Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as markets enter an unusual phase where large players are repositioning and liquidity is tightening. Against this backdrop, the timing of one major transfer has raised fresh questions about what might be coming next for Bitcoin.

Crypto News of the Day: BlackRock’s $400 Million Bitcoin Move Sparks Liquidity Alarm—What Are They Bracing For?

BlackRock quietly moved 4,471 BTC to Coinbase Prime, hours before the PPI report. The move comes as its flagship Bitcoin ETF, IBIT, logged record monthly outflows.

The timing has ignited a new debate: Is the world’s biggest asset manager preparing for a deeper US liquidity shock?

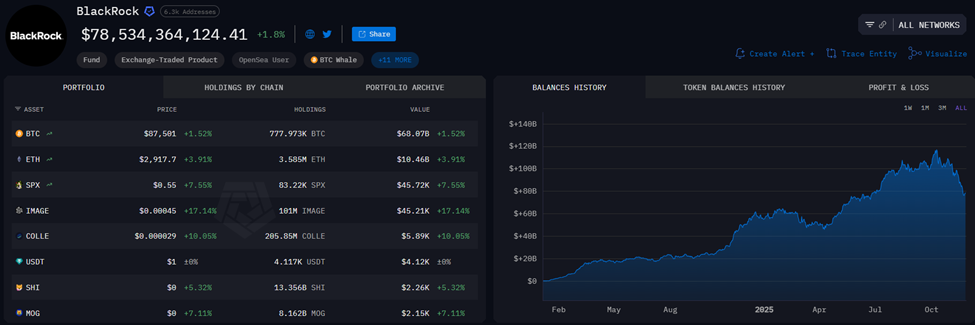

Arkham data shows the same wallet has fallen from a $117 billion peak to $78.4 billion, losing more than 30% of its value over the past month.

BlackRock BTC Holdings. Source: Arkham Intelligence

The transfer occurs at a time of increasing stress across Bitcoin markets, with analysts like Crypto Rover noting that BlackRock’s move could exacerbate selling. Meanwhile, the timing ahead of the US PPI has also raised concern.

Meanwhile,VanEck’s Matthew Sigel sees the Bitcoin price’s ongoing struggle as primarily a macro dynamic, calling it an “overwhelmingly a US-session phenomenon.

“…The driver: tightening US liquidity and widening credit spreads as AI-capex fears collided with a more fragile funding market,” he stated.

This aligns with recent stress across equities, credit, and rate-sensitive assets. Traders are watching whether the November PPI print, due just after the BTC transfer, signals further tightening. However, ARK Invest’s Cathie Wood argues the current liquidity pressure is temporary.

“The liquidity squeeze that has hit AI and crypto will reverse in the next few weeks,” she said.

The Ark Invest executive cited a 123% surge in Palantir’s US commercial business, calling it evidence that enterprise adoption is accelerating despite macro headwinds.

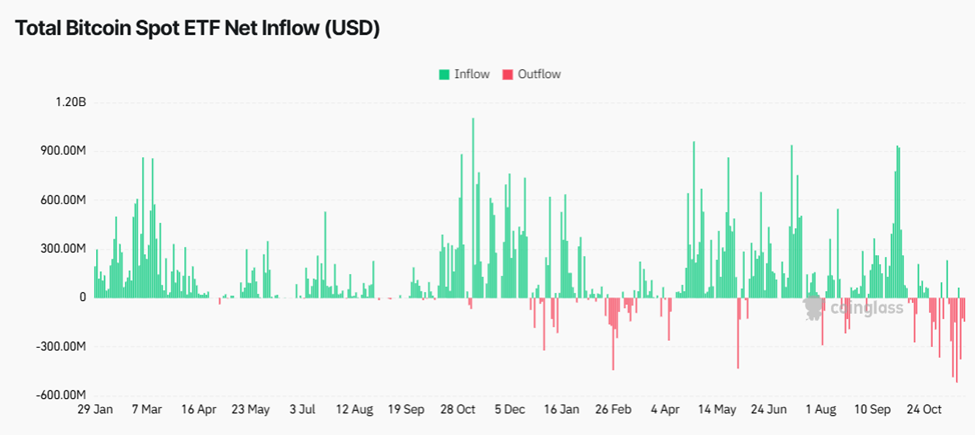

IBIT Faces Record Outflows—But the Full Picture Is More Complicated

The blockchain activity comes as BlackRock’s IBIT posts its worst outflow month on record, over $2 billion this month. Analysts highlight it as the biggest withdrawal wave since launch.

“…After months of steady inflows, the outflows reflect rising caution as Bitcoin falls ~22% over the past month and 7% year-to-date,” wrote Walter Bloomberg.

However, ETF analyst Eric Balchunas pushed back on the panic, stressing that context is being lost. According to the analyst, the majority of investors are sticking around despite the outflows.

He also highlighted the collapse in short interest, ascribing plummeting IBIT short interest to traders who tend to short into strength and cover in downturns.

In other words, despite headlines screaming about “record outflows,” the majority of institutional holders appear to be staying put.

Chart of the Day

BlackRock’s IBIT ETF Flow Data. Source: Coinglass

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Tom Lee’s BitMine reveals 3.6 million ETH holdings amid disputed average purchase price.

XRP price aims for $2.5 after ETFs recorded $164 million in inflows on Monday.

Five days, zero inflows: Litecoin ETF struggles to break $7.44 million.

Hedge funds are heavily shorting the USD – What does it mean for crypto?

Korean retail frenzy triggers harsh new rules on US leveraged ETFs.

Bitcoin stalls below $90,000 as on-chain data suggests consolidation, not reversal.

Dogecoin rally hopes rise after ETF push — but the real fight lies at $0.18.

Is this the next big crypto shift? Quantum tokens hit $9 billion.

Crypto Equities Pre-Market Overview

| Company | At the Close of November 24 | Pre-Market Overview |

| Strategy (MSTR) | $179.04 | $176.09 (-1.65%) |

| Coinbase (COIN) | $255.97 | $252.73 (-1.27%) |

| Galaxy Digital Holdings (GLXY) | $24.78 | $24.70 (-0.32%) |

| MARA Holdings (MARA) | $11.21 | $11.18 (-0.27%) |

| Riot Platforms (RIOT) | $13.88 | $13.79 (-0.65%) |

| Core Scientific (CORZ) | $15.75 | $15.72 (-0.19%) |

Crypto equities market open race: Google Finance