Bitcoin rejected below $90,000, weighed down by ETF outflows and unsteady retail demand.

Ethereum recovery takes a breather under $3,000 despite ETF inflows.

XRP offers mixed technical signals amid a steady increase in futures Open Interest.

Bitcoin (BTC) is edging lower, holding above $87,000 at the time of writing on Tuesday. This pullback comes after two consecutive days of gains that pushed BTC to a weekly high of $89,228 on Monday.

Altcoins, including Ethereum (ETH) and Ripple (XRP), are showing technical weakness, despite inflows into Exchange Traded Funds (ETFs). The next few days will be crucial in determining the direction the crypto market takes as we head into the final month of the year.

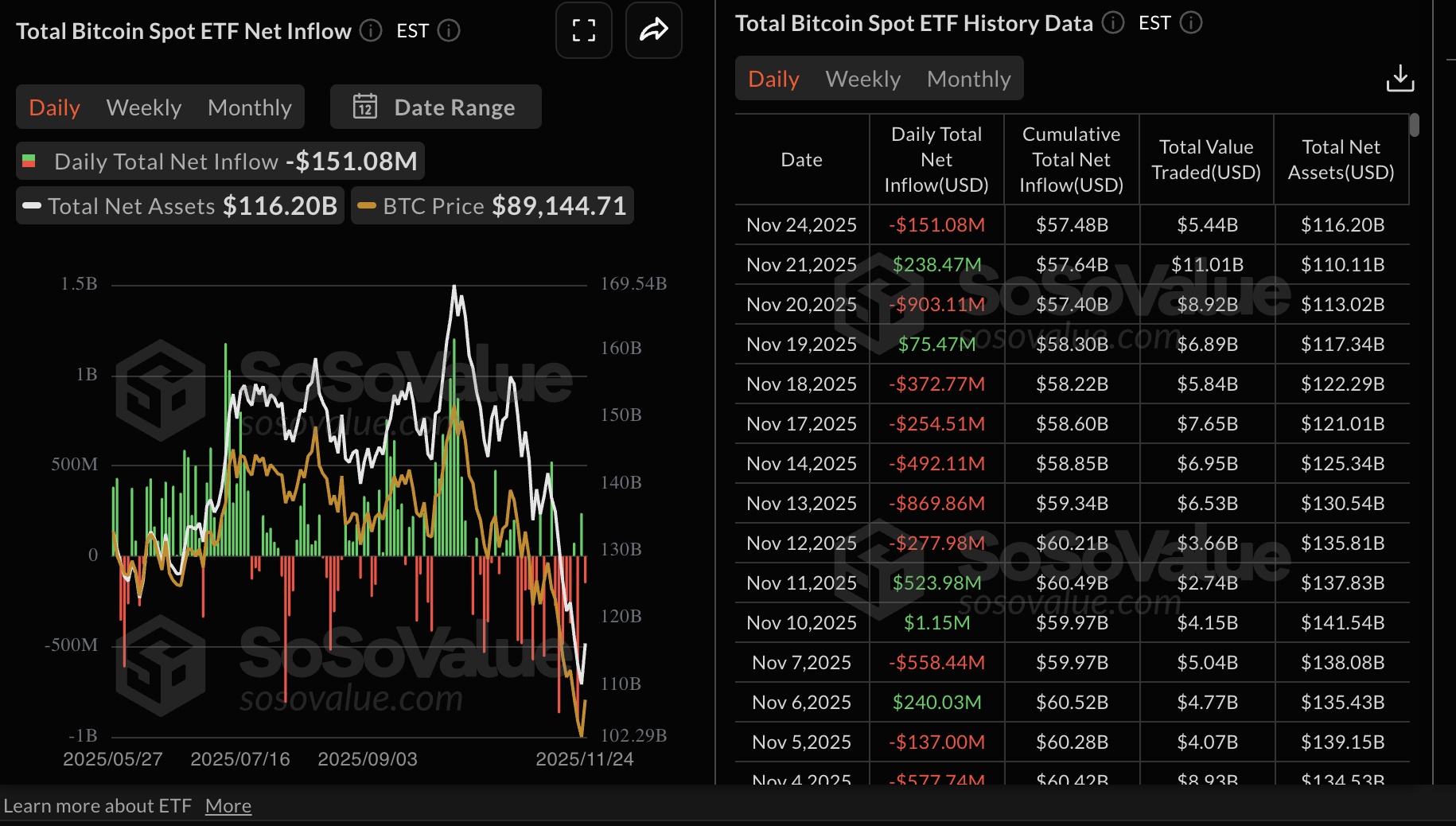

Data spotlight: Bitcoin ETF outflows resume as institutional interest shifts toward altcoins

Bitcoin ETFs listed in the United States (US) recorded $151 million in outflows on Monday, as bearish sentiment persisted in the broader cryptocurrency market.

A bullish turnaround led to two days of inflows last week, approximately $75 million on Wednesday and $$238 million on Friday. It is not clear whether outflows will continue this week or if the demand for ETFs will increase.

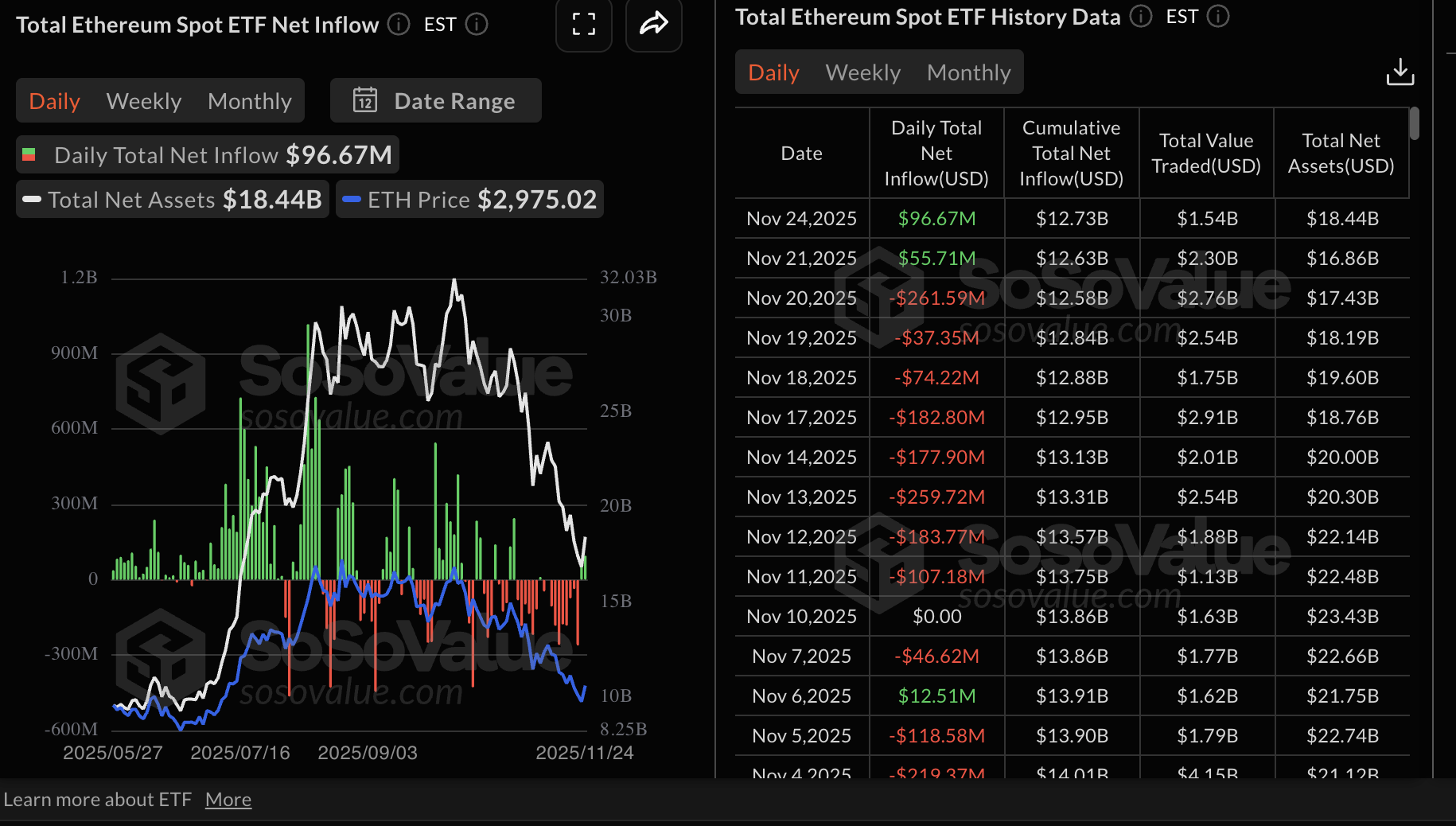

Ethereum ETFs, on the other hand, experienced their second consecutive day of inflows with nearly $97 million streaming in on Monday and $56 million on Friday.

BlackRock’s ETHA was the best-performing ETH ETF with almost $93 million in inflow volume, followed by Grayscale’s ETH with $10 million and 21Shares’ TETH with approximately $742,000. The cumulative total net inflow volume as of Monday stands at $12.73 billion, with net assets averaging $18.44 billion.

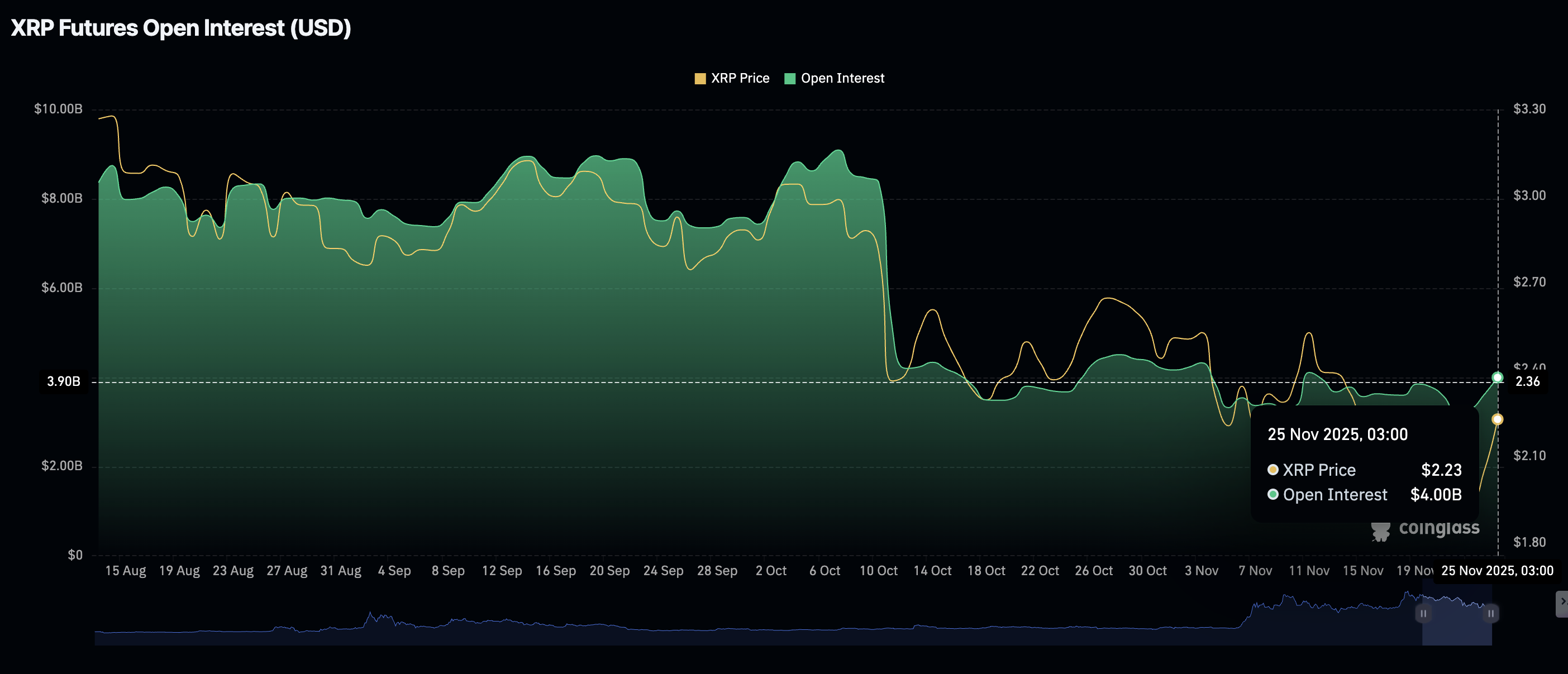

Meanwhile, retail demand for XRP derivatives products has picked up this week, as reflected by futures Open Interest (OI) crossing $4 billion on Tuesday, up from $3.61 billion on Monday and $3.28 billion on Sunday.

When OI rises, it supports positive market sentiment, encouraging investors to increase their risk exposure. This creates a health environment that tends to sustain gains.

Fed interest rate cut bets surge

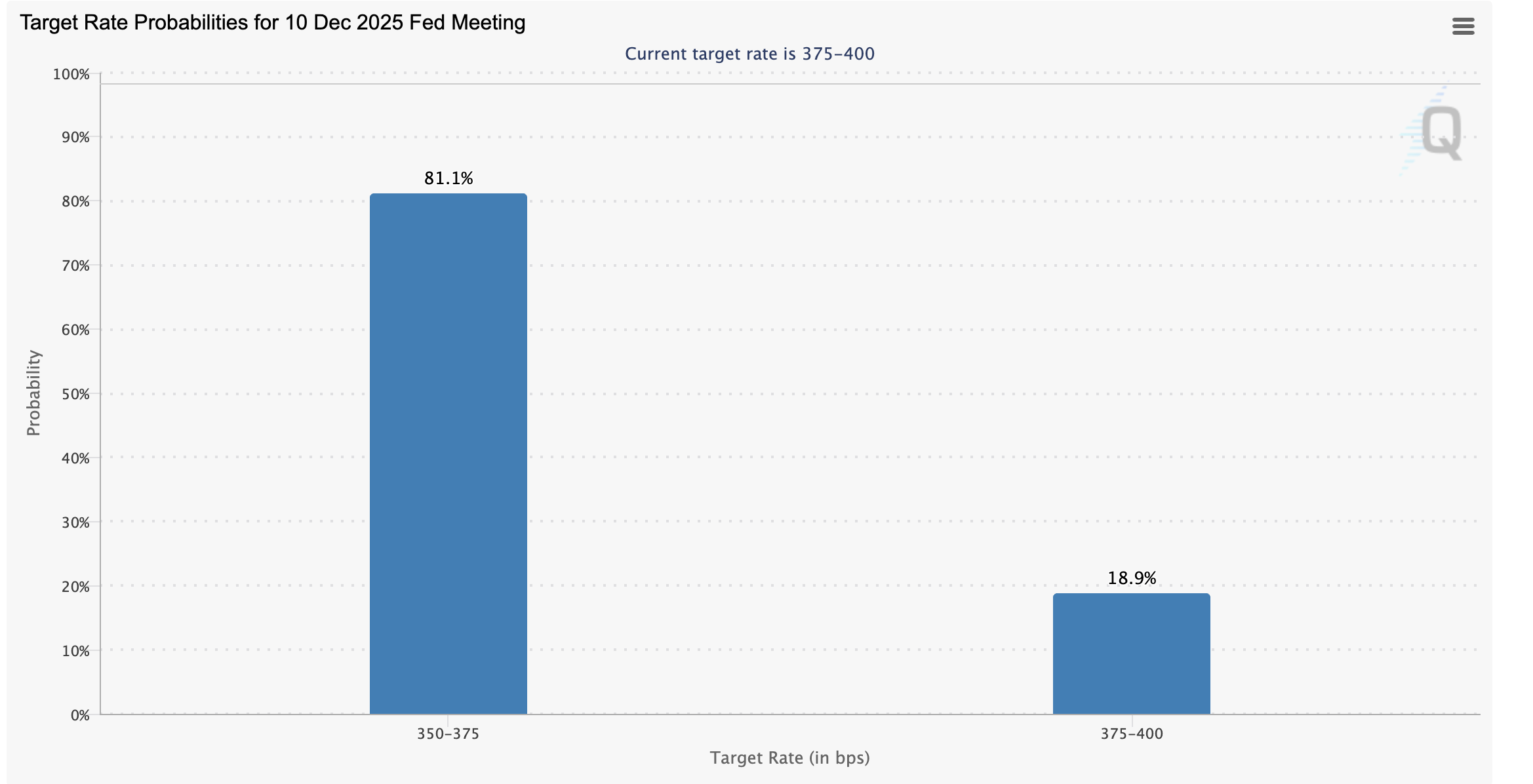

The Federal Reserve (Fed) December policy meeting will be in two weeks, and bets supporting a final interest rate cut this year are steadily rising. According to CME Group’s FedWatch Tool, chances of a 25 basis points rate cut by the Fed are at 81%, with the rate range between 3.50% and 3.75%.

About 19% of traders expect the Fed to leave the rates unchanged in the range of 3.75% to 4.00%. A rate cut in December would boost investor risk appetite for riskier assets, such as Bitcoin and altcoins.

Chart of the day: Bitcoin struggles to sustain recovery

Bitcoin is trading above $87,000 at the time of writing on Tuesday, as the Relative Strength Index (RSI) edges lower, suggesting it is approaching oversold territory. RSI reading below 30 indicate intense bearish momentum but could also signal a potential bullish shift.

The Moving Average Convergence Divergence (MACD) indicator has maintained a sell signal since November 3, which is encouraging investors to reduce their risk exposure.

Bitcoin is also positioned significantly below the downtrending 50-day Exponential Moving Average (EMA) at $101,737, the 200-day EMA at $105,802, and the 100-day EMA at $106,143, all of which point to a deteriorating technical structure.

A daily close above $90,000 would affirm the bullish grip and increase the odds of a breakout toward $100,000 in the short- to medium-term. Still, Bitcoin is at risk of dropping below $80,000 if profit-taking persists and support at $83,000 breaks.

Altcoins update: Ethereum, XRP lean bearishly

Ethereum is trading below $2,900 at the time of writing on Tuesday after stalling near $3,000 on the previous day. The 50-day EMA crossed below the 200-day EMA, completing a Death Cross pattern that backs the sticky bearish sentiment surrounding ETH.

The RSI has also broken its uptrend and is now at 35, moving back towards oversold territory. If the RSI declines further, it will indicate increasing bearish momentum. Ethereum is at risk of falling to $2,632, a support area tested on Friday.

However, if the MACD line in blue crosses above the signal line in red, a buy signal would call on investors to buy the dip and support a bullish reversal above $3,000.

As for XRP, sellers are largely in control, with the token also trading below the 50-day EMA at $2.38 and the confluence resistance formed by the 200- and 100-day EMAs at $2.52.

Since the RSI has been rejected below the midline, the path of least resistance could remain downward, especially if the indicator declines toward oversold territory.

The immediate resistance lies at $2.28, which must be broken to pave the way for a sustained move above the 50-day EMA at $2.38 and the confluence resistance at $2.52. The demand zone at $1.82 remains XRP’s key support level.

Still, the MACD indicator shows a buy signal that was confirmed earlier in the day. A steady recovery above the zero line would back bullish sentiment and increase the odds of a bullish breakout.