Bitcoin’s latest price action suggests that investor confidence is beginning to crack after months of optimism.

According to new data from Glassnode, the cryptocurrency has slipped below key cost-basis levels that typically serve as psychological and technical support during bullish phases. This breakdown is being reinforced by long-term holders cashing out profits, leaving the market in a fragile state that could precede a prolonged consolidation period.

Bitcoin now trades below the short-term holders’ cost basis of around $113,100, which marks the average entry point for investors who bought within the last few months. Historically, when Bitcoin falls under this level after reaching new highs, the market tends to enter a cooling phase. It’s a signal that enthusiasm is fading and that recent buyers are beginning to question their conviction.

Signs of Demand Exhaustion

Glassnode’s analysts describe the current market structure as “demand exhaustion.” Repeated failures to reclaim cost-basis thresholds indicate that inflows from new investors have slowed, while existing participants are taking profits or moving to the sidelines.

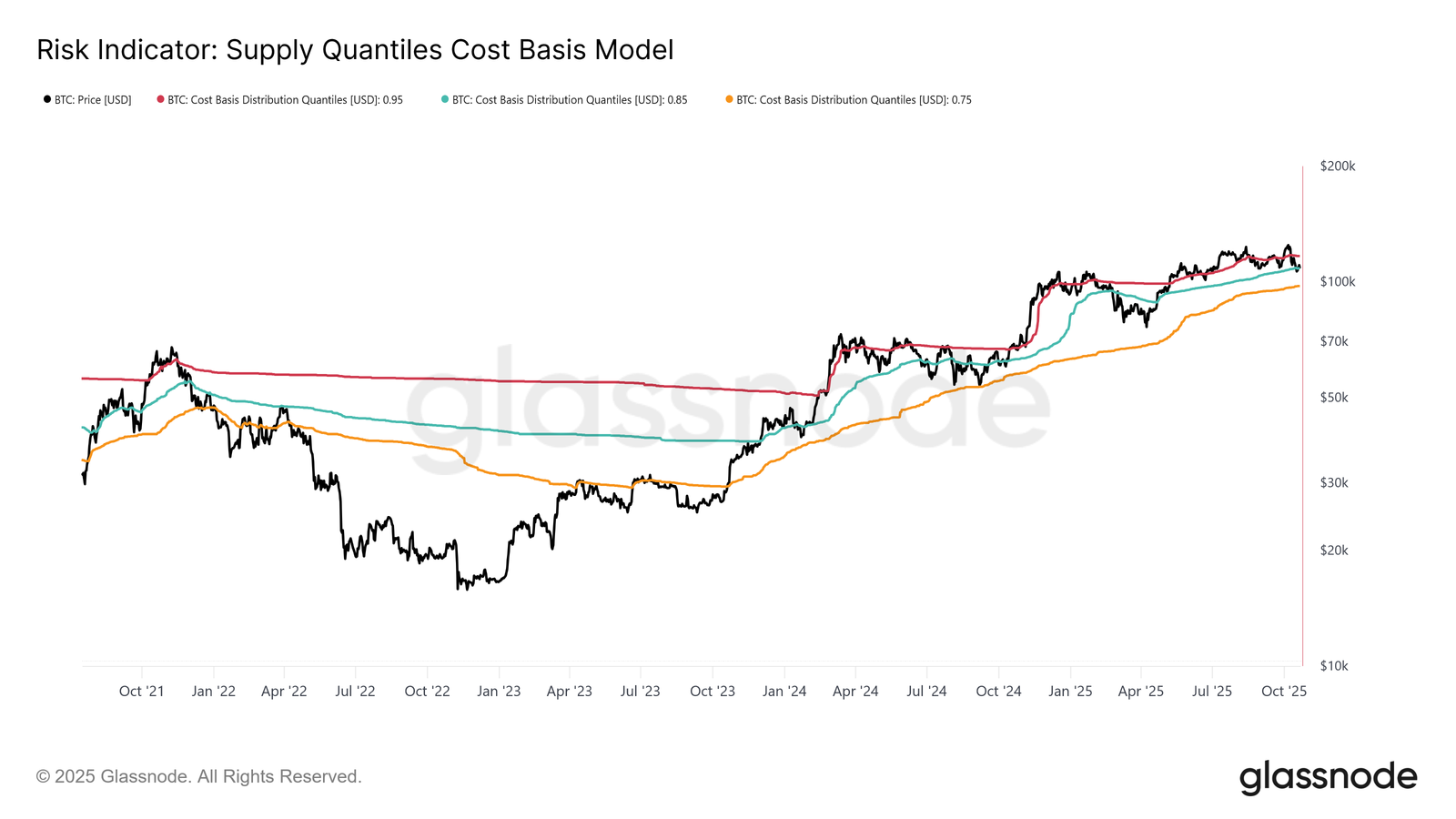

The firm’s Supply Quantile Cost Basis model highlights just how critical this moment is. Bitcoin is not only trading under the short-term holder cost basis but is also struggling to stay above the 0.85 quantile, currently around $108,600. Dropping below this mark would push a larger share of supply into loss, raising the risk of emotional selling. The next key level, the 0.75 quantile, sits near $97,500 – a potential target if bearish momentum intensifies.

These cost-basis thresholds essentially measure the market’s health by tracking where most of the supply last changed hands. When prices dip below them, investor morale often weakens, leading to reduced liquidity and thinner buy-side support.

Long-Term Holders Drive Selling Pressure

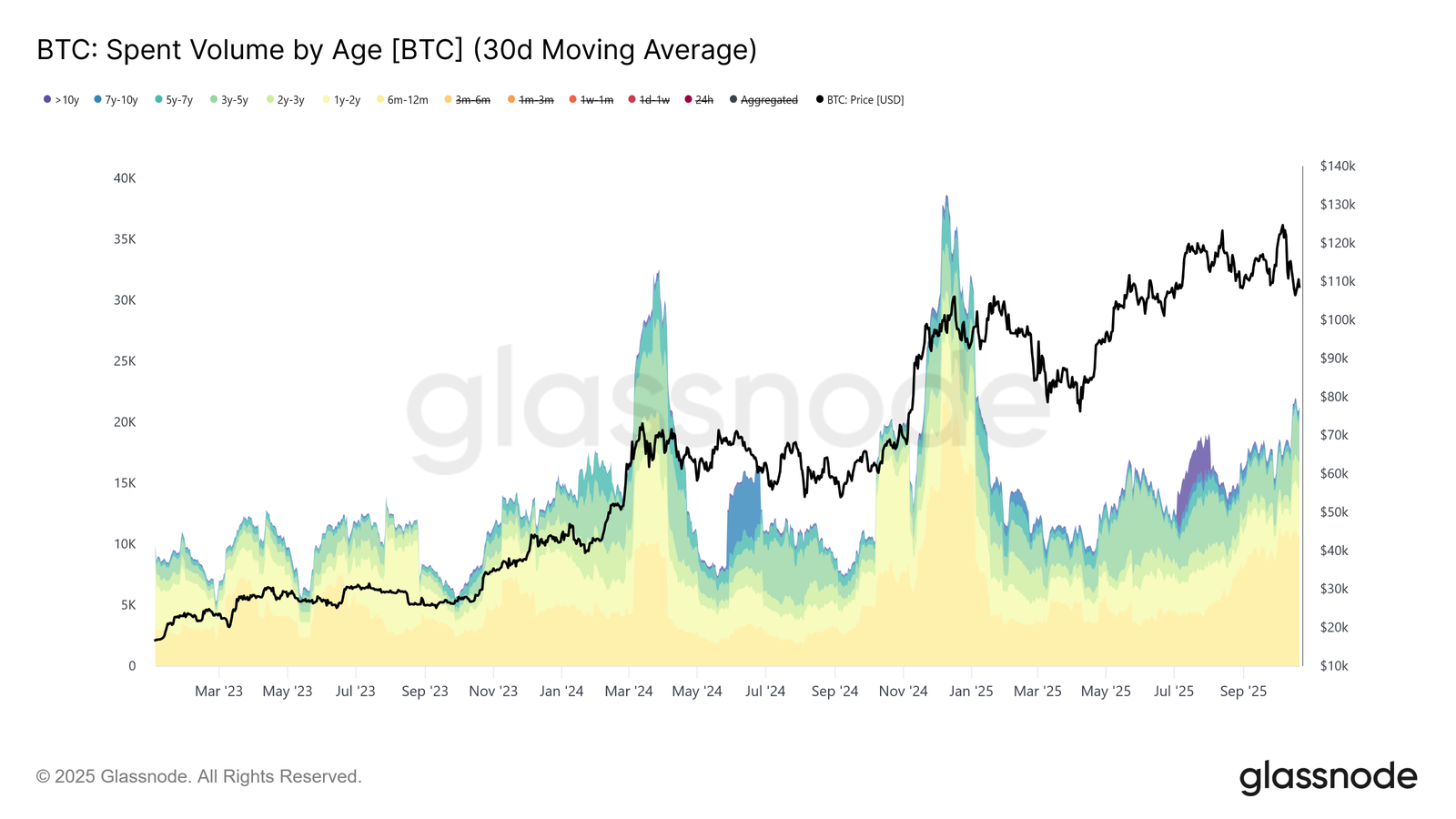

While short-term participants are retreating, long-term holders are taking advantage of elevated prices to realize profits. Since July 2025, the volume of Bitcoin sold by these investors has surged from 10,000 BTC per day to over 22,000 BTC daily. This sustained profit-taking has put continuous pressure on the market, acting as a counterweight to any short-term rallies.

These seasoned investors tend to sell into strength – a behavior that historically marks late-cycle dynamics. In previous cycles, such as 2017 and 2021, similar distribution patterns preceded long periods of sideways consolidation before new uptrends emerged. This suggests that Bitcoin’s bull market may now be transitioning from an expansion phase to a digestion phase, where the asset needs time to absorb spent supply and rebuild momentum.

A Test of Conviction

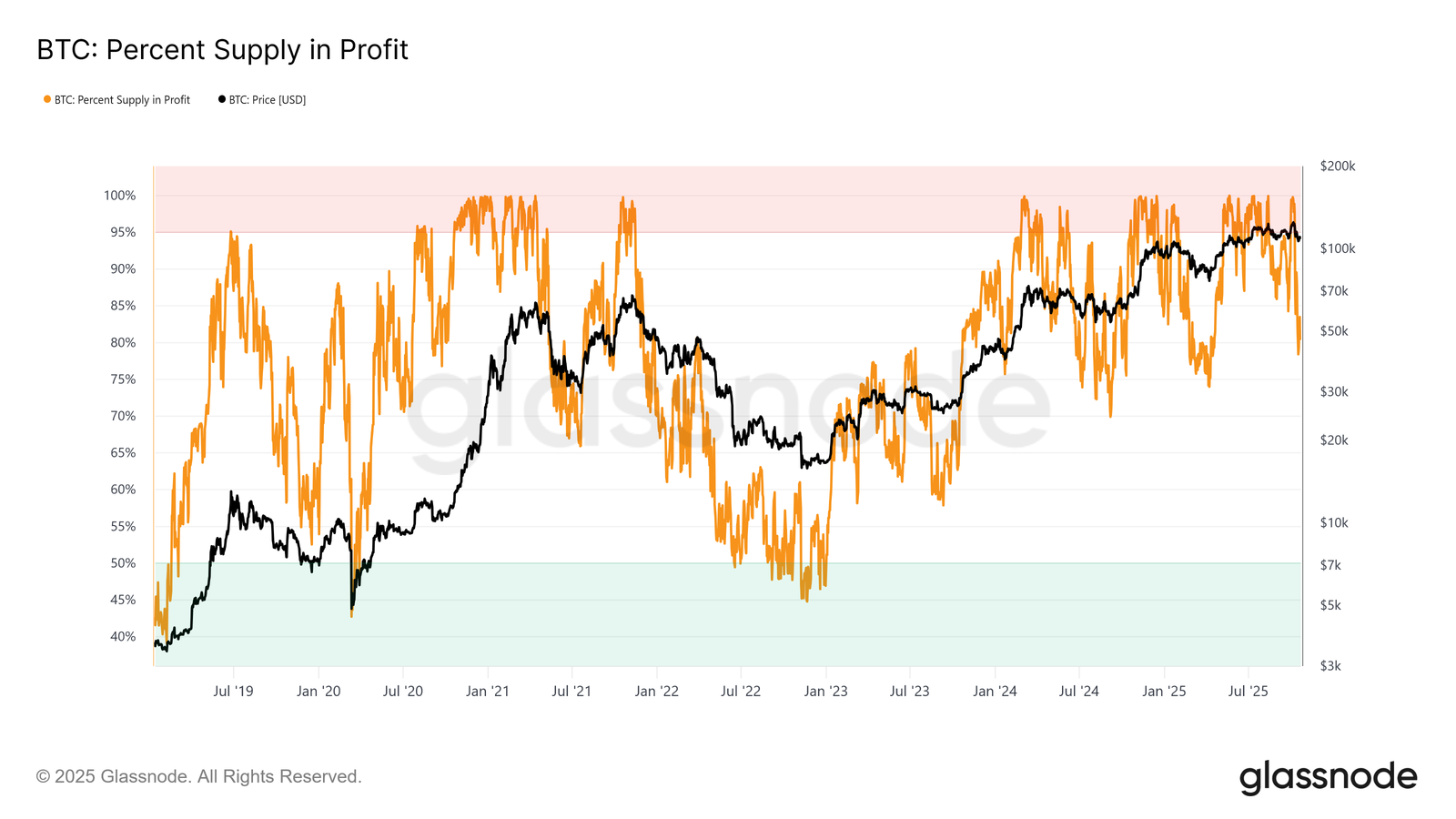

The $113,000-$114,000 range has now become the battleground zone. For Bitcoin to reestablish bullish control, it needs to recover and hold above these levels. Failure to do so could drag the percentage of coins in profit down to roughly 85%, leaving 15% of the circulating supply at a loss – a setup that has often led to further liquidation cascades in past cycles.

This is the third time in the current bull run that Bitcoin has retested this cost-basis region, and repeated breakdowns tend to erode trader confidence. For many market participants, it’s a test of conviction – whether they believe the long-term thesis outweighs the short-term pain.

Macroeconomic Backdrop Adds Pressure

Adding to the uncertainty, global macroeconomic conditions have grown more complex. Rising Treasury yields, shifting inflation expectations, and a cautious Federal Reserve stance have tightened liquidity, which often spills over into risk assets like Bitcoin.

Institutional traders who previously viewed Bitcoin as a hedge against inflation are now scaling back positions amid broader market volatility. Meanwhile, long-term believers remain steady but are showing less willingness to accumulate aggressively, preferring to wait for clearer signs of bottom formation.

A Necessary Reset

While this phase might look discouraging, Glassnode’s analysts argue that it could represent a healthy reset rather than the start of a deep bear market. Bitcoin has been through similar phases before – in early 2021 and mid-2023 – when sharp pullbacks gave way to months of accumulation before the next major uptrend.

The current cooling period may allow the market to stabilize, flush out speculative leverage, and pave the way for more sustainable growth. Once spot demand rebuilds and long-term holders slow their distribution, structural conditions for another breakout could form.

The Bigger Picture

For now, Bitcoin remains in a delicate balance. Falling below cost-basis levels underscores short-term weakness, but the long-term narrative remains intact. Glassnode concludes that the network is likely entering a transitional phase, where fading enthusiasm gives way to quiet rebuilding.

If history is any guide, these subdued periods often precede renewed strength once conviction returns. As seasoned investors continue to lock in profits and short-term participants reassess their risk, Bitcoin’s next rally may depend on how quickly new inflows return – and whether the market can reclaim its lost confidence above the $113,000 threshold.

Until then, the market seems poised for patience, not panic.

Read the full report here