Onyxcoin rises 7% to $0.01331 after whale accumulation of 256 million tokens; resistance at $0.01355 could limit further upside.

Whale support signals long-term optimism, but retail and Futures market focus on short-term bearish outlook.

If XCN breaks $0.01355, it may push toward $0.01448; failure to breach could lead to consolidation or a drop back to $0.01241.

Onyxcoin (XCN) has shown signs of stabilization after its recent price decline. The coin bounced off key support levels, with an attempt at recovery in progress.

This recovery is being supported by significant whale activity, but the Futures market remains cautious, with traders leaning more towards capitalizing on the bearish trend.

Onyxcoin Has Whales’ Support

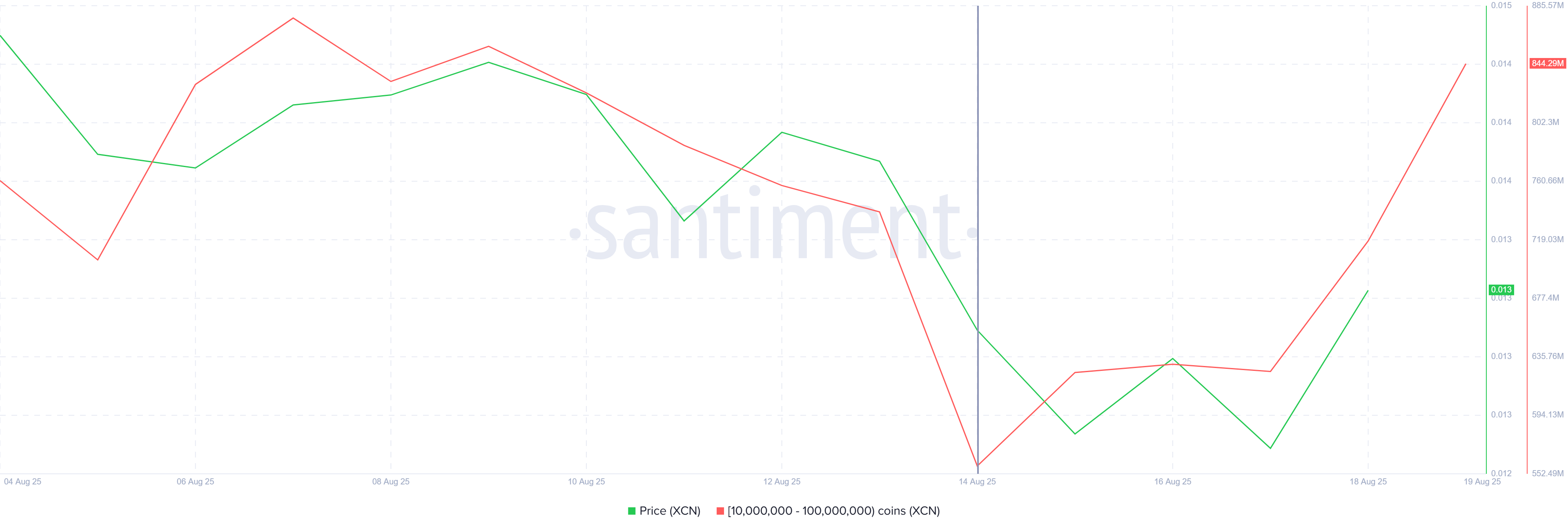

Over the past five days, Onyxcoin whales have been actively accumulating XCN, purchasing 256 million tokens worth over $3.3 million. This massive accumulation indicates that large investors are buying the dip, likely anticipating a price recovery.

Claim Your USDT Bonus from BTSE. Limited Time OnlyGet up to 50 USDT

Sponsored

Despite the whale support, the broader market sentiment remains cautious. The accumulation of XCN by large holders could signal that these investors believe the price will rise in the long term. However, retail investors and the Futures market seem more focused on short-term price movements, and the overall outlook remains mixed.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

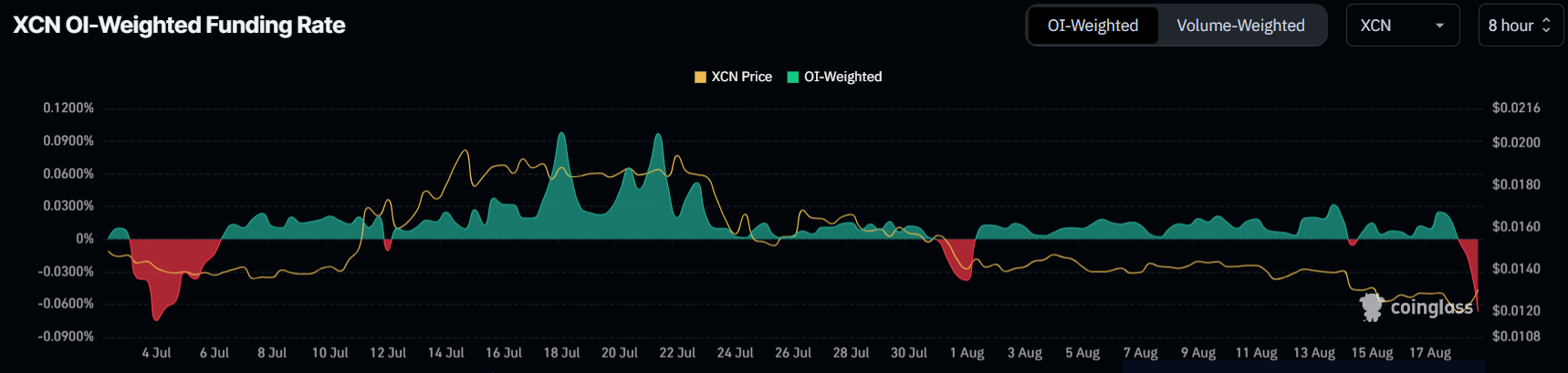

The funding rate for Onyxcoin has dipped sharply, reaching a monthly low. A negative funding rate signals that short positions dominate, with traders betting on further price declines.

Given this negative funding rate, the macro momentum for Onyxcoin appears tilted toward bearishness in the short term. As traders focus on shorting the coin, a continued negative outlook could keep the price under pressure.

XCN Price Needs To Break Out

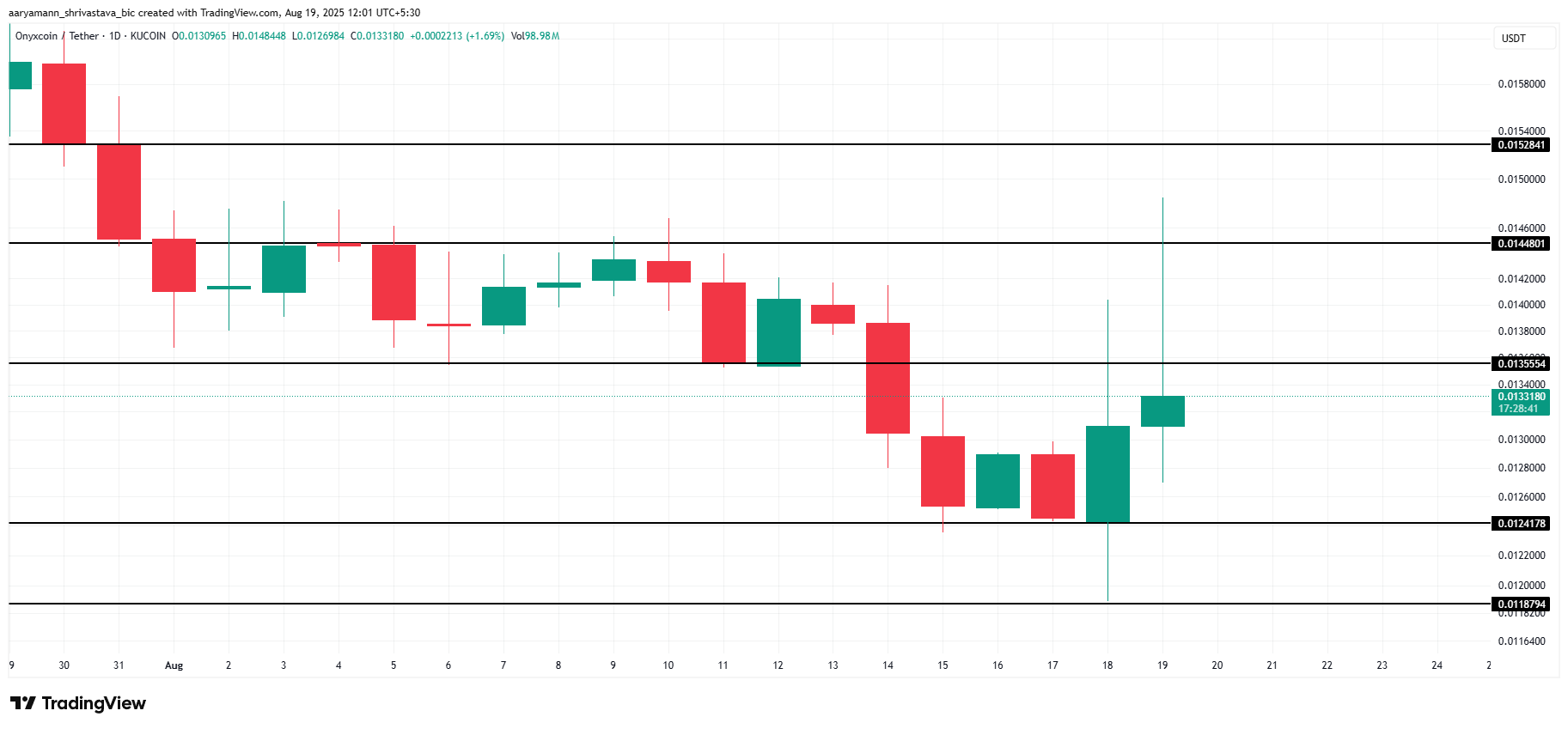

Currently, XCN is trading at $0.01331, reflecting a 7% rise in the last 24 hours after bouncing off the support at $0.01241. The strong whale accumulation may have contributed to this uptick, with larger holders positioning themselves for a potential price recovery.

However, Onyxcoin is currently facing resistance at $0.01355. If the altcoin successfully flips this resistance into support, it could push toward $0.01448 and higher. This would mark a key breakthrough and strengthen the bullish case for Onyxcoin, placing it on the path of potential recovery of the losses noted in July.

On the other hand, if the resistance at $0.01355 holds and the price fails to breach it, XCN could remain trapped below this barrier. In this case, the altcoin might either consolidate further under $0.01355 or fall back to $0.01241, which would invalidate the bullish outlook.