Following a significant downturn that saw Bitcoin (BTC) plunge to the $80,000 mark on November 21, the leading cryptocurrency has managed to stabilize above this critical threshold for several days.

This development has sparked speculation about whether this level represents a short-term bottom and if a new upward trend might follow.

Potential Local Bottom For Bitcoin

According to analysis from CryptoQuant analyst Carmelo Aleman, on-chain data indicates a market landscape characterized by institutional redistribution, structural weakness, and signs of a rebound that may hint at a local bottom.

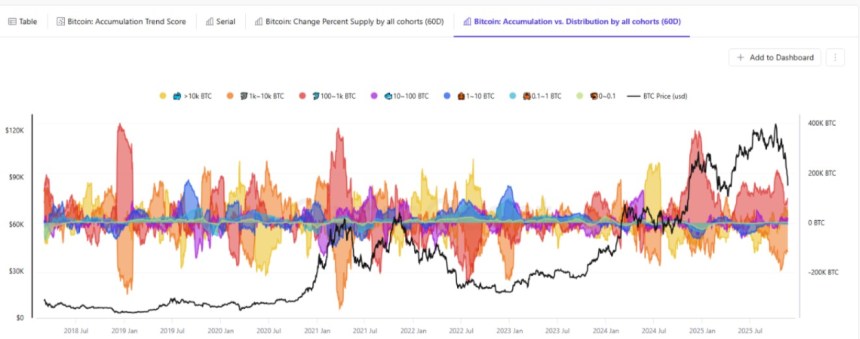

One of the observations made is that large whale investors have been actively distributing their holdings. The cohorts holding more than 10,000 BTC and those with 1,000 to 10,000 BTC appear to be primarily in a selling position.

Carmelo stated that this kind of behavior reflects ongoing profit-taking by institutions looking to reduce their risk exposure, which leads to an overall offloading of supply into the market.

Retail investors have also been contributing to the distribution trend. Over the past 60 days, wallets holding between 0 to 1 BTC and 1 to 10 BTC have demonstrated net selling rather than accumulation, suggesting a lack of purchasing support from the retail sector.

In contrast, mid-sized BTC holders—those in the 100 to 1,000 BTC range—appear to be acquiring steadily, while the 10 to 100 BTC group is showing consistent accumulation.

Hidden Bullish Divergence

After this 11-day selling spree, signs of stabilization have emerged. Bitcoin has rebounded above $89,000 on late Monday, which may suggest the formation of a local bottom, although this has yet to be conclusively confirmed.

However, while momentum is positive, Aleman warned that the possibility of a trend reversal is heavily reliant on ongoing accumulation from crucial investor cohorts, notably mid-sized investors.

While there are obvious rebounds and support from particular groups, the continued distribution of the 1,000 to 10,000 BTC cohort prevents definitive confirmation of a trend reversal.

Other analysts, including Ash Crypto, have noted bullish indicators that further support this outlook. He highlighted that Bitcoin is experiencing a hidden bullish divergence on the weekly timeframe, suggesting that selling pressure is easing, momentum is stabilizing, and the weekly Relative Strength Index (RSI) may soon reverse.

If this hidden bullish divergence is confirmed, it typically precedes a strong continuation rally, according to the analyst, adding to the argument that BTC may be on the verge of a new upward trajectory.

Bitcoin is currently trading at $87,150, 30% below its all-time high of $126,000. This momentum has caused the top cryptocurrency to erase all gains recorded in all time frames, including year-to-date, with a drop of roughly 9% during this period.

Featured image from DALL-E, chart from TradingView.com