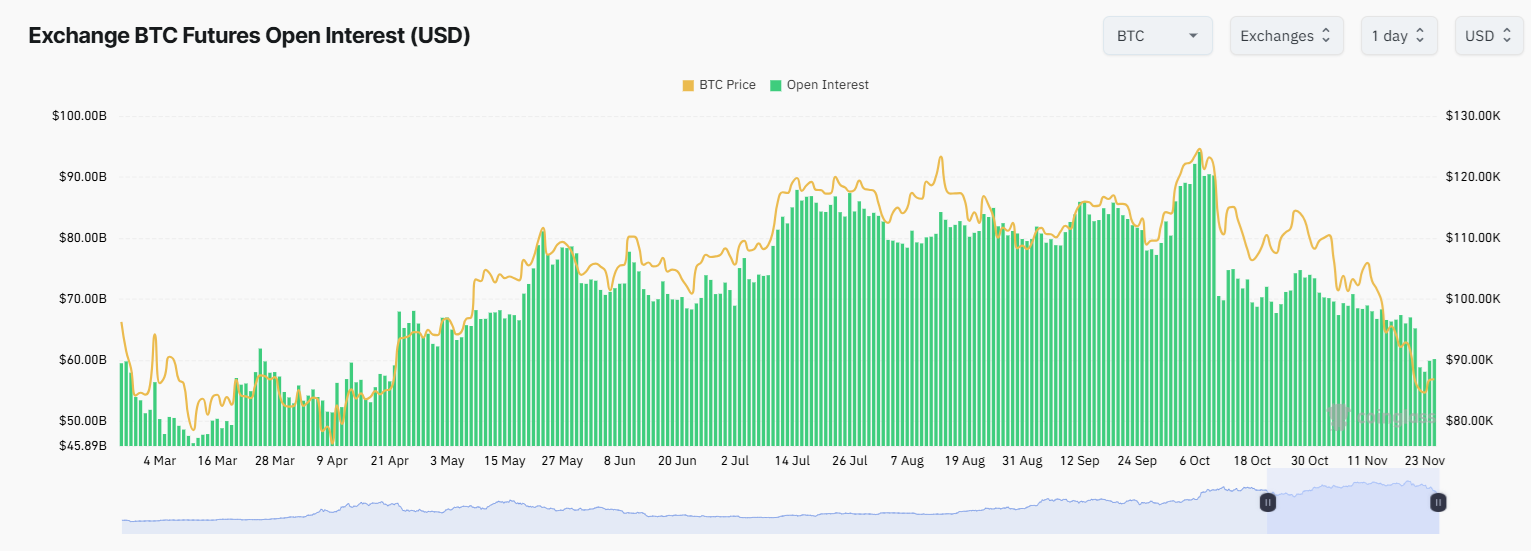

The BTC derivative market is cooling down further, with open interest sliding to a six-month low. Traders are wary after a series of large-scale liquidations, with an outflow of long positions.

BTC derivative trading is slowing down, showing the effect of unwinding long positions. Open interest slides further, after the market wiped out the accumulated long positions over a six-month period.

BTC open interest is down to $30B on crypto-insider exchanges, with an additional $11B on CME. At the peak ahead of the October 10 liquidation, CME held more than $18B in open interest, while Binance posted over $16B in open positions.

The futures outflow shows the disparity between smaller exchanges, CME, and Binance. Previously hot markets shed open interest faster, while Binance still retained its top position.

The low open interest coincides with a period of extreme fear, based on the Bitcoin fear and greed index. The index moved up to 19 points, from a recent low of 11 points. Fearful trading means a lower probability of taking up long positions.

BTC open interest is closely watched with a sign of shifting sentiment. An accumulation of long positions and a rapid spike in OI may signal a sense that BTC has reached its local bottom. However, the past few episodes of rebuilding long open interest led to renewed liquidations.

BTC open interest remains cautious on long positions

The outflow of long positions suggests BTC has lost its long-term conviction for a bullish direction. Long positions were liquidated, but some were closed as funding rates turned negative.

Most of the remaining whales on Hyperliquid with long positions are paying significant fees. The derivative market signals ongoing weakness and traders waiting on the sidelines for a clearer directional move.

BTC has rebuilt some open interest through short positions, accumulating at around $88,000. The current price range is locked between $80,000 and $90,000, with limited open interest below that range.

BTC traded at $86,764.94, establishing a new relatively stable position. Dominance shrank below 57%, as other speculative tokens continued their short-term rallies. BTC is still trading with an uncertain sentiment, with predictions for either a long-term crash, or a renewed bull rally. The Coinbase premium has disappeared, showing an outflow of US-based retail interest.

CME open interest slides close to yearly lows

Open interest on CME gauges the mainstream interest for BTC trading. In the past month, open interest slid close to the lower range for 2025, returning to levels not seen since April.

CME open interest declined to $11.5B, with a constant slide since October 10. BTC open interest has not seen any attempts to rebuild, instead leading to almost constant unwinding of leveraged positions.

The CME is still used as a gauge of direction for BTC, based on the exchange’s price gap. This gap may disappear in 2026, as the exchange prepares to offer perpetual trading.

Get up to $30,050 in trading rewards when you join Bybit today