XRP traders are being pulled in two opposite directions this week. On one side, heavy selling from big holders has triggered anxiety across the community.

Key Takeaways:

Whales have sold 190 million XRP in the past 48 hours, triggering strong selling pressure.

Multiple spot XRP ETFs are launching, including the 21Shares ETF approved to trade under ticker TOXR.

XRP is currently near $2.11, with weak momentum and bearish RSI/MACD signals.

On the other, a wave of new spot XRP ETFs – including one from 21Shares that has just secured automatic approval – is generating intense speculation about major institutional inflows. The market now finds itself at a crossroads, where short-term fear and long-term optimism collide.

Whales Cash Out 190 Million XRP in 48 Hours

Fresh data shared by analyst Ali (@ali_charts) reveals that 190 million XRP has been offloaded by whales in the past two days. The sell-off has weighed noticeably on price performance, pushing XRP back toward $2.11 and erasing part of last week’s relief bounce. Historically, similar spikes in whale distribution have preceded large volatility events – and traders are watching closely to determine whether this marks the start of a downtrend or the end of a capitulation wave.

190 million $XRP sold by whales in the last 48 hours! pic.twitter.com/nB0P7jADCx

— Ali (@ali_charts) November 20, 2025

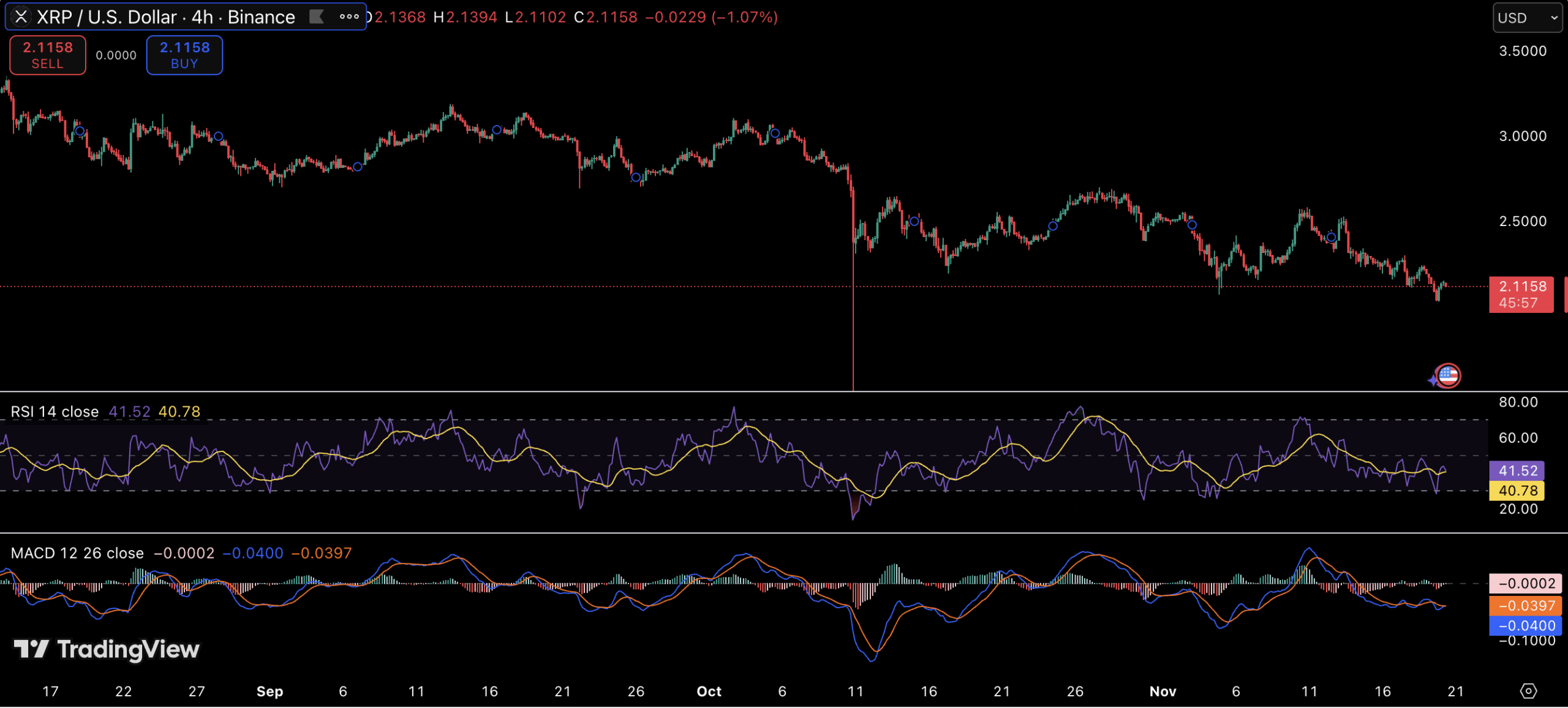

The four-hour chart shows how aggressive the selling pressure has been. Despite occasional attempts to reclaim higher levels, sellers have remained in control since October, preventing XRP from rebuilding a firm bullish structure. The current price action reflects uncertainty, not panic – but the longer XRP stays below the $2.25–$2.30 range, the harder recovery becomes.

ETF Launches Bring a Very Different Story

Against this bearish backdrop, the institutional landscape for XRP has never looked stronger. The 21Shares XRP ETF has gone auto-effective following its Form 8-A filing with the U.S. SEC, clearing the way for trading on the Cboe BZX Exchange under ticker TOXR as early as next week.

The race doesn’t stop there. Three more asset managers are preparing to launch XRP funds almost simultaneously:

Bitwise will list its ETF on NYSE Arca under ticker XRP

Franklin Templeton will debut with the lowest management fee in the category

Grayscale has confirmed its own entry with the upcoming GXRP ETF

Grayscale XRP Trust ETF (ticker: $GXRP) is coming. pic.twitter.com/SGIWuRwCMC

— Grayscale (@Grayscale) November 19, 2025

The XRP ETF market is shaping up to become one of the most competitive institutional battlegrounds since the approval of Bitcoin spot ETFs, and analysts expect fee wars and liquidity hunts to escalate quickly.

Technical Signals: Weak Momentum for Now

Despite the ETF buzz, price charts still reflect cautious sentiment. XRP is currently trading around $2.11, resting near the bottom of a descending structure.

The RSI on the 4-hour timeframe hovers near 41, signaling weak demand. Buyers are not exhausted – they’re simply hesitant.

The MACD shows a bearish trend, with the signal line holding above the MACD line and no bullish crossover in sight. For traders, this means the market has not yet confirmed a reversal.

Support sits near $2.05, and if the price falls below it, sellers could attempt to drag XRP toward the $1.98–$2.00 zone. A recovery, meanwhile, requires a clean move back above $2.30 – the boundary that whales have repeatedly defended.

Short-Term Pain vs Long-Term Potential

What makes XRP’s current setup so unusual is the timing. Whales are selling aggressively right before ETFs go live. There are multiple ways to interpret this behavior:

Broader market derisking

Pre-ETF profit-taking

Attempt to shake out retail before institutional liquidity enters

No matter the cause, once the ETFs start trading, inflows – or lack of them – will likely dictate the next major move. A strong debut with high volume could overwhelm selling pressure and launch a trend reversal. A weak debut could accelerate the ongoing decline.

Critical Week Ahead

XRP is approaching a decisive moment. If the ETF launches next week trigger institutional demand, the market narrative could shift instantly from concern to bullish acceleration. If enthusiasm falls flat and whales continue to trim holdings, XRP might face a deeper correction before finding footing.

Either way, the next movement will not be subtle. XRP is sitting on a pressure point – and when that tension breaks, traders should expect velocity.