Ondo price prediction is a topic that keeps coming back in crypto discussions, especially among new investors who want clear answers without technical jargon. The market moves fast, and many beginners feel unsure about what these movements actually mean. That is why this guide takes a simple, human approach. It explains how Ondo works, what shapes its price, and what analysts expect in the future.

At the moment, ONDO trades close to $0.7. This price has stayed fairly stable despite a busy month. The token dropped to around $0.67 on October 31, yet it also managed to climb as high as about $0.97 on October 7.

In the next sections, you will get a clear look at what Ondo actually is. We explain who created it, what problem it tries to solve, and how the ONDO token fits into the bigger vision. You will also see a summary of price history, future forecasts, and technical levels that traders often watch.

If you want a balanced, easy-to-follow explanation of Ondo — and want to know whether ONDO could be a good investment — this guide will help you explore the project step by step.

| Current ONDO Price | ONDO Prediction 2025 | ONDO Price Prediction 2030 |

| $0.7 | $2 | $15 |

Ondo (ONDO) Overview

Ondo is a blockchain project focused on bringing traditional financial products into the crypto world in a simple and transparent way. The project was created by Ondo Finance, a company founded by former Goldman Sachs professionals who wanted to connect digital assets with real-world financial instruments. Their goal was clear from the beginning: make regulated, yield-bearing financial products available on-chain, where anyone can access them without complex banking processes.

The ONDO token sits at the center of this ecosystem. It acts as a governance and utility token that supports different functions within Ondo Finance’s products. The project is best known for its tokenized real-world assets, especially products backed by short-term U.S. Treasuries. These products aim to give users stable, transparent returns without leaving the blockchain environment.

Ondo operates on Ethereum and follows familiar ERC-20 standards, which makes the token easy to integrate with wallets, exchanges, and DeFi

applications. This also helps developers build tools and services around Ondo without learning a new system. The project focuses strongly on compliance, something that sets it apart from many other crypto initiatives. It works within existing financial regulations and aims to offer an experience that feels safe for both institutions and retail users.

The ONDO token will play a larger role over time. It will be used for governance decisions, such as voting on product updates or managing key parts of the ecosystem. The team also plans to expand its use in decentralized finance, where ONDO may support liquidity, staking, or new financial products.

In simple terms, Ondo combines traditional finance with blockchain technology. It offers real-world yield in a digital format and provides a token that gives users a voice in how the ecosystem grows. This mix of regulated products, strong financial background, and blockchain efficiency is what makes Ondo a unique project in today’s market.

ONDO Price Statistics

| Current Price | $0.7 |

| Market Cap | $2,201,265,508 |

| Volume (24h) | $116,600,007 |

| Market Rank | #62 |

| Circulating Supply | 3,159,107,529 ONDO |

| Total Supply | 10,000,000,000 ONDO |

| 1 Month High / Low | $0.97 / $0.67 |

| All-Time High | $2.14 Dec 16, 2024 |

Ondo (ONDO) Price History Highlights

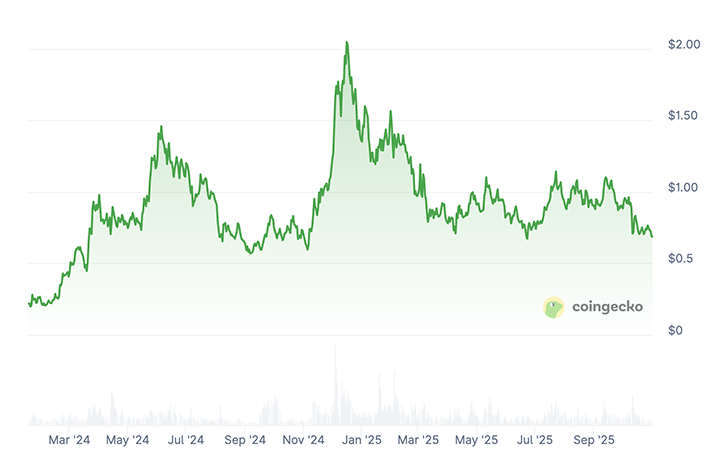

2024: Early Volatility and Rapid Growth

Ondo entered the market in January 2024, and its first days were far more dramatic than many expected. ONDO opened at $0.1617 on January 18 and quickly dropped to its all-time low of $0.0835. Despite this shaky start, the token recovered fast and closed the month at $0.2152, gaining more than 35% from its opening price.

The first quarter of 2024 marked the beginning of strong momentum.

February 2024 almost doubled ONDO’s value, rising from $0.22 to $0.43, fueled by growing excitement around tokenized real-world assets (RWA).

In March 2024, the price surged again, jumping from $0.43 to $0.98, a remarkable monthly gain of 130%. The key catalyst was a major announcement: Ondo Finance moved $95 million of its OUSG assets into BlackRock’s BUIDL fund. This partnership boosted confidence and brought institutional attention.

From April to August 2024, ONDO entered a period of turbulence and consolidation.

April saw a correction to $0.75, despite hitting a temporary peak of $1.6.

May rebounded strongly with a rise to $1.25, while June and July delivered sideways and negative movement, with July falling by almost 25%.

August 2024 became the weakest month of the period, with ONDO dropping to $0.63, reflecting a broader market slowdown.

The final quarter of 2024 brought a mix of recovery and explosive growth.

September climbed nearly 20%, while October fell by about 10%, ending at $0.69.

Then came November 2024, when the price soared to $1.23, gaining 80% in a single month.

The most dramatic moment arrived in December 2024, when ONDO hit its all-time high of $2.15 after news linked to World Liberty Financial, a project publicly supported by the Trump family. ONDO closed December at $1.34, marking one of the most impactful months in its history.

2025: Unlock Shock, Correction, and Slow Stabilization

The year began with January 2025, which pushed ONDO to $1.49, the second-highest monthly close ever. However, on January 18, the market faced a major supply event: 1.94 billion ONDO tokens were unlocked, increasing circulating supply by 135%. Despite historical strength after previous unlocks, February reacted with a sharp drop to $0.99, losing more than 30%.

March 2025 continued the decline, falling another 20% to $0.78, placing ONDO nearly 63% below its ATH.

In April, the token showed the first signs of recovery, rising to $0.907.

The following months were mixed:

May: down 8%

June: down 7%

July: up 20% to $0.92

August and September 2025 stabilized with mild declines under 3%, suggesting consolidation.

The latest major move came in October 2025, when ONDO dropped by 20% to $0.7, returning to price levels last seen in early 2025.

ONDO Price Chart

CoinGecko, October 31, 2025

Ondo Price Prediction: 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.6 | $4.14 | $2 | +185% |

| 2026 | $1.5 | $9.87 | $5 | +615% |

| 2030 | $3.3 | $31.8 | $15 | +2,000% |

| 2040 | $64.3 | $627 | $300 | +43,000% |

| 2050 | $784 | $909 | $800 | +114,000% |

ONDO Price Prediction 2025

DigitalCoinPrice analysts expect ONDO to trade between $0.62 (-10%) and $1.53 (+120%) in 2025, with an average target of $1.33 (+90%). Their outlook suggests moderate but steady growth as demand for tokenized real-world assets increases.

PricePrediction experts project a slightly higher range, forecasting $1.03 (+45%) at the yearly low and $1.14 (+65%) at the peak.

Telegaon’s outlook for 2025 is the most bullish among all sources. Their models anticipate ONDO trading between $1.51 (+115%) and $4.14 (+495%), supported by accelerated RWA adoption and institutional inflows into tokenized products.

ONDO Price Prediction 2026

DigitalCoinPrice forecasts a 2026 ONDO trading range between $1.49 (+115%) and $1.74 (+150%), representing continued market expansion for the protocol.

PricePrediction analysts expect a similar zone, projecting $1.59 (+130%) at the low and $1.83 (+160%) at the high.

Telegaon again provides the most aggressive prediction, forecasting a minimum of $4.18 (+500%) and a maximum of $9.87 (+1,300%) — a scenario aligned with mass adoption of RWAs and broader global tokenization.

ONDO Price Prediction 2030

DigitalCoinPrice believes ONDO could reach between $3.29 (+370%) and $3.81 (+445%) by 2030, assuming consistent market expansion and deeper institutional usage.

PricePrediction is more bullish, signalling a range of $7.20 (+930%) to $8.99 (+1,190%).

Telegaon’s long-term prediction is extremely optimistic. According to their models, ONDO may trade between $27.35 (+3,800%) and $31.76 (+4,450%), placing it among the most explosive RWA assets of the decade.

ONDO Price Prediction 2040

PricePrediction analysts foresee massive long-term potential for ONDO, estimating a 2040 valuation between $528.87 (+75,500%) and $626.79 (+89,500%). Such projections imply ONDO becoming a top-tier global RWA infrastructure asset.

Telegaon provides a more conservative—but still highly bullish—forecast. Their 2040 range spans $64.29 (+9,100%) to $69.34 (+9,800%), reflecting growth aligned with expanding global tokenized finance regulations.

ONDO Price Prediction 2050

PricePrediction experts anticipate ONDO reaching unprecedented heights by 2050, projecting $783.64 (+111,000%) at the lower bound and $909.31 (+123,000%) at the upper bound.

Ondo (ONDO) Price Prediction: What Do Experts Say?

Recent analysis from leading crypto commentators shows a mix of bullish long-term expectations and short-term caution for ONDO.

Chad Steingraber, one of the more outspoken voices in the space, positioned ONDO as a core building block of what he calls “Wall Street 2.0.” He highlighted how ONDO and XRP are shaping a new financial system by merging blockchain technology with traditional markets.

Steingraber stressed that ONDO’s model for tokenizing real-world assets is not just another trend but foundational infrastructure for the next generation of global finance. He also underlined the significance of the upcoming Ondo Finance Summit on February 3, 2026, in New York. The event will include heavyweights such as Goldman Sachs, BlackRock, Citi, State Street, and Franklin Templeton, alongside major blockchain firms like Ripple and Chainlink. This level of institutional participation reinforces the belief that ONDO is becoming a key bridge between traditional and decentralized finance.

Another perspective comes from Gerhard of the Bitcoin Strategy YouTube channel, who shared on-chain insights on October 29, 2025. He observed that despite ONDO’s platform fundamentals improving and its TVL growing steadily, the token price has remained stuck between $0.66 and $0.84 following the October 10 flash crash.

His analysis revealed a major supply challenge: ONDO’s circulating supply has increased from 1.5 billion to 3.4 billion tokens, which continues to generate selling pressure. Still, he identified promising signs such as small retail accumulation, a reduction in large whale wallets, and negative futures funding rates that suggest oversold conditions. According to Gerhard, if supply unlocks slow and market sentiment improves, ONDO could begin to reflect the platform’s real growth and potentially move toward $2.00 or higher.

Coinpedia added another layer of technical context with its October 26 report. Their analysis states that a November close above $1.1 could open the way toward $1.5 and possibly $2.1 before year-end. They view the October crash to $0.6 as more of a liquidity washout than a real breakdown. Their November forecast ranges between $0.8 and $1.29, with an average near $1. A bullish continuation requires a daily close above $1.16, while a bearish break below $0.8 could expose deeper supports at $0.66 and $0.45.

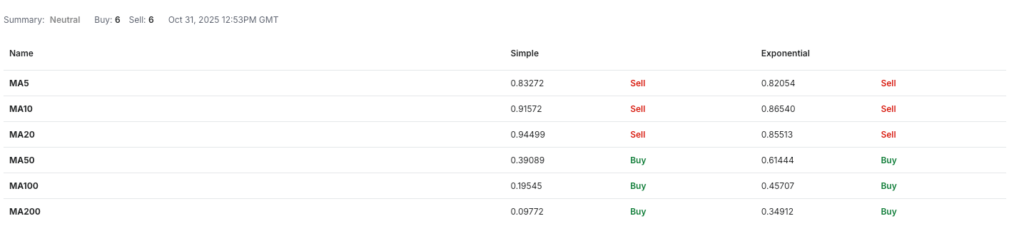

ONDO USDT Price Technical Analysis

Monthly technical data from Investing shows a mixed but generally bearish structure for ONDO, with indicators pointing to weakening momentum and a market still searching for a stable support level. The overall Technical Indicators summary is “Strong Sell,” while Moving Averages remain “Neutral,” showing an even split between buying and selling signals. This combination suggests uncertainty, with price action caught between recovering from the October flash crash and facing renewed selling pressure.

Investing, October 31, 2025

Momentum indicators present a divided picture. The RSI (14) at 53.93 signals neutral momentum, implying neither overbought nor oversold conditions. However, several oscillators show weakening pressure. The Stochastic (34.80) and Williams %R (-76.51) both register Sell signals, indicating a lack of strong bullish follow-through. The CCI (14) at -121.83 also leans bearish, reflecting downward pressure throughout the month. One red flag is the StochRSI (91.49), which sits in extreme overbought territory, often a precursor to short-term corrections if price fails to break resistance.

There are, however, limited bullish signals. The MACD (12,26) remains on a Buy signal, suggesting potential early trend recovery, while the ROC (10.03) also indicates upward movement. Still, these signs have not been strong enough to shift the broader technical sentiment.

Volatility remains elevated. The ATR (14) at 0.47 shows that price swings are wide, matching recent market instability. High volatility usually favors breakout traders but increases risk for short-term entries.

Moving averages highlight the long-term trend more clearly. Short-term MAs (MA5, MA10, MA20) all flash Sell, confirming persistent downward pressure. In contrast, the MA50, MA100, and MA200 remain deep in Buy territory, reflecting ONDO’s strong performance earlier in the year and showing that the macro trend remains intact despite the recent correction.

Pivot points help map key levels for November. Classic calculations place support zones at $0.78, $0.68, and $0.5, while resistance sits at $1.06, $1.23, and $1.33. A decisive monthly close above $1.06 could signal renewed bullish structure, while a break below $0.68 would confirm further downside risk.

What Does the Ondo Price Depend On?

Ondo’s price is shaped by a mix of market forces, adoption trends, regulatory developments, and internal tokenomics. Because ONDO sits at the intersection of blockchain and traditional finance, its price behavior often reflects broader sentiment toward tokenized real-world assets. While short-term moves can look volatile, the long-term structure depends on deeper fundamentals.

One of the strongest drivers is demand for tokenized Treasury products and other real-world assets. Ondo Finance plays a leading role in this sector, so every expansion in its institutional partnerships or product lineup tends to influence ONDO’s market confidence. Growth in total value locked (TVL) often supports positive sentiment, especially when new banks, funds, or asset managers join the ecosystem.

Another factor is supply dynamics, which have become crucial after major token unlocks. When the circulating supply expands faster than demand, price pressure increases. Investors watch unlock schedules closely because they can temporarily shift sentiment. At the same time, long-term lockups by institutions or governance participants can reduce sell-side liquidity.

Here are several additional elements that impact ONDO’s value:

Market sentiment toward RWAs — positive cycles push institutional flows into the sector.

Regulation — supportive frameworks accelerate adoption; restrictive ones slow inflows.

Partnerships — every new integration strengthens ONDO’s credibility.

Liquidity — deeper liquidity across exchanges attracts larger traders.

Macro conditions — interest rates and bond yields affect demand for yield-bearing products.

Technology development also matters. Updates to Ondo’s infrastructure, new product launches, and integrations with major blockchain networks can boost investor confidence. ONDO’s role as a governance token means its utility grows as the ecosystem expands, which can positively influence long-term valuation.

Speculation remains a big part of the crypto market, so short-term volatility is often driven by traders reacting to Bitcoin’s price movement, funding rates, liquidation clusters, and general market fear or excitement. However, ONDO tends to recover faster during bullish phases because it is tied to a sector with strong real-world demand.

Ondo (ONDO) Features

Ondo offers a wide range of technical and structural features designed to support real-world asset tokenization and institutional-grade finance on-chain. The ONDO ecosystem blends traditional financial standards with blockchain efficiency, creating a framework that appeals to both retail users and regulated institutions. Below is a clear breakdown of the most important features shaping the protocol.

Ondo is built primarily on Ethereum as an ERC-20 token, but it also supports Solana and Polygon, giving users and developers broad multi-chain flexibility. Its core strength lies in its use of smart contracts to tokenize real-world assets, enabling transparent, auditable, and immutable transactions.

A key part of the ecosystem is Flux Finance, a decentralized lending protocol forked from Compound V2. It includes modifications that allow the system to support both permissionless and permissioned assets. Flux Finance uses an overcollateralized peer-to-pool model, ensuring that borrowers must always deposit more collateral than the value of their loan. This protects the protocol from insolvency risks.

Important features include:

fToken Standard that mirrors Compound’s cToken design, allowing lenders to earn yield through rising exchange rates.

Permissioned token support, enabling interaction with restricted assets like OUSG.

Hybrid architecture on Ondo Chain, a Layer-1 chain that blends public accessibility with permissioned financial controls.

Permissioned validators operated by regulated institutions, helping maintain trust and compliance.

Enshrined oracles and proof-of-reserve systems for accurate data and transparent backing of tokenized assets.

Omnichain messaging and bridging, allowing seamless cross-chain movement of assets.

RWA-backed staking, where validators stake tokenized Treasuries and other high-quality assets.

Multi-signature security using a 3-of-7 structure for safe redemption and stablecoin management.

Together, these features make Ondo one of the most advanced infrastructures in the real-world asset sector. The platform focuses heavily on compliance, transparency, and interoperability, positioning ONDO as a key token in bridging institutional finance with blockchain technology.

Ondo Price Prediction: Questions And Answers

Is Ondo a Good Investment?

Ondo may be a good investment for people who believe in the long-term growth of tokenized real-world assets. The project works closely with major financial institutions and offers regulated on-chain products, which adds credibility. However, ONDO has shown strong volatility, especially during token unlocks, so new investors should balance long-term potential with short-term risk before making a decision.

What Is the Price of Ondo Finance Today?

The price of Ondo Finance today is around $0.7, based on recent October 2025 data. The token has been trading sideways after a sharp correction earlier in the month, moving mostly between $0.65 and $0.85. Even though the price has stabilized, market sentiment remains mixed, and investors continue to watch upcoming supply events and institutional developments.

Will Ondo Go Up?

Ondo may go up if demand for real-world asset tokenization continues to grow. Analysts note that institutional interest in Ondo Finance is increasing, and major events like the Ondo Summit could strengthen momentum. Still, supply inflation from unlocks and general crypto market conditions can slow upside movement. ONDO tends to perform best when both sentiment and liquidity improve.

How High Can Ondo Coin Go?

Analysts offer very different targets. Short-term technical forecasts suggest a possible return toward $1.5–$2.1 if ONDO breaks above key resistance. Long-term models from some sources show far higher values, especially if RWA adoption becomes mainstream. While extreme predictions should be taken carefully, ONDO does have room to grow if the sector strengthens.

Can Ondo Coin Reach $5?

Reaching $5 is possible in strong market conditions, but it would likely require major institutional adoption, slowed token unlocks, and broader acceptance of RWA-based products. Current 2025–2026 forecasts from most analysts do not expect a move to $5 soon, but long-term models for 2030 or later suggest it may be within reach if the ecosystem expands.

Can Ondo Reach $10?

A move to $10 is considered unlikely in the short term but possible in the long run. Some long-range forecasts, such as those from PricePrediction or Telegaon, show double-digit valuations if global tokenization accelerates. For ONDO to reach $10, it would need strong liquidity, reduced selling pressure, and significant usage across institutional markets.

Can ONDO Finance Reach $20?

Reaching $20 would require major global adoption of tokenized financial products and deep integration with traditional markets. Some of the most optimistic 2035–2050 forecasts mention such levels, but these are speculative. For now, ONDO’s fundamentals are growing, yet market maturity and regulatory certainty would need to improve before such prices become realistic.

Can Ondo Hit $100?

A price of $100 is extremely speculative and not supported by mainstream analysts in the foreseeable future. Such a valuation would imply ONDO becoming one of the largest financial networks globally. While the RWA sector holds strong potential, reaching $100 would require industry-wide transformation and mass institutional migration onto blockchain rails.

What Will Ondo Finance Be Worth in 2025?

Most 2025 forecasts place ONDO between $0.6 and $1.5 according to DigitalCoinPrice, $1 to $1.1 based on PricePrediction, and $1.5 to $4 according to Telegaon. The wide range shows uncertainty, especially with upcoming token unlocks. However, steady RWA adoption could help ONDO finish 2025 stronger than current levels.

What Will ONDO Be Worth in 5 Years?

In five years, ONDO’s price could vary widely based on RWA growth and regulation. Moderate estimates place it in the $3–$8 range by 2030, while more aggressive long-term models predict $20+ during major global adoption cycles. The exact outcome depends on supply dynamics, institutional involvement, and overall crypto market conditions.

What Blockchain Is Ondo On?

Ondo is primarily an ERC-20 token on Ethereum, but the ecosystem also supports Solana and Polygon for multi-chain accessibility. Ondo additionally operates its own Ondo Chain, a hybrid Layer-1 blockchain designed to combine regulated financial controls with public-chain functionality. This structure helps the project connect traditional institutions with decentralized systems.