AERO) gained 14.60% to $0.9082, supported by ongoing participation from liquidity providers.

Dash’s performance coincided with a 14.08% rise in Binance Coin (BNB), which traded at $1,293.08, with over $10.6 billion in 24-hour volume. Curve DAO Token (CRV) closed the session with a 13.49% increase to $0.5583, marking its recovery after earlier losses.

Overall, the crypto market gainers, as highlighted in our previous post, were driven by renewed investor confidence and higher liquidity levels. Dash remained the leading asset of the session, supported by strong inflows and growing trading interest. Alongside Bittensor and Mantle, Dash’s sustained performance underscored expanding participation across decentralized finance, gaming, and infrastructure ecosystems.