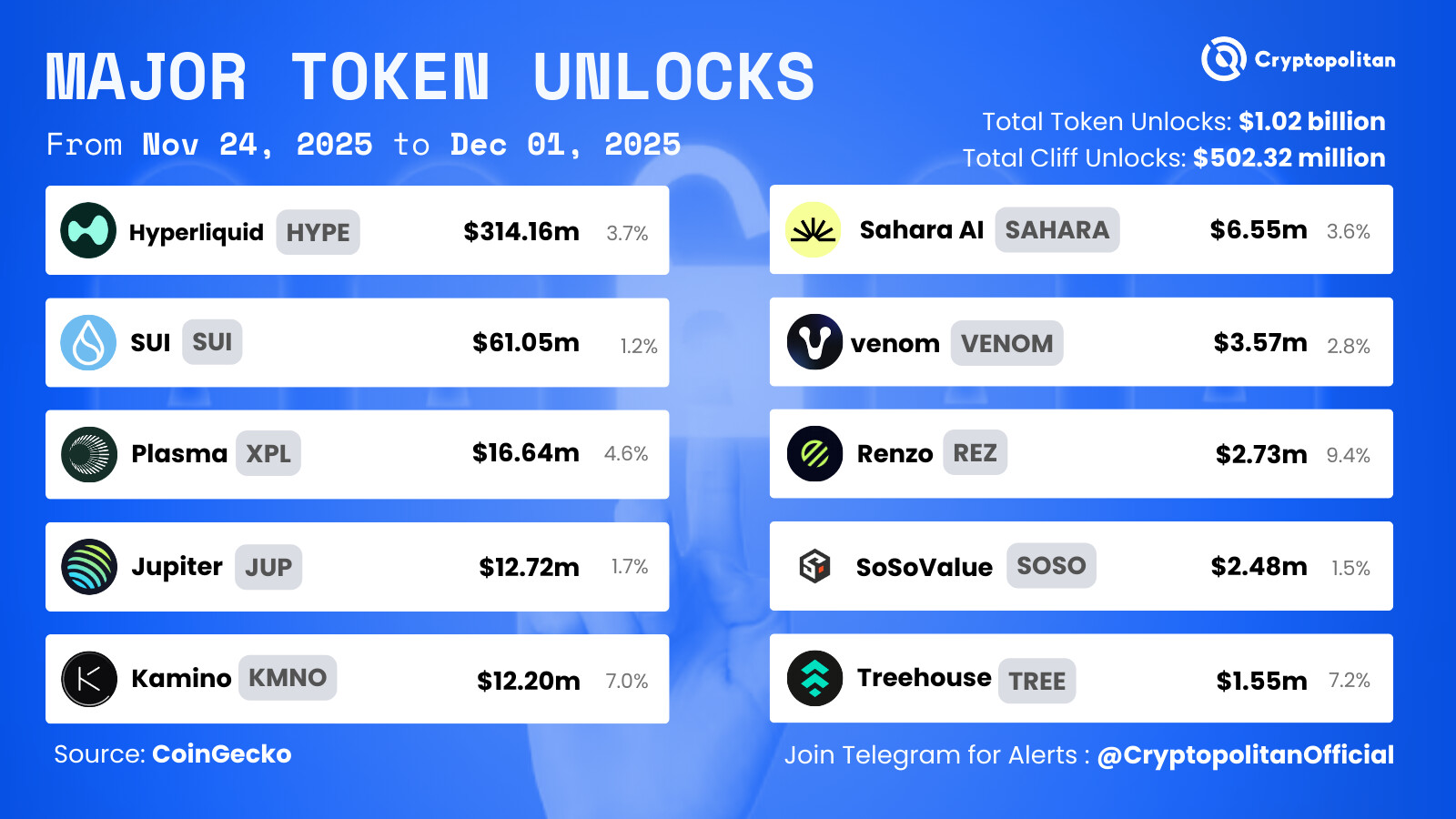

The cryptocurrency market faces over $566 million in scheduled token unlocks between November 24 and December 1.

Data from CoinGecko shows Hyperliquid’s HYPE commanding the largest single release at $318.17 million. The week includes both one-time cliff events and linear daily distributions across 17 major projects.

Eight tokens will experience cliff releases exceeding $5 million each. Nine additional projects operate continuous daily releases above $1 million throughout the period.

Hyperliquid dominates token unlocks with $318 million release

Hyperliquid led the largest single token unlocks event scheduled for the November 24 to December 1 period. The project will release 9.9 million HYPE tokens valued at $318.17 million. The distribution is 3.66% of the total supply entering circulation.

The HYPE distribution follows a cliff structure rather than linear vesting. The entire 9.9 million tokens become available simultaneously rather than being spread across multiple days. Market participants often reduce positions ahead of large releases to avoid a potential price drop.

Solana leads linear token unlocks at $65 million

Linear daily distributions bring $167.85 million in new supply across nine projects during the seven-day period. Solana tops the continuous release schedule with 490,350 tokens valued at $65.06 million. The distribution represents 0.09% of Solana’s circulating supply.

TRUMP token follows with 4.89 million tokens worth $31.25 million scheduled for gradual release. The distribution accounts for 2.45% of circulating supply. Worldcoin releases 37.23 million tokens valued at $23.03 million over the seven days. The amount represents 1.59% of existing circulation. Dogecoin adds 95.51 million tokens worth $14.10 million through continuous vesting.

Aster distributes 10.28 million tokens valued at $11.52 million throughout the period. Avalanche releases 700,000 tokens worth $9.38 million, representing 0.16% of supply. Bittensor TAO adds 25,200 tokens valued at $7.50 million to circulation.

Zcash distributes 11,030 tokens worth $6.42 million. Ether.fi completes the linear schedule with 8.53 million tokens valued at $5.99 million, representing 1.40% of circulating supply.

Plasma and seven other projects face cliff token unlocks

With 89 million tokens worth $17.20 million, Plasma XPL has the second-largest one-time unlock. The release amounts to 4.71% of the entire supply going into circulation at the same time.

Jupiter releases 53 million tokens, or 1.66% of the total supply, valued at $12.62 million. With 230 million tokens worth $11.96 million, or 6.92% of current circulation, KMNO is most affected.

Optimism releases 31 million tokens valued at $9.49 million, representing 1.65% of supply. Zora distributes 170 million tokens worth $8.67 million, accounting for 3.73% of circulation.

The H protocol adds 63 million tokens valued at $7.44 million, representing 3.42% of supply. Sahara completes the cliff schedule with 84 million tokens worth $6.65 million, accounting for 3.54% of total supply.

Less popular token unlocks show varied progress levels

CoinMarketCap data reveals token unlock activity among smaller market cap projects during the same period. Niillion trades at $0.09125 with a market cap of $25.73 million and 281.94 million tokens circulating.

The project shows 27.11% total progress through its vesting schedule. The next release brings 10.84 million NIL tokens worth $989,784, representing 1.08% of the remaining locked supply.

Letit maintains 63.99 million tokens in circulation with 76.60% of total supply already released. The upcoming distribution adds 1.8 million LETIT valued at $43,245, representing 1.80% of locked tokens. TENET shows 76.33% progress through its full vesting timeline.

GT Protocol trades at $0.05229 with a $3.16 million market cap and 60.4 million circulating tokens. The project reached 82.28% unlock progress with 1.21 million GTAI tokens worth $63,244 scheduled for release. GTAI gained 2.62% in the 24 hours before the distribution.

WalletConnect Token trades at $0.1145 with a $23.32 million market cap and 203.54 million tokens circulating. The project shows just 20.35% vesting progress with 100.65 million WCT tokens worth $11.53 million scheduled for release, representing 10.07% of locked supply.

Claim your free seat in an exclusive crypto trading community - limited to 1,000 members.