Stellar coin is under renewed bearish pressure following a technical breakdown that has shaken market sentiment.

A prominent market analyst has warned of a potential deeper decline, describing the current setup as one of the most vulnerable phases for the asset in 2025. Price action now reflects growing weakness, with buyers struggling to reclaim lost ground and restore confidence.

XLM Awaits a Major Breakdown

In a recent post on X, TheBlockBull issued a stark warning, labeling the current Stellar setup as “Nuke Town Incoming.” The accompanying chart revealed a decisive breakdown below a long-term ascending trendline that had supported since early 2025.

The token is now trading near $0.31, following repeated rejections from the $0.33–$0.34 resistance zone. This breakdown suggests a growing shift in market sentiment, with bulls losing momentum and sellers tightening control.

Source: X

The breached trendline had previously acted as a strong recovery foundation throughout the year, helping the asset maintain upward momentum during earlier pullbacks. However, the latest candle closing below it indicates that this support may have transitioned into resistance, signaling a possible start of a broader downtrend.

If the bearish momentum extends, the coin could slide toward the $0.20 zone, a critical support level that aligns with the yearly low and prior demand area. This zone is expected to serve as a key decision point between a relief bounce or a deeper continuation of the bearish structure.

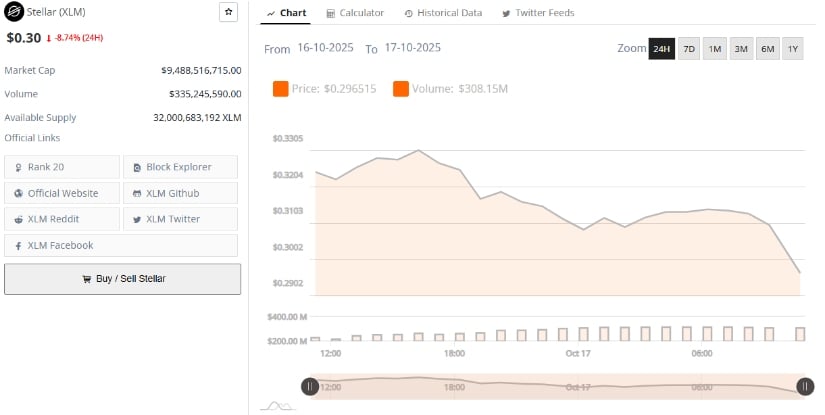

Market Data Confirms Sharp Daily Decline

According to BraveNewCoin data, Stellar trades at $0.30, marking an 8.74% decline in the past 24 hours. The coin holds a market capitalization of $9.48 billion and a 24-hour trading volume of $335.2 million, ranking it 20th among global cryptocurrencies. Despite the price correction, the coin maintains an active circulating supply of 32 billion tokens, ensuring sufficient liquidity across markets.

Source: BraveNewCoin

The steep daily drop reflects broader selling pressure across altcoins, particularly as market volatility has risen in mid-October. The decline also reinforces the analyst’s caution that the coin’s bullish momentum may be fading, especially if the token fails to reclaim lost levels in the near term. Nevertheless, strong on-chain participation and capital inflows suggest that some holders remain positioned for potential recovery once market conditions stabilize.

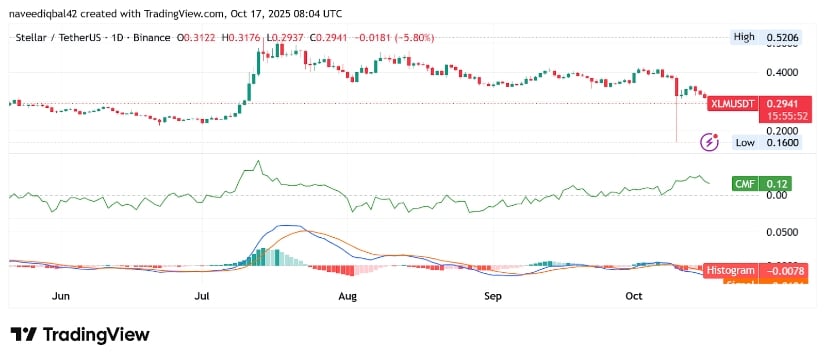

Technical Indicators Show Persistent Bearish Momentum

At the time of writing, according to TradingView, XLM/USDT trades at $0.2969, down 4.90% in the past 24 hours. The chart reveals a pronounced bearish structure following multiple failed attempts to break above the $0.32 resistance level. Momentum has weakened, with sellers firmly in control as the asset struggles to maintain support above $0.29, signaling continued downside pressure.

Source: TradingView

Technical indicators further validate the bearish trend. The MACD shows a bearish crossover, with the signal line moving above the MACD line and the histogram extending red bars, indicating sustained downward momentum. This suggests that recent recovery efforts have lost strength. However, if the histogram begins to contract, it may hint at slowing bearish pressure, potentially leading to short-term consolidation before a rebound attempt.

Interestingly, the Chaikin Money Flow (CMF) remains positive at 0.13, signaling that not all capital outflows have ceased. This suggests that despite the decline, some accumulation is taking place near current price levels. Should buying volume increase, the cryptocurrency could attempt a rebound toward the $0.33–$0.35 zone.