Expectations for a December Federal Reserve rate cut have fallen sharply, with major platforms now showing odds below 50% for the first time in a month. Bitcoin dropped to $90,410, losing 5.4% in 24 hours as changes in monetary policy outlook hit risk assets.

This abrupt shift marks a clear departure from previous certainty. Traders now await the November 19 FOMC minutes for insight into the Fed’s increasingly cautious approach.

Rate Cut Odds Fall Sharply Across Key Platforms

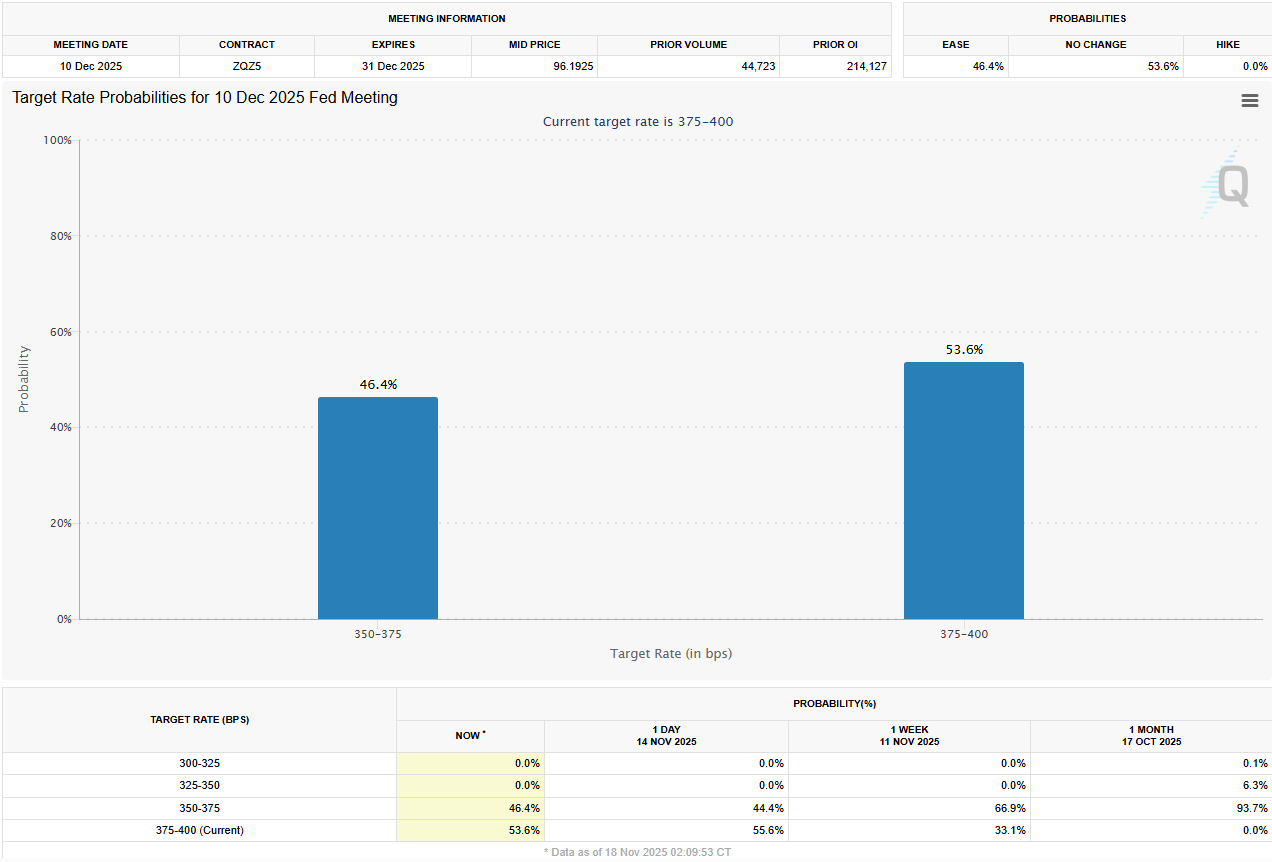

The odds of a December rate cut have reversed dramatically on multiple platforms. According to the CME FedWatch Tool, there is a 46.4% chance of a 25-basis-point cut and a 53.6% probability that rates will be held steady.

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Other prediction markets are even more hawkish. Kalshi shows 55% odds for no cut, while Polymarket leans slightly toward rate stability at 54%.

“A cut was all but certain a month ago,” wrote Barchart.

Financial markets responded quickly as Federal Reserve officials sent mixed signals. The bond market now reflects an expectation of “higher for longer” policy, with analysts seeing little chance of a December move.

This sentiment shift stems from concern about stubborn inflation and a resilient economy. What was once a near-certain pivot toward easing is now a point of intense debate among market participants and Fed leaders.

Fed Officials Offer Conflicting Views Ahead of FOMC Minutes

Federal Reserve officials have sent mixed signals, increasing uncertainty as the FOMC minutes approach. Governor Christopher Waller stands out as a strong advocate for a December cut, citing deteriorating labor conditions.

Waller argues core inflation, excluding tariffs, is near the Fed’s 2% goal. He views tariffs as one-time price shocks, rather than lasting inflationary pressures, and urges policymakers to look beyond these effects.

Vice Chair Philip Jefferson, however, calls for caution and a strictly data-driven approach, staying non-committal about near-term policy moves in recent remarks. This division among Fed leaders is fueling further market debate.

Fed Chair Jerome Powell’s recent comments make a December cut even less likely. Analysts now believe a pause is more probable, with many shifting expectations for a rate reduction to March or April 2026.

The sharply different views within the Fed reflect internal disagreement. While some focus on labor market weakness, others highlight inflation concerns and the risks of acting too soon.

Risk Assets Slide as Macro Uncertainty Deepens

The changing outlook for rate cuts triggered broad selling of risk assets. Bitcoin fell below $90,000, a 14% decline over the week. Crypto markets are vulnerable when financial conditions tighten and risk appetite fades.

Major equity markets moved in tandem. The Dow Jones Industrial Average dropped 0.88%, the Nasdaq Composite slipped 0.90%, and the S&P 500 fell 0.84%. These declines reflect how rate uncertainty is now the key force driving markets.

Meanwhile, a disconnect has emerged between corporate and consumer views on inflation. Mentions of inflation on corporate earnings calls have dropped 88% since 2021, but consumers still expect 4.7% inflation ahead.

This contrast may point to improved business pricing or a disconnect between businesses and households.

The Empire State manufacturing survey beat expectations, surging to 18.7 versus a forecast of 5.5. However, stronger data could reinforce the case for the Fed to keep policy tight for longer, rather than encourage rate cuts soon.

Market participants are at a crossroads. The FOMC minutes due November 19 may either confirm the hawkish shift in pricing or show ongoing disagreements inside the Fed.

In either case, traders prepare for significant volatility leading up to the policy meeting at the end of the year.