Zcash’s sudden resurgence is not just another rotation, argues Helius CEO Mert Mumtaz; it is a re-centering of crypto on first principles of cryptography and user choice. In a wide-ranging conversation on Messari’s “Fully Diluted” (Oct. 23) with host Dylan Bane and Messari researchers, Mumtaz framed Zcash as “secret Bitcoin”—a full-stack, zero-leakage design for money that Bitcoin’s earliest architects wanted but could not ship with 2010-era tooling.

Zcash Proves Satoshi Right

“The simplest conceptual way to understand this is that it’s a secret Bitcoin. It’s an encrypted Bitcoin,” Mumtaz said, invoking early forum posts from Satoshi and Hal Finney. “You have forum posts of Satoshi and Hal [Finney] saying things like, ‘If we knew how to add ZK proofs to Bitcoin, it would make it a better Bitcoin.’ But this is 2010 and they didn’t have the tech. And since then, the tech has been made.” In his telling, that lineage matters: Zcash inherits Bitcoin’s monetary template while replacing probabilistic obfuscation with “pure encryption.”

Mumtaz’s critique of “bolt-on” privacy was unambiguous. Privacy, he argued, is not a feature toggle; it is a system property that must be designed from the ground up to minimize information leakage across the entire stack—wallets, RPCs, mempools, validators, bridges, and application UX. “Privacy is not, in my view, something that can be bolted on,” he said.

“You have to start from first principles and approach the problem from a vertically integrated full-stack solution.” He contrasted Zcash’s shielded pool with approaches like Monero and mixers that rely on decoys: “With Monero… you’re introducing probabilistic decoys… it’s that cups-and-ball game… with Zcash there is no obfuscation, it is a pure encryption—if the ball just didn’t exist at all.”

The immediate catalyst behind Zcash’s rally, Mumtaz suggested, was less a single headline than a confluence: product-level UX improvements, a shifting policy backdrop, and attention—both supportive and hostile—compounding on social media. He pointed to the new Zashi wallet as a turning point: “People are actually able to use this new Zashi wallet to have some fun… sending each other private messages and shielding stuff and tipping each other.”

He also argued the market had “over-indexed on extremely weird coins” while neglecting “privacy ideals,” leaving Zcash’s market cap “pathetically low” relative to its potential at the moment he began highlighting it.

Regulation loomed over privacy the last few years. Mumtaz was blunt about the chilling effect of enforcement on privacy R&D: “People were scared of going to jail for even launching tokens, let alone writing privacy code. And there’s people still in jail for this.” He sees parts of the US moving in a friendlier direction under US President Donald Trump, while parts of Europe move toward surveillance and scanning of private messages.

That divergence makes long-range forecasting difficult, he cautioned, but it reinforces why the industry should “guard zealously people’s right to privacy” as crypto’s legal status improves elsewhere. “There’s people in jail for writing privacy code, but not for launching scams. That seems like a pretty big problem that we need to correct.”

Bitcoin, Solana And ZEC

On the perennial question—why not add robust privacy to Bitcoin directly?—Mumtaz cited both governance inertia and technical realities. Bitcoin core changes are hard by design, he said, and privacy demands more than a script-level patch. “Unless you are designing with leaks minimized from the bottom up, the leaks kind of add up… It just takes one leak to compromise that privacy.”

Zcash’s roadmap featured prominently. Mumtaz expects the Tachyon work spearheaded by Sean Bowe to address “state growth” and lay “foundations for scaling,” cleaning up legacy design choices that waste compute, such as brute-decoding notes. He called for pragmatic fee markets to mitigate spam and for improving mining decentralization as price action draws new hashrate.

But he rejected, in its current form, the “Crosslink” hybrid PoW/PoS finality proposal: “It’s a bad idea… With a privacy system especially, the more moving pieces you introduce, the more attack surface increases… It’s unclear to me what exactly you’re gaining from this other than kind of a new finality time.” If given a token-holder vote, he said he would vote against it unless substantially revised.

Mumtaz repeatedly returned to an “atomic unit” framing of privacy: information leakage. He extended that lens to bridges and cross-ecosystem liquidity. Helius helped bridge ZEC exposure into Solana via NEAR, but he stressed users give up Zcash’s privacy when they hold it on Solana. “Once that asset is on Solana, you don’t have the privacy benefits… You can bridge it back and deposit in the shielded pool… then you get the privacy back, but while you’re on Solana you’re not going to have the same privacy as the private blockchain.” The utility, for now, is market access and DeFi composability rather than end-to-end confidentiality.

The market meta, he conceded, is cyclical because attention is finite. The objective is to ratchet the floor higher each cycle by converting narrative into durable engineering and sensible legislation. “It’s on the builders… to use that momentum… to actually drive forward sensible legislation and harden the engineering of these systems such that they endure in scale and are usable for many people.”

Asked to handicap the 2030 leaderboard, he demurred on precise ordering but volunteered a long-horizon view in which Zcash belongs in the conversation alongside Bitcoin and Solana: “If you were to tell me 20 years then I’m going to say Bitcoin, Solana, ZEC.”

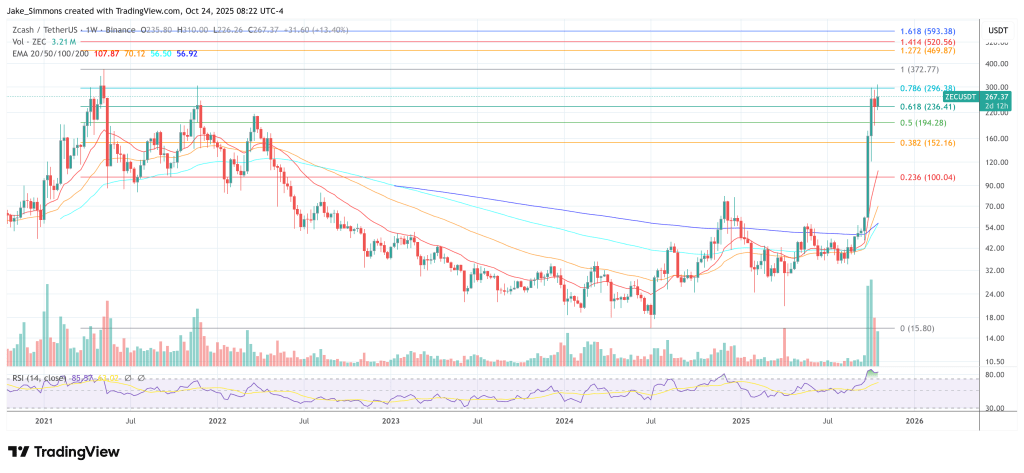

At press time, ZEC traded at $267.