Stellar Coin is showing early signs of recovery after enduring sharp volatility that briefly sent prices below the $0.19 mark before rebounding above $0.31.

The market turbulence, characterized by a swift liquidation phase, appears to have flushed out speculative leverage, resetting market conditions for a potential stabilization period.

Open Interest Decline Signals Market Reset

At the time of writing, XLM/USD trades at $0.3122, consolidating after a volatile session that saw intense selling pressure. The brief dip below $0.19 triggered widespread liquidations before an aggressive recovery restored stability near the $0.31 region. This sharp rebound suggests that buyers absorbed supply at lower levels, countering the short-term bearish momentum.

Source: Open Interest

Aggregated open interest fell sharply from above $160 million to around $81 million, indicating a major deleveraging event. The unwinding of excessive leverage typically improves market health by removing speculative positions and reducing systemic risk. With open interest now flatter, the crypto’s price action could be entering a more organic phase where accumulation outweighs forced selling. If this structure holds, it sets the groundwork for gradual recovery as confidence rebuilds.

Looking forward, maintaining support above $0.31 will be crucial for confirming a steady bullish base. A stable open interest combined with reduced volatility may encourage buyers to regain control, while a sudden resurgence in leveraged activity could reignite instability. For now, the market appears to be recalibrating after a liquidity-driven correction.

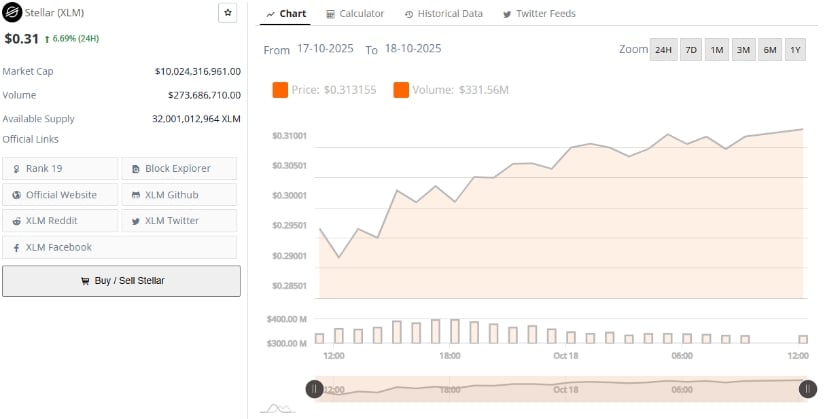

Market Data Shows 6.69% Daily Gain and Rising Market Activity

On the other hand, Stellar is trading at $0.31, marking a 6.69% increase over the last 24 hours. The cryptocurrency maintains a market capitalization of $10.02 billion and a 24-hour trading volume exceeding $273 million, ranking 19th globally. With a circulating supply of 32 billion tokens, the asset continues to exhibit healthy liquidity levels across exchanges.

Source: BraveNewCoin

The rebound in price and volume reflects improving short-term sentiment following the volatility spike. While the broader market remains cautious, the stability seen after such an abrupt decline suggests that panic selling has subsided. The moderation in open interest alongside rising spot activity further supports the notion of a market finding equilibrium after a disruptive move.

Technical Indicators Hint at Oversold Conditions

At the time of writing, Stellar’s market cap sits at $10.02 billion, up 1.48% on the day. Technical indicators from the daily chart reveal that he memecoin is currently trading near the lower Bollinger Band, signaling potential oversold conditions after recent losses. Historically, such positioning has often preceded short-term rebounds once selling pressure begins to ease.

Source: TradingView

The Relative Strength Index (RSI) stands at 36.43, below the neutral midpoint of 50, reflecting sustained bearish momentum but also suggesting the possibility of a rebound as oversold conditions deepen. Should buyers continue defending the current zone, the token could attempt to reclaim the Bollinger Band basis near $11.57 billion in market cap, a threshold that often serves as confirmation of renewed bullish momentum.

If support above $9.3 billion holds, the asset may transition from stabilization to gradual recovery, with technical metrics favoring a potential retest of higher resistance zones once market confidence improves. For now, the coin’s structure reflects a balanced reset — a calmer market backdrop following a leveraged washout that may pave the way for a steadier phase ahead.