Bitcoin’s drop has knocked a huge chunk off the estimated wealth tied to its mysterious creator. Prices fell more than 30% from an October peak near $126,000 to around $85,500, and that slump has cut the value of the coins believed to belong to Satoshi Nakamoto by roughly $41 billion.

Satoshi’s On-Chain Holdings Under Scrutiny

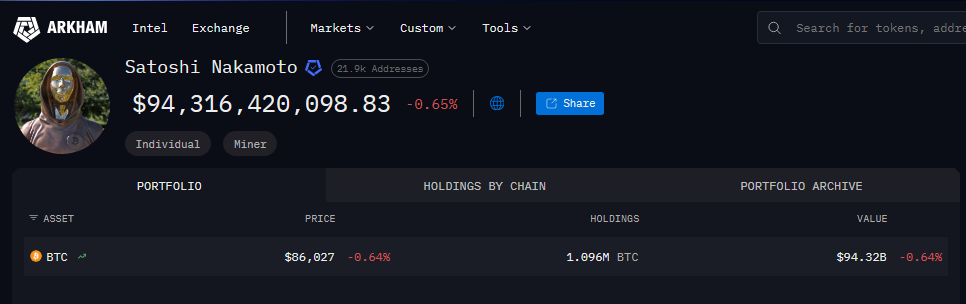

According to on-chain analysts, about 1.1 million BTC are attributed to Satoshi by patterns seen in early mining. Reports have disclosed that this total was worth about $138 billion at Bitcoin’s October high.

Based on current prices, those holdings are now estimated at close to $96 billion. That places the pseudonymous owner below US billionaire Bill Gates, who is estimated at about $104 billion. These figures are estimates, and the methods used to tie addresses to the creator are debated.

Early Mining Pattern Still Contested

Arkham Intelligence and other blockchain researchers point to the so-called Patoshi Pattern as the key evidence linking many early blocks to one actor.

The pattern is a technical signature in the way early blocks were mined. It is not proof of identity. Some experts say the pattern strongly suggests a single miner was responsible for many of the earliest coins.

Others caution that assumptions about ownership must be treated carefully. The wallets in question have been largely inactive for years. That inactivity makes the idea of liquidating such a stake more theoretical than practical.

Market Volatility Highlights Paper Wealth Risk

A lesson here is simple. When most of a fortune is in one asset, swings in price move the headline number a lot. The $41 billion drop is a paper loss. No sale was reported. The funds remain where they have been for years.

Still, the change in valuation has pushed Satoshi down in hypothetical rich lists compiled by observers and crypto outlets. Wealth trackers that require verified identities, like Forbes, do not include Satoshi because the ownership and identity are not confirmed.

Based on reports, the discussion also revived talk about what dormant crypto holdings mean for public measures of wealth. Some commentators raised more speculative concerns, such as future technical threats that could affect custody of private keys.

Those scenarios are distant and uncertain, and they remain a matter for technical debate rather than immediate reality.

What This Means For The Market

Traders watching Bitcoin see how much headline numbers can swing. A 30% move in a few weeks changes math dramatically. Investors who focus on stable, diversified holdings might view this as another reminder of crypto’s big swings.

For now, Satoshi Nakamoto remains silent, as always, despite his/her massive loss; and the coins attributed to the enigmatic crypto creator sit largely untouched — and their paper value will rise or fall with Bitcoin’s next moves.

Featured image from Pexels, chart from TradingView