According to NYDIG research, the same money that pushed Bitcoin up into October’s peak is now pulling it down, and the pull looks structural rather than just emotional selling.

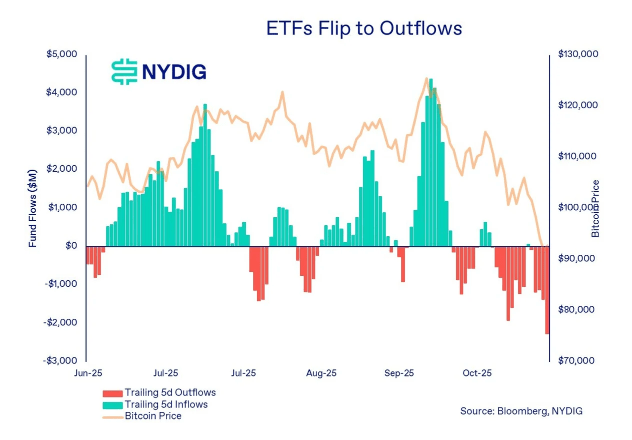

The firm’s head of research says a large liquidation in early October flipped spot ETF flows, pushed digital asset treasury (DAT) premiums lower, and coincided with a drop in stablecoin supply — a mix that points to liquidity leaving the system.

=

ETF And Treasury Reversals

Reports have disclosed that spot Bitcoin ETFs, once steady buyers, shifted from steady inflows into a meaningful headwind, while DAT premiums compressed across the market and stablecoin balances ticked down.

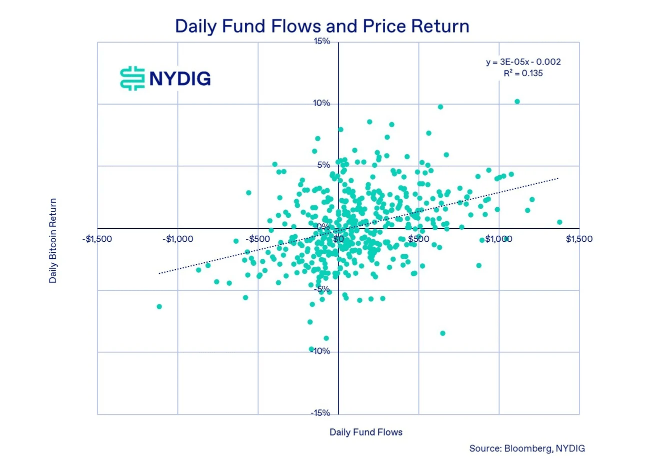

That combination reduced the steady pool of buy-side demand that had been supporting prices. The change is what NYDIG and other market watchers call a break in the feedback loop that previously amplified gains.

Bitcoin Dominance Creeps Higher As Risk Assets Unwind

According to crypto market data, Bitcoin’s share of the total crypto market climbed back above 60% in early November before settling around 58% as of Monday, a sign that traders are moving out of smaller, more speculative coins and into the largest, most liquid asset.

That shift often happens when money tightens: capital consolidates into the biggest name as smaller positions are cut.

DATs Show Cooling Demand, But No Broken Balance Sheets

Based on NYDIG’s note, the DAT sector has not shown signs of insolvency. Issuers still face modest obligations and many structures allow payments to be suspended if needed.

In short: demand has cooled significantly, but the frameworks that underpin many of these funds haven’t collapsed. That means the current stress is on flows and liquidity rather than on solvency.

Crypto analysts are watching technical levels for short-term direction. Michael van de Poppe flagged a CME gap at $85,200 as a likely downside magnet after a recent roughly 10% rise from lows, and suggested Bitcoin could then retest between $90,000 and $96,000 to form a new base.

Traders watch these gaps because futures markets close over weekends while spot markets do not, creating price gaps that often get revisited.

Prepare For Choppy Markets Ahead

Investors should note two separate ideas at once. Based on reports, the long-term story for Bitcoin — growing institutional interest and broader adoption — remains on the table.

At the same time, the short-term cycle driven by flows, concentrated ETF activity, and reflexive buying has shifted.

That points to an uneven path forward, with more volatile moves likely until buy-side engines reappear or fresh liquidity returns.

Featured image from Gemini, chart from TradingView