Next crypto to 1000x is at the center of discussion in the crypto landscape after the broader market rebounds strongly. Established tokens, including Bitcoin, Ethereum, and XRP, have experienced strong demand after weeks of consistent selling.

Now, as the crypto market prepares for the next bull cycle, investors are in search of the next big winner. Every bull cycle rewards fresh narratives across sectors. This is primarily because new tokens can easily yield life-changing profits due to their small market cap.

Meme investors are focusing on a similar opportunity for the upcoming bull run. Maxi Doge, a fresh meme narrative, is gaining significant traction in the market with its 1000x leverage culture and high-yield staking. Just a few weeks into its presale, the project has attracted $4.2 million in investments.

In this guide, we will discuss the next catalyst for crypto revival and why Maxi Doge is a top contender for the next crypto to 1000x.

Market Revival and Upcoming Fed Meeting

The crypto market has been experiencing bearish pressure in the past few months. The largest crypto, Bitcoin, tumbled below $90,000 mark, triggering panic selling across the market, and a ripple effect has been seen in altcoins. However, many experts argue that this could be an inflection point for the digital assets market, and cryptos could regain previous levels.

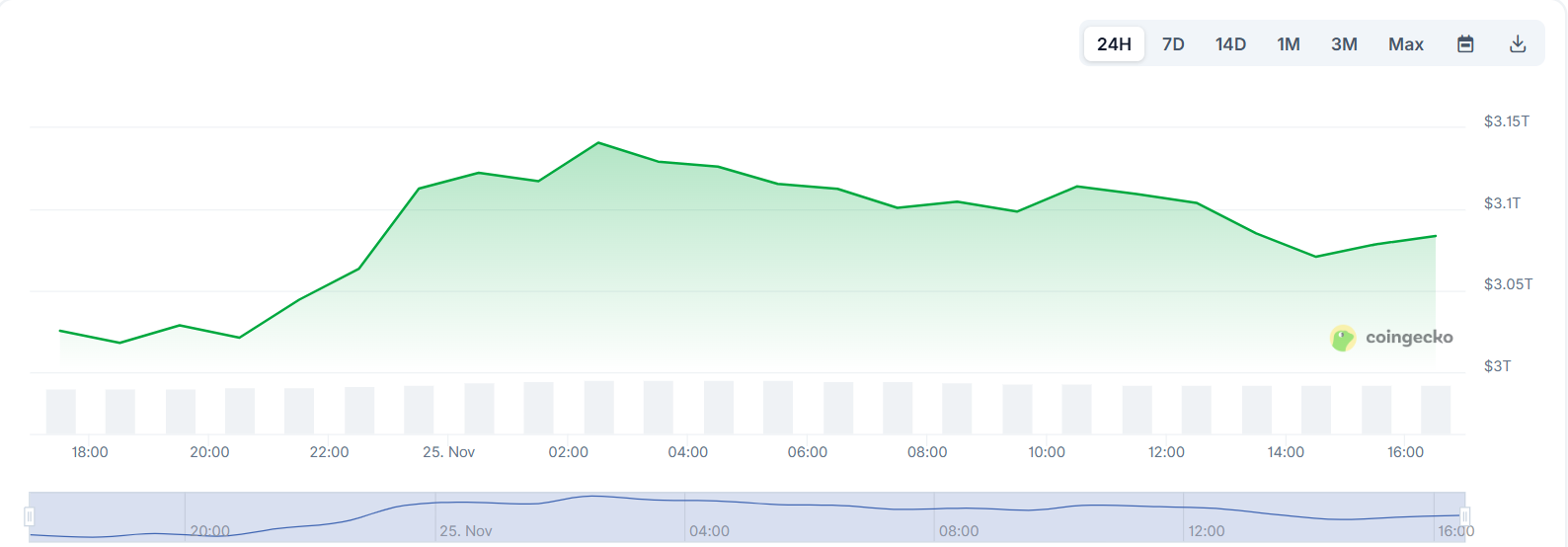

Total crypto market cap surging. Image source: Coingecko

Investors are watching the US Federal Reserve closely as expectations grow for another rate cut. The market now predicts a 25-basis-point reduction, following the recent cut that signaled a shift in policy. After three cuts in late 2024, the Fed kept rates unchanged for most of 2025 while assessing the impact of Trump-era tariffs, stubborn inflation, and rising unemployment. With economic pressure mounting, more cuts are now likely.

Higher rates dragged crypto prices down in 2022. But once borrowing costs peaked, the market found its bottom and bounced back through 2023 and 2024. Bitcoin ETFs gave Bitcoin an extra lift, while expectations of cheaper money and strong ETF inflows helped push Ethereum higher as well.

Maxi Doge Rallies as Traders Search for Next Crypto To 1000X

Maxi Doge (MAXI) is being called the evolution of Dogecoin: meme energy, bodybuilding, and trading on 1000x leverage. Investors seeking fast ROIs are accumulating MAXI tokens, driving its presale above $4.2 million in just a few weeks of launch.

Maxi Doge takes the familiar meme and cranks it up, think a supercharged, gym-built version built for thrill-seeking traders who love fast, risky moves. The project is targeting Gen Z and hustle culture investors who want to change their lives with one trade at a time.

Behind the curtains, MAXI is built on the ERC-20 standard and runs on Ethereum’s proof-of-stake network. The project is offering 73 p.a. Staking rewards for presale investors. Maxi Doge has already been audited for smart contracts by SolidProof and Coinsult, demonstrating its high security and transparency.

MAXI is the native token of the Maxi Doge ecosystem and is currently available at a discounted price of $0.00027. It gives users voting power, lower trading fees, early access to launchpad deals, and a promo. With demand exploding in the presale, many argue this could be the next big thing in the crypto market.

Why Maxi Doge Might Be The Next Big Thing In Meme Sector

Maxi Doge is introducing a new theme in the crypto market. A meme coin wrapped with high meme hype around simple utility: 1,000x future trading option for investors, passive income through staking, weekly trading contests, and plug into partner events to test your futures trading skills.

That ain’t a calendar, it’s a scoreboard.

Always P to be made. $MAXI style. pic.twitter.com/I0Lnb2i6Qp

— MaxiDoge (@MaxiDoge_) November 23, 2025

Another highlight of the presale is that it is currently priced at just $0.00027 in the early stages, and experts forecast it reaching $0.20 in the 2026 bull rally, representing a massive 73974.1% upside.