Bitcoin price steadies around $87,700 on Wednesday, after correcting more than 36% from its record highs.

US-listed spot Bitcoin ETFs continue to record mixed flows, reflecting uncertain institutional sentiment.

A report highlights that this week may offer BTC some breathing room and consolidation, as US markets close due to Thanksgiving.

Bitcoin (BTC) hovers around $87,700 at the time of writing on Wednesday after correcting more than 36% from its record highs of $126,199 in early October. The range-bound price action is further supported by mixed flows in spot Bitcoin Exchange Traded Funds (ETFs). Moreover, a report suggests that BTC price action may consolidate this week, as US markets will be closed in the second half due to Thanksgiving.

Indecisiveness among institutional investors

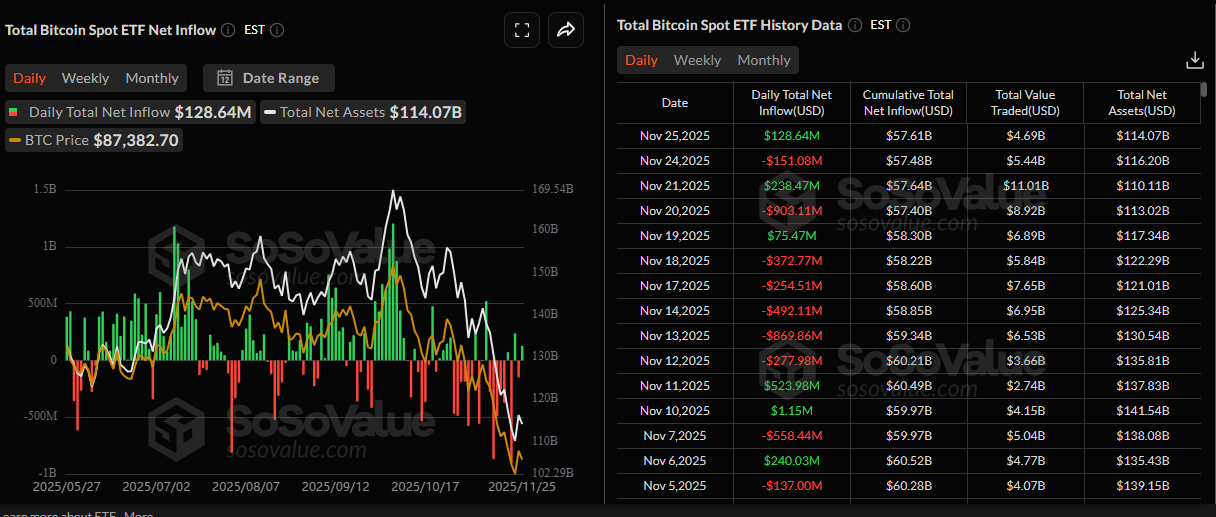

Institutional flows reflect a mixed sentiment so far this week, as Bitcoin spot ETFs see alternating inflows and outflows — an inflow of $128.64 million on Tuesday, in contrast with the $151.08 million inflow on Monday, according to SoSoValue data. This highlights indecision among institutional investors, as fluctuating ETF flows suggest a cautious approach toward the largest cryptocurrency by market capitalization.

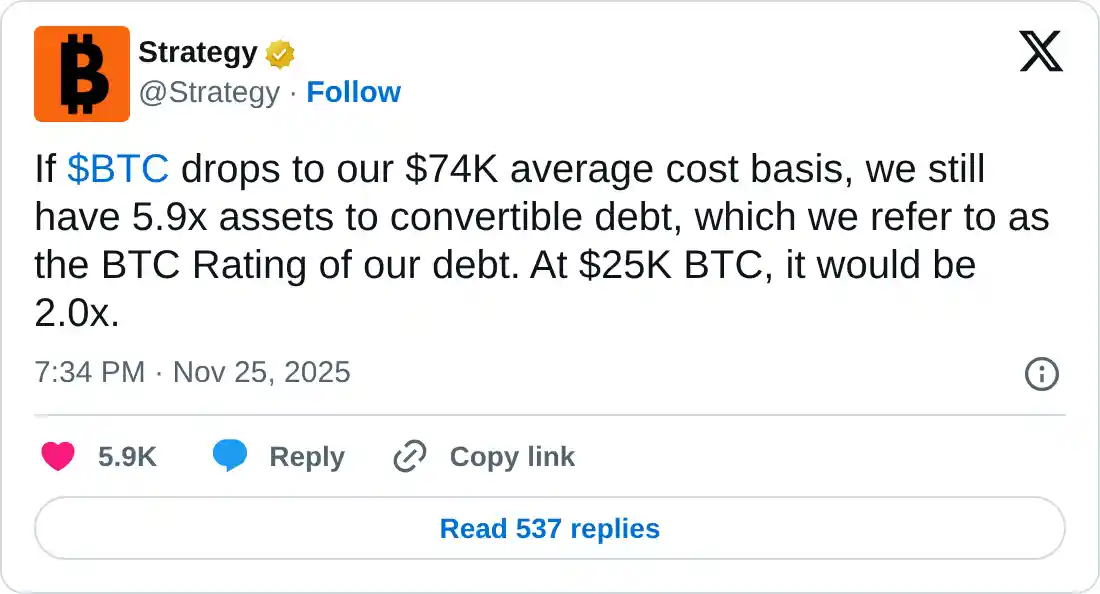

On Wednesday, Strategy stated on its official X account that even if Bitcoin drops to its average cost basis of $74,000, its BTC holdings would still cover its convertible debt by 5.9 times — a ratio the company refers to as its ‘BTC Rating’.

The firm added that at a BTC price of $25,000, the coverage would remain at 2 times, highlighting that it can easily cover its debts even if BTC crashes sharply.

Bitcoin consolidates after a deep correction

Bitcoin price started the week on a slight positive note, recording a mild recovery after its fourth consecutive negative weekly close, BTC’s deepest drawdown since the 2022-2024 era. The largest cryptocurrency by market capitalization has now endured a peak-to-trough drawdown of 36.24% from its October 6 all-time high of $126,199.

A K33 report on Tuesday highlighted that this week may offer breathing room and consolidation for BTC, as US markets will be fully closed on Thursday and partially closed on Friday due to the Thanksgiving holiday.

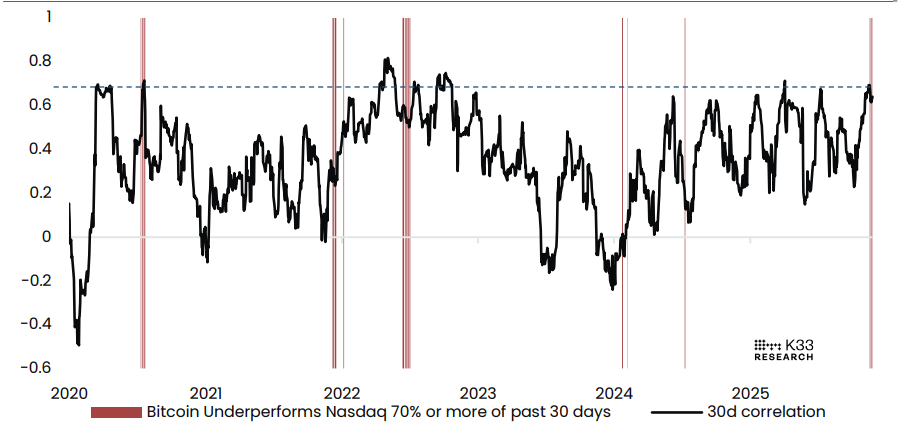

The report further explained that Bitcoin has underperformed the Nasdaq index (as measured with the Invesco QQQ ETF) 21 out of the last 30 trading days, or 70% of all trading days over the last month. This current situation is rare and marks the first time rolling relative underperformance has surpassed 70% since July 2024.

Historically, BTC has shown similar consistent underperformance on six previous occasions since 2020, in July 2020, December 2021, June 2022, January 2024, and July 2024. Of these three most recent periods of distinct underperformance, each was associated with a clear negative crypto-specific narrative: Mt. Gox and German selling (July 2024), Grayscale outflows (January 2024), and contagion (June 2022).

“Correlations trended lower in these environments,” reports the analyst.

This recent stretch of relative underperformance emerged from the October 10 deleveraging but has also been accompanied by aggressively rising correlations, with BTC following price impulses in equity indices, albeit with a tendency toward deeper drawdowns on down days and worse recoveries on up days. This behavior points to aggressive, sticky relative selling in BTC amid broad risk aversion across markets.

Additionally, BTC’s price relative to the QQQ index has fallen to 143, the lowest level since November 5, 2024, as shown in the chart below. In other words, all relative strength after the US Presidential election has now been retraced. The participants in BTC today are very different from the participants in BTC during the 2021 era, and even during the Q1 2024 impulse higher.

“We view the current relative pricing of BTC to other risk assets as a significant disconnect from its underlying fundamentals and consider BTC a strong relative buy at current levels for any long-term-focused investor,” concludes the analyst.

Bitcoin Price Forecast: BTC steadies after a four-week decline

Bitcoin price found support roughly around the key psychological level of $80,000 on Friday, recovered slightly over the weekend, and closed above $88,300 on Monday. At the time of writing on Wednesday, BTC steadies at around $87,700.

If BTC continues its recovery, it could extend the rally toward the next key resistance at $90,000.

The Relative Strength Index (RSI) on the daily chart reads 32, after slipping below the oversold threshold last week, suggesting that downside pressure may be moderating as bearish momentum shows early signs of exhaustion. Additionally, the Moving Average Convergence Divergence (MACD) indicator on the same chart shows decreasing red histogram bars, with the MACD line poised to cross above the signal line.

BTC/USDT daily chart

On the other hand, if BTC continues to drop, it could extend the decline toward the key psychological level at $80,000.