Injective (INJ) is a Layer-1 protocol built on Cosmos, an open, scalable blockchain with smart contracts that is designed for DeFi applications. Any developer can easily create finance apps with inherent value using Injective’s plug-and-play modules, which include an order book and a derivatives trading module. Over the past month, INJ coin has demonstrated volatility, surging from its low of $9 to a peak of $14.7 (+65%) before stabilizing around $14. This significant price surge highlights shifting market dynamics and a resurgence of investor confidence in Injective. In this analysis, we explore the key factors fueling INJ’s recent momentum and deliver an updated Injective price prediction, taking into account the latest trends and ecosystem advancements.

| Current INJ Price | INJ Price Prediction 2025 | INJ Price Prediction 2030 |

| $14 | $45 | $170 |

Injective (INJ) Overview

Injective uniquely provides powerful core financial infrastructure primitives that applications can leverage, including a fully decentralized MEV-resistant on-chain order book. All types of financial markets, including spot, perpetual, futures, and options, are also entirely on-chain. The decentralized cross-chain bridging infrastructure works with Ethereum, IBC-enabled blockchains, and chains like Solana that are not compatible with the Ethereum Virtual Machine (EVM). Additionally, Injective offers a powerful interchain smart contract platform built on CosmWasm that is the next generation and extremely interoperable. Injective is a custom application created with the Cosmos SDK that uses a Proof-of-Stake (PoS) consensus mechanism based on Tendermint to provide instant transaction finality and maintain blazing-fast speed (10,000+ TPS).

Injective Hub is the dashboard that provides users with the overview and functionality they need to make the most of the Injective Protocol. Users can access the Injective Hub to stake their INJ to become network validators tasked with upholding the security of the PoS blockchain. INJ holders can also choose to delegate their tokens to network validators and earn a percentage of their rewards in return. Injective Hub is also the location for community members to propose and vote on proposals that will shape the future of Injective. Examples of proposals that are put to a vote include new trading pairs, platform functionality, and governance procedures.

| Current Price | $14 |

| Market Cap | $1,398,877,749 |

| Volume (24h) | $221,279,354 |

| Market Rank | #66 |

| Circulating Supply | 99,970,935 INJ |

| Total Supply | 100,000,000 INJ |

| 1 Month High / Low | $14.71 / $9.01 |

| All-Time High | $52.75 Mar 14, 2024 |

Injective was co-founded in 2018 by Eric Chen (CEO) and Albert Chon (Chief Strategy Officer). The project was incubated by Binance Labs and later gained support from prominent investors like Pantera Capital, Mark Cuban, and Jump Crypto. The INJ token was first launched in late 2020 with the initial testnet, Solstice. On November 8, 2021, Injective’s mainnet officially launched with the release of Injective’s Canonical Chain.

Injective Features

Injective offers a variety of features that can be used in Web3:

Decentralized exchange infrastructure: Injective provides a fully decentralized, MEV-resistant order book, enabling seamless trading without intermediaries.

Cross-chain trading and yield generation: Injective has the ability to enable a wide range of trading and yield generation operations across various L1 blockchain networks, including Cosmos and Ethereum.

Community-driven network governance: Injective’s decentralized community, which is managed by a DAO structure, votes on all new improvements.

Zero gas fees: Users can trade and transact without paying gas fees, thanks to Injective’s unique feeless model.

Fast, scalable transactions: Built on a Tendermint-based PoS consensus, Injective achieves instant finality and high throughput.

Customizable DeFi modules: Developers can build and deploy tailored financial dApps (like derivatives, options, and prediction markets) with ease.

Injective Price History Highlights

Injective launched its token, INJ, in late 2020. The token started trading at $0.4. In April 2021, $INJ hit a high of $18.74.

In April 2022, INJ coin dropped from a price level of $6.5 and traded below $2 for the rest of the year.

In July 2023, Injective’s price surpassed $8 and, after several corrections, hovered around $6 for a while before soaring to nearly $17 in August.

In March of 2024, Injective reached its all-time high of $52.75 and later surged to another high of $33.44 in late December.

At the beginning of 2025, the INJ coin price was around $25, then dropped to $7. In the last month, Injective has shown significant growth, and now its price fluctuates between $13 and $15.

INJ Price Chart

CoinGecko, July 18, 2025

Injective Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $13 | $75 | $45 | +220% |

| 2026 | $25 | $133 | $80 | +470% |

| 2030 | $69 | $269 | $170 | +1,100% |

| 2040 | $432 | $9,887 | $5,200 | +37,000% |

Injective Price Prediction 2025

DigitalCoinPrice experts anticipate Injective crypto may trade between $12.86 (-10%) at its 2025 low and $31.85 (+120%) at peak valuation.

PricePrediction crypto analysts project stronger performance, with $INJ expected to range from $16.91 (+15%) to $18.85 (+30%) during 2025.

Telegaon analysts suggest a 2025 price range of $35.59 (+145%) to $75.14 (+420%), pointing to a potentially stronger market acceptance.

INJ Price Prediction 2026

DigitalCoinPrice experts project that in 2026, the Injective coin may reach $37.32 (+160%) at peak valuation, while potentially declining to $31.08 (+115%) at its lowest point.

According to PricePrediction’s expert analysis, $INJ could reach a peak of $29.26 (+105%) by 2026. On the conservative end, the token is expected to maintain a strong floor at $24.51 (+70%). These projections underscore growing confidence in Injective’s long-term value proposition, driven by its scalable infrastructure, institutional adoption, and expanding DeFi ecosystem.

Telegaon’s bullish outlook suggests INJ crypto may trade between $132.86 (+820%) at minimum and $75.28 (+420%) at maximum during 2026, reflecting strong confidence in Injective’s long-term growth prospects.

Injective Price Prediction 2030

DigitalCoinPrice analysts think that by 2030, INJ coin will considerably rise in price: according to their calculations, its maximum price level is expected to be around $79.1 (+450%), while at its minimum, it will cost no less than $68.77 (+380%).

According to PricePrediction’s 2030 projections, the INJ token is also anticipated to surge in price significantly, with a potential low of $112.06 (+680%) and a possible peak of $137.18 (+850%).

According to Telegaon’s 2030 forecast, $INJ could achieve a maximum valuation of $269.15 (+1,800%) while maintaining a floor of $221.11 (+1,450%).

INJ Price Prediction 2040

PricePrediction’s ultra-bullish scenario suggests the token could reach between $8,180 (+56,500%) and $9,887 (+68,500%), reflecting extreme confidence in Injective’s potential to dominate the DeFi and institutional blockchain infrastructure sectors over the next two decades.

In contrast, Telegaon’s more conservative analysis forecasts a 2040 price range of $432.45 (+3,000%) to $535.54 (+3,650%), still representing massive growth potential but accounting for market uncertainties and competitive pressures.

Injective (INJ) Price Prediction: What Do Experts Say?

Analysts remain optimistic about Injective due to its strong fundamentals, including its zero-gas-fee model, institutional adoption, and expanding ecosystem. Some experts, like CoinLore, predict that if bullish market conditions persist, INJ could reach $370 by 2040, driven by increasing demand for DeFi solutions and strategic partnerships.

It’s important to note that Injective has partnered with a number of DeFi companies to bring decentralized trading to the masses. Injective became partners with Klaytn, a public blockchain developed by Ground X. By integrating Injective’s decentralized derivatives protocol, Klaytn offered its users access to a diverse array of new financial markets. Moreover, strategic partnerships with industry leaders like Polygon (MATIC) and Fetch.ai are accelerating Injective’s ecosystem expansion by enhancing interoperability and AI-powered DeFi capabilities.

Most recently, in March 2025, Injective announced a key partnership with Aethir, a decentralized GPU cloud infrastructure provider. This alliance aims to integrate Aethir’s enterprise-grade AI and gaming GPU resources into Injective’s blockchain, unlocking new possibilities for AI-driven dApps and high-performance decentralized applications. In summary, such high-profile collaborations underscore Injective’s commitment to innovation and long-term growth in the Web3 space.

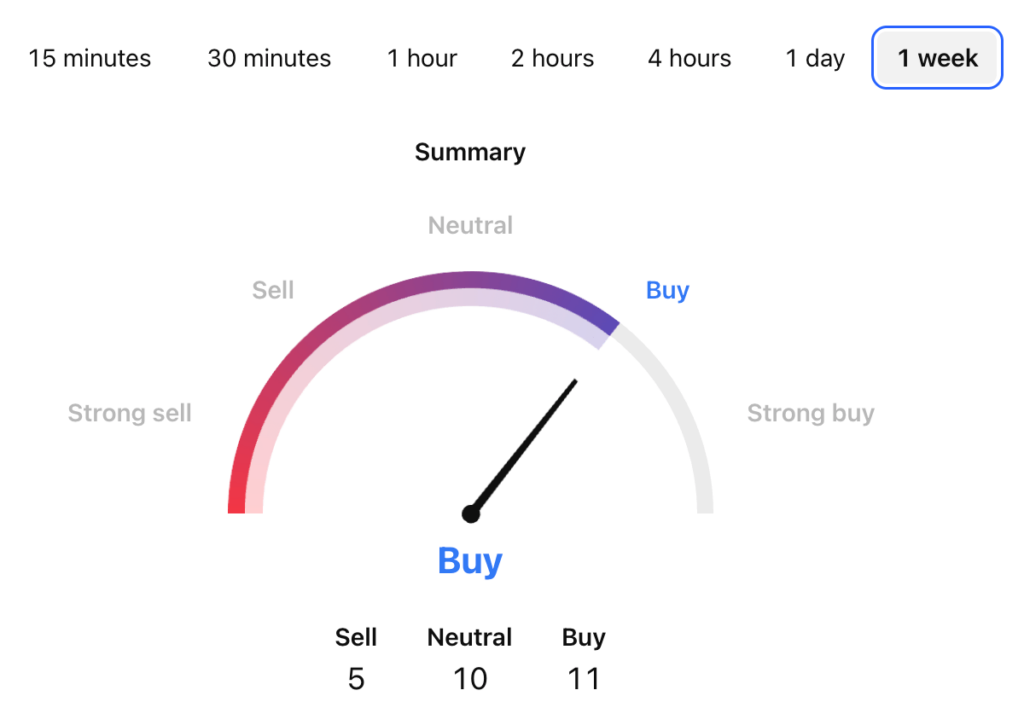

INJ USDT Price Technical Analysis

Tradingview, July 18, 2025

Now that we’ve taken a look at the possible future of the INJ coin, let’s find out a bit more about the factors that can lead to its further success.

What Does the Injective Price Depend On?

The price of Injective is primarily driven by ecosystem adoption and technological innovation. As a blockchain specializing in DeFi, its value is closely tied to the growth of its trading volume, dApp development, and institutional integration. Key factors include partnerships (like those with Polygon, Fetch.ai, and Aethir), real-world asset (RWA) tokenization, and cross-chain interoperability. These features enhance demand for INJ as the native governance and staking token. Additionally, market sentiment around L1 blockchains and DeFi trends plays a significant role in short-term price movements.

Macroeconomic conditions and crypto market cycles also heavily influence INJ’s valuation. Bull runs often amplify gains for high-performance altcoins like INJ, while bear markets test their utility-based resilience. Regulatory developments, particularly concerning DeFi and derivatives trading, could impact adoption.

Risks and Opportunities

Injective is well-positioned to capitalize on the booming DeFi and institutional blockchain adoption, all thanks to its zero-gas-fee model, high-speed transactions, and cross-chain interoperability. Strategic partnerships with industry leaders enhance its ecosystem, while innovations in RWA tokenization and AI-powered DeFi could drive massive demand for INJ. Additionally, as one of the few blockchains offering MEV-resistant, institutional-grade trading infrastructure, Injective could attract major financial players seeking compliant DeFi solutions.

However, despite its strengths, Injective faces challenges, including intense competition from established smart contract platforms like Ethereum, Solana, and Cosmos-based chains. Regulatory uncertainty, particularly around derivatives trading and DeFi, could hinder adoption. Market volatility and macroeconomic downturns may also suppress prices, especially if crypto enters another prolonged bear cycle. Additionally, while INJ’s tokenomics (staking, burns, and governance) are designed for scarcity, failure to sustain network activity could lead to sell pressure.

Is Injective a Good Investment?

Injective presents a compelling long-term investment opportunity due to its innovative DeFi infrastructure, strategic partnerships, and strong tokenomics, but it’s not without risks. The platform’s zero-gas fees, institutional-grade trading tools, and cross-chain interoperability position it well to capture the growing demand for decentralized finance. However, competition from established L1 blockchains, regulatory hurdles, and market volatility could impact its trajectory. Investors should remain informed of inherent risks, including cryptocurrency market volatility and intensifying competition within the crypto space.

Does INJ Coin Have a Future?

Yes, INJ coin has strong future potential as a leading DeFi token, backed by Injective’s institutional-grade infrastructure, thriving ecosystem, and real-world adoption. Its unique advantages (including gas-free transactions, MEV-resistant trading, and cross-chain interoperability) position it to capitalize on the next wave of decentralized finance growth.

Why Is the Injective So Popular?

Injective has surged in popularity due to its unique combination of institutional-grade DeFi infrastructure, frictionless trading experience, and pioneering crypto-economic design.

What Is an Injective All-Time High?

Injective hit its all-time high of $52.75 on March 14, 2024.

Will an Injective Coin Go Up?

Injective has strong potential to appreciate in value given its cutting-edge DeFi infrastructure, accelerating adoption, and deflationary tokenomics, but upside isn’t guaranteed. While short-term volatility is inevitable, INJ’s unique positioning at the intersection of TradFi and DeFi makes it one of the better bets for sustained long-term growth in the crypto space, provided the team maintains its current development momentum.

How High Can Injective Crypto Go?

Short-term, the combination of its hyper-deflationary tokenomics, institutional derivatives adoption, and upcoming Ethereum L2 integration could propel INJ toward the $200 or $300 range, a 5-8x from current levels. Long-term, if Injective captures just 5 or 10% of the global derivatives market through its institutional DeFi solutions, $10,000 per INJ (100x+) becomes mathematically plausible. However, these bullish scenarios require flawless execution against competitors like dYdX and assume mainstream TradFi adoption of crypto-native derivatives platforms.

Can Injective Reach $100?

Yes, it’s possible. Injective has a realistic path to reach $100, especially if the market turns bullish and key ecosystem milestones are achieved.

Can INJ Price Hit $250?

Reaching $250 per INJ is ambitious but achievable under optimal conditions, requiring a 12 to 15x increase from current levels, something possible in crypto bull markets for tokens with strong fundamentals.

Will Injective Reach $1,000?

A $1,000 INJ price would require near-perfect execution and unprecedented adoption, but it isn’t impossible in a long-term hyper-bullish scenario, potentially by 2030 if DeFi disrupts traditional finance at scale.

What Is Injective Price Prediction for 2025?

According to DigitalCoinPrice, at its peak in 2025, the price of Injective will rise to $30.

How Much Will Injective Be Worth in 2030?

PricePrediction experts believe that in 2030, the INJ token will hit a maximum of $137 per coin.

How Much Is INJ Worth in 2040?

Telegaon analysts estimate that in 2040, INJ’s price will go as high as $535.

What Is the Price Prediction for Injective in 2050?

According to PricePrediction, in 2050, $INJ will soar to $13,735 per coin at its peak.

Conclusion

Injective stands out as one of the most ambitious projects in crypto, merging institutional-grade infrastructure with DeFi’s permissionless nature. Its zero-gas architecture, MEV-resistant trading, and aggressive tokenomics position it as an underdog capable of disrupting derivatives markets if adoption keeps pace with its technological edge, and Injective isn’t just building another blockchain – it’s racing to redefine global markets. Whether that vision materializes will depend on execution, regulatory tides, and crypto’s broader march toward mainstream finance.