According to the latest 10x Research report, global risk sentiment has stabilized even as investors steer capital into very different corners of the market.

Traditional finance showed resilience, while safe-haven demand and selective crypto strength signaled that traders are positioning for volatility rather than a uniform rally.

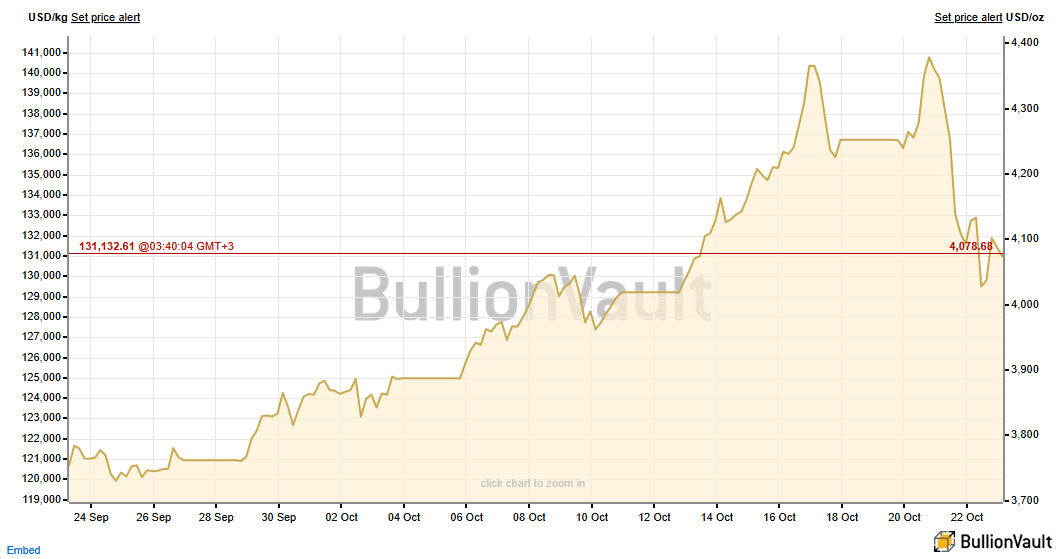

In U.S. equities, industrial and technology giants such as Broadcom, TSMC, and Caterpillar helped lift the S&P 500 and Nasdaq despite ongoing dollar weakness and pressure on Treasury yields. Liquidity concerns and rising credit-loss warnings from smaller banks prompted some rotation into defensive assets. Gold, which recently peaked at $4,379, has since cooled to around $4,074 but remains elevated as traders continue to price in rate cuts and seek refuge from broader market uncertainty. Treasury yields slipped further as investors favored stability amid tightening liquidity conditions.

Crypto Market Finds Mixed Momentum

In digital assets, sentiment was uneven. Optimism around a potential U.K.-listed Bitcoin fund briefly boosted market confidence, but geopolitical headlines and new regulatory seizures tempered enthusiasm. The result was a sideways week for Bitcoin and selective gains across the altcoin sector.

Corporate-linked crypto stocks highlighted this divide. MicroStrategy’s shares slipped as dilution concerns resurfaced following a new equity offering, while Galaxy Digital advanced after expanding its retail products. Coinbase also drew attention with its India expansion plans, positioning itself to capture growth beyond the United States.

AI-Linked Miners Steal the Spotlight

Bitcoin miners reflected the same polarization seen in equities. Companies that embraced AI or cloud infrastructure strategies significantly outperformed those still reliant on traditional mining models.

Bitdeer Technologies led the rebound as its pivot toward AI-computing and strong output figures fueled renewed investor interest. Riot Platforms also benefited from bullish options activity tied to its data-center expansion. CleanSpark, meanwhile, saw sentiment improve thanks to higher Bitcoin production and new credit lines, even as its revenue slipped slightly month-over-month.

By contrast, debt-funded miners faced turbulence. Bitfarms’ plan to issue $300 million in convertible notes sparked dilution fears, while Core Scientific’s shareholder dispute over a potential CoreWeave takeover rattled confidence.

Iren’s Explosive Growth Raises Valuation Questions

A standout performer in the 10x Research data was Iren, whose stock has climbed more than 500 percent since mid-year as it transitions toward AI-cloud services. The firm’s issuance of $1 billion in zero-coupon notes funded its expansion but also stretched valuations, prompting some analysts to warn of overheating. The report showed Iren’s performance sharply diverging from Bitcoin’s trend, underscoring how AI alignment has become the dominant narrative in mining-related equities.

TeraWulf joined that movement by raising $3.2 billion to finance new data-center facilities, signaling that hybrid computing strategies are rapidly replacing pure mining operations as the industry norm.

Selective Altcoin Gains Continue

Altcoin performance remained highly selective. MakerDAO and Ethena led decentralized-finance gains as token migrations and ecosystem partnerships revitalized DeFi activity. Ethereum and Solana posted renewed on-chain traction, though both continued to face short-term selling pressure amid macro uncertainty.

Ripple extended its institutional expansion drive with a $1 billion acquisition that strengthens its foothold in cross-border finance. Meanwhile, BNB, Dogecoin, and Cardano drew speculative interest ahead of upcoming ETF and network-upgrade catalysts. Tron, Avalanche, and Aptos sustained momentum through institutional funding rounds and developer initiatives, showing that capital still gravitates toward utility-driven ecosystems rather than speculative memecoins.

Bitcoin Technical Setup at a Crossroads

Trader Michaël van de Poppe highlighted the $112,000 zone as a decisive resistance that could determine whether Bitcoin re-enters a bullish cycle. In his latest analysis, he noted that a clean break above this level is essential for Ethereum to reach new all-time highs and for altcoins to launch a broader rally.

I keep mentioning the $112K area.

If that doesn't break, then there's no $ETH ATH and no #Altcoin party, as of yet.

I do believe that we're on edge of breaking it, as we've taking all liquidity around that area in this first test.

A matter of time.

If #Bitcoin reaches sub… pic.twitter.com/1FTBl8YGwo

— Michaël van de Poppe (@CryptoMichNL) October 22, 2025

He described the market as being “on the edge of breaking it,” suggesting that Bitcoin is currently absorbing liquidity around that range. However, van de Poppe also pointed out that a brief dip below $106,000 could offer a strong accumulation opportunity, framing the current phase as a healthy retest rather than a bearish breakdown.

This view aligns with several institutional desks tracking Bitcoin’s liquidity zones, which see the $106K-$112K corridor as a make-or-break range heading into late October.

Market Outlook: Consolidation or Breakout Ahead?

The coming sessions may hinge on whether Bitcoin can hold above the $110K mark and challenge the $112K ceiling. A confirmed breakout could trigger a broader risk-on rotation across the crypto complex, lifting Ethereum and higher-beta tokens that have lagged in recent weeks. Conversely, if Bitcoin remains capped below $112K, investors may continue favoring safer assets such as gold—now trading around $4,074 after retreating from its $4,379 peak—or redirecting flows toward AI-linked equities instead..

For now, traders remain divided but watchful. The divergence between traditional markets, gold, and crypto underscores a wider reality: capital is flowing not into one single trade but into multiple parallel narratives. Whether Bitcoin reclaims leadership or yields it temporarily to gold and AI-driven firms may define the next chapter of the market cycle.

Read the full report here