Key Notes

Solana price rally could stay intact with daily trading volumes surging to $6 billion.

The recently approved Alpenglow upgrade aims to enhance consensus efficiency and reduce finality times to 150 milliseconds.

Odds of spot Solana ETF approval have surged to 99% on Polymarket, which could potentially drive strong institutional inflows.

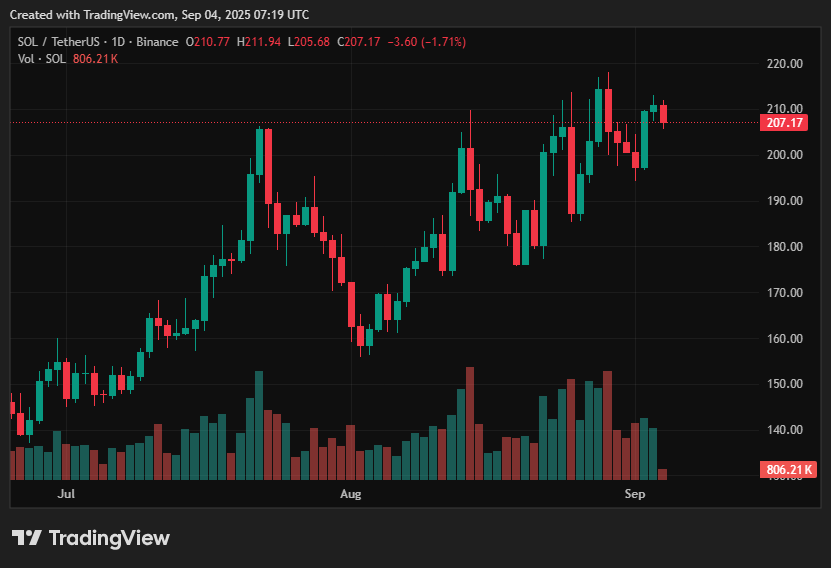

Despite Solana SOL$242.3 price showing strength with 23% upside over the past month, the recent rally has been paused as the altcoin fails to break past $210.

However, the bullish narrative remains intact, with daily trading volumes staying around $6.0 billion.

Solana Price Action Ahead

Solana price is trading at $206.8, with intraday movement between $206.2 and $212.4. The price continues to follow an ascending pattern of higher lows, with $197-$200 acting as a key support zone.

On the upside, the $215-$220 range remains a major resistance level. A breakout above this zone could open the way toward $236-$252, and with strong trading volume, some analysts project levels as high as $260.

Solana price eyes breakout above $215. | Source: TradingView

Much of the bullish outlook depends on the successful rollout of Alpenglow, which is expected to deliver near-instant block finality and enhanced scalability.

These two features are seen as critical for broader adoption and ecosystem growth.

The recently approved upgrade leverages technologies like Rotor and Votor to enhance consensus efficiency. It also cuts finality times to approximately 150 milliseconds, improving the network performance, suitable for RWAs and DeFi.

On the other hand, if Solana price fails to hold support in the $206-$200 range, it could decline toward $190-$186, with further downside potentially extending to $180.

Solana ETF Optimism Rising Again

Optimism surrounding the approval of spot Solana ETF has been on the rise. Solana currently has both spot and collateralized ETF applications under review.

The SEC has requested updated S-1 filings, indicating the process is in its final stage, with approval expected as early as October and a 90% probability.

According to Polymarket, the odds of Solana ETF approval have surged to a massive 99%.

An approval could possibly lead to strong institutional inflows in Solana, driving the SOL price higher.

Solana approval odds went up by 99%.| Source: Polymarket

On the other hand, Mike Novogratz’s crypto investment firm Galaxy Digital has become the first publicly traded company to tokenize its SEC-registered equity on a major blockchain.

In a collaboration with fintech firm Superstate, Galaxy’s Class A common shares can now be tokenized and held on the Solana blockchain.