Chainlink Price continues to trade under pressure as its downtrend extends into the new week, despite a mild intraday recovery that has helped lift the token back toward the $12.80–$13.00 range.

The market’s broader risk-off mood, coupled with weak derivatives participation, has created a cautious environment in which traders remain hesitant to take strong directional positions. With technical indicators showing limited momentum, the asset now moves into a critical consolidation phase.

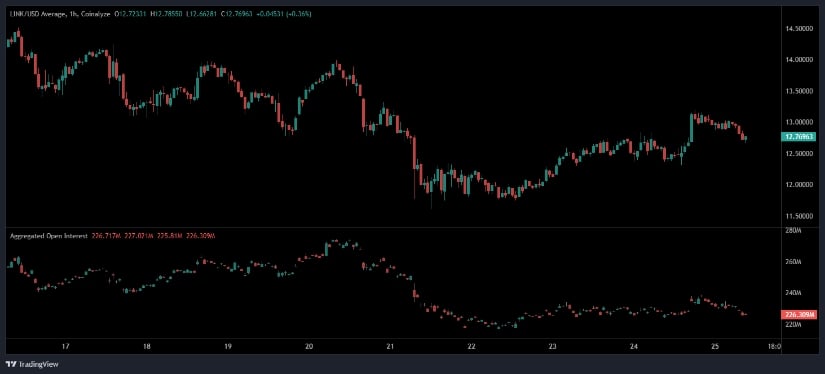

Open Interest Declines Then Stabilises, Reflecting Trader Caution

Aggregated open interest fell from above 227 million to roughly 226.3 million as the recent sell-off unfolded. This decline in OI, paired with falling price, indicates that traders were closing positions rather than adding exposure—typically a sign of risk reduction during downside volatility.

Source: Open Interest

Following the token’s minor price recovery, open interest has stabilised but has not risen. This flat OI behaviour indicates a lack of fresh bullish conviction, as traders are opting to remain on the sidelines rather than initiate new long positions. Without increasing OI, upward momentum is likely to remain limited.

Short-term sentiment hinges on how OI reacts to price movement. Rising OI alongside price gains suggests accumulating long positions and enhancing bullish interest. Conversely, a renewed drop in both price and OI would reinforce the cautious, bearish stance prevailing in the market.

Data Shows a 2.58% Daily Rise, but Macro Trend Still Soft

According to BraveNewCoin, Chainlink trades at $12.89, up 2.58% over the past 24 hours. The token maintains a market cap of $9.00 billion with an available supply of 696.8 million tokens, ranking it #19 among major cryptocurrencies. Daily trading volume stands near $650–$657 million, reflecting healthy liquidity despite the broader downturn.

The 24-hour increase brings short-term relief but has not altered the medium-term trend, which remains decisively bearish. The coin remains well below its recent highs and continues to trade significantly beneath the critical $19.53 support-turned-resistance level, underscoring the challenges facing bulls as they attempt to regain lost ground.

Technical Indicators Remain Weak as MACD Flattens and RSI Nears Oversold

TradingView data indicates that LINK has experienced steady downside pressure since late September, falling from above $19 to the current $12.70–$12.90 zone. With the previous major support at $19.53 now acting as a firm resistance ceiling, the coin remains far from reclaiming key levels that would shift the market structure.

Source: TradingView

Momentum indicators echo this weakness. The MACD line stays below the signal line, hovering close to zero, while the histogram fluctuates between small positive and negative bars—typically a sign of stagnant momentum. No bullish crossover has formed, leaving the bias neutral to bearish.

The RSI sits at 36, hovering just above oversold conditions. While this suggests fading buying pressure, it also opens the possibility for a relief bounce if RSI rebounds above 40 in the coming sessions. Traders should remain cautious, as prolonged stays near RSI 30–40 often accompany extended downtrends.

LINK Price Outlook

The coin currently trades in a constrained zone between $12.60 and $13.00, with no strong catalyst visible. A breakout above $13.40 would be the first sign of bullish momentum, especially if accompanied by rising open interest. However, a breakdown beneath $12.50 could expose the token to deeper downside targets near $11.80.

For now, the outlook remains neutral-to-bearish, and momentum must shift decisively before any sustained recovery can take shape.