Pump.fun denied sending USDC to Kraken, based on previous suspicions after large-scale wallet transfers. Instead, it claims that it is preparing to reinvest the proceeds from its ICO.

Pump.fun wallets were suspected of moving funds to Kraken, supposedly for cashing out. The project’s team said the suspicions were unfounded, and the funds moved on a technicality.

In total, Pump.fun wallets moved $435.6M USDC to the Kraken centralized exchange. The team explained that the operation was part of its treasury management, where the proceeds from the PUMP token sale were sent to different wallets.

Pump.fun has been closely watched after a series of SOL sales in the past year. However, the project recently started retaining more of its SOL, with much fewer transfers of tokens to exchanges. Some of the SOL is used for regular PUMP buybacks.

Pump.fun has prepared for new investments, after its recent acquisition of a meme token trading platform Padre Trading and wallet tracker app Kolscan.

Pump.fun has also rebought over 12% of the PUMP supply, with smaller daily purchases. Over the past days, 100% of revenues on average have been used to acquire PUMP.

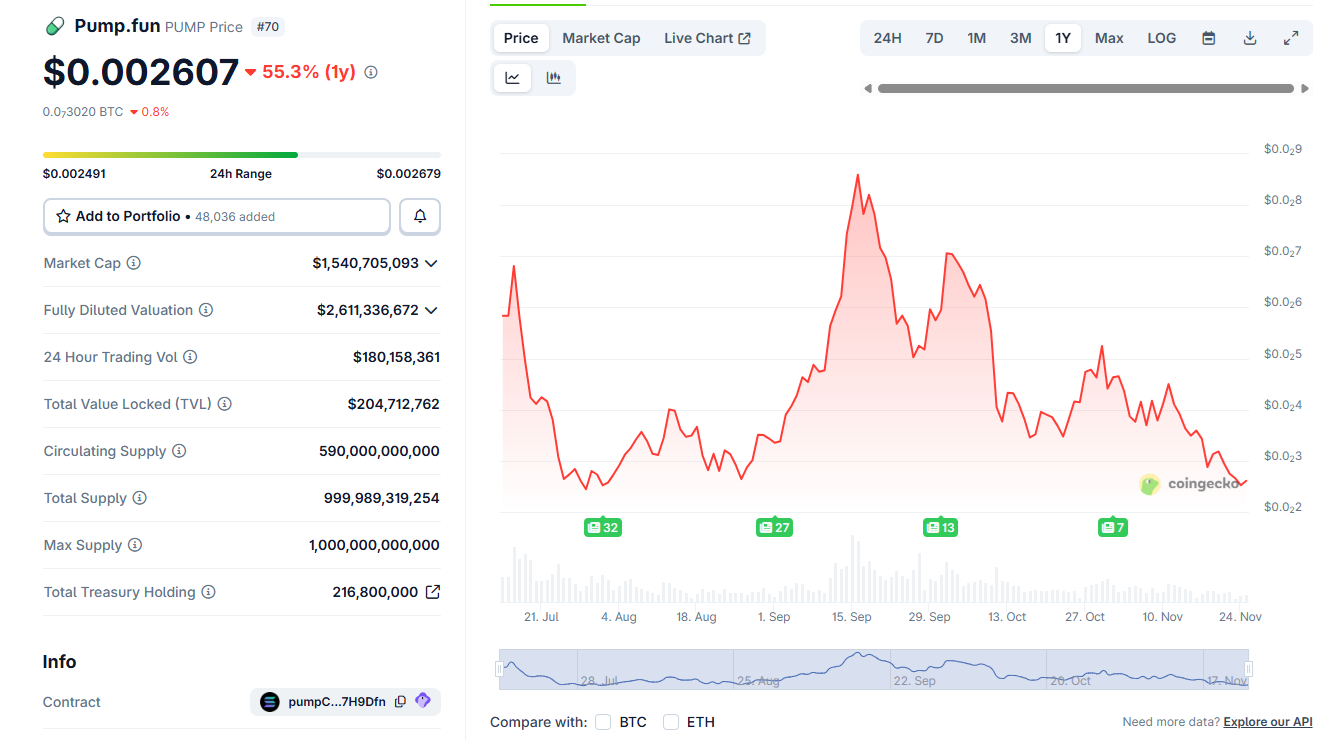

PUMP slides to yearly lows

Despite the regular buybacks, PUMP trended lower after the latest market downturn. The token slid toward its lowest levels for 2025, down to $0.0026. PUMP is down over 72% from its recent local high in September.

The token was also affected by the recent rumors that the Pump.fun team was preparing to dump tokens. The rumors were also a source of fear for the market, causing additional concerns that a big player was planning an exit.

The PUMP mindshare also fell by over 44% in the past months, as the entire meme space slowed down.

Pump.fun activity slows down, with fewer graduating tokens

Pump.fun produces around 15K new tokens daily. The platform is still among the top 10 apps based on daily fee generation, making over $1.4M daily. Volumes have slowed down since the latest wave of meme trading in September. The platform retained relatively lower volumes, despite the introduction of AI-driven trading in Mayhem Mode.

Despite this, Pump.fun compensated with trading on its native decentralized platform. New meme tokens have only 85 daily graduations, with few tokens reaching a significant market cap.

Even the highest-value graduating token for the day is at $6.2M market capitalization, while tokens rarely reach $30M anymore. Pump.fun now bets on innovation and new access points, as the initial enthusiasm for trading in the trenches has dissipated.

Pump.fun also boosted the general Solana ecosystem, as its top activity venue was the Jupiter limit orders wallet. The wallet realized over $44M in profit. Trader Neko (@arukasane) came second, with $43M in realized profits to date. Most of the gains on the platform were by teams or large-scale whales, with most retail traders logging losses.

Join Bybit now and claim a $50 bonus in minutes