Coinbase Ventures outlines four strategic themes it expects to drive crypto innovation in 2026. The investment arm shared its outlook in a new blog post, identifying the priority areas in which it aims to invest.

These include Real-World Asset (RWA) perpetual contracts, specialized trading infrastructure, next-generation decentralized finance (DeFi), and artificial intelligence (AI) and robotics.

1. RWA Perpetuals Unlock Synthetic Market Exposure

The first theme centers on Real-World Asset (RWA) perpetual derivatives. These provide synthetic exposure to off-chain assets.

Unlike traditional tokenization, perpetual futures provide a faster and more flexible way to deliver on-chain exposure without requiring teams to custody the underlying asset.

“Because perpetuals do not require securing an underlying asset, markets can form around virtually anything, enabling the ‘perpification’ of everything,” the blog read.

Coinbase Ventures expects growth in two directions:

On-chain macro exposure, which gives traders a way to position around energy prices, inflation expectations, credit spreads, and volatility without touching traditional financial rails.

New categories of markets, including private companies, niche datasets, and alternative metrics that are difficult to tokenize but easy to replicate synthetically.

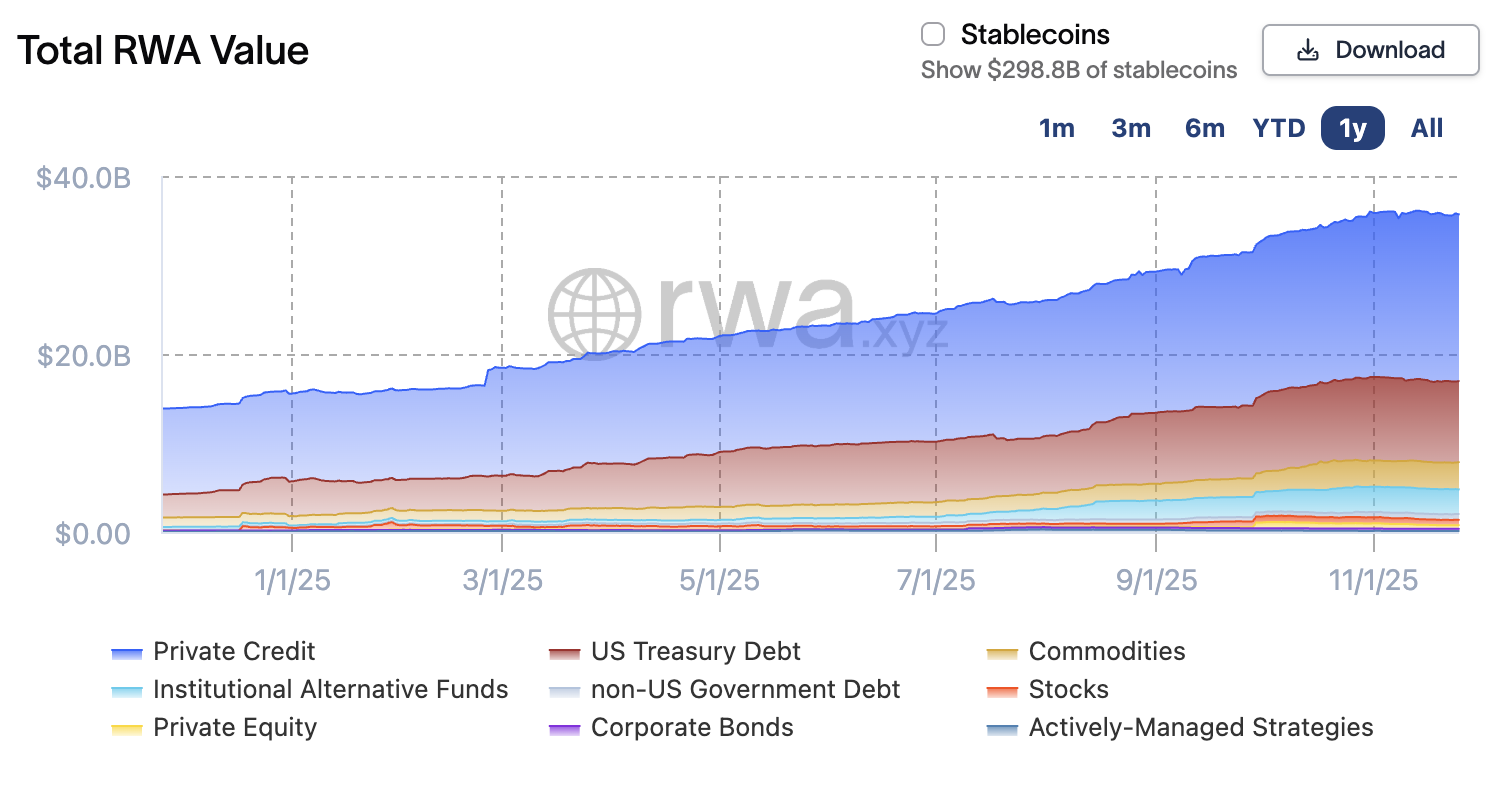

It is worth noting that RWAs have experienced remarkable growth this year, increasing from approximately $13.8 billion to around $36 billion in on-chain value. At the same time, the number of asset holders has risen to 550,194, a 7.58% increase over the past month.

RWA Growth in 2025. Source: RWA.xyz

2. Specialized Trading Infrastructure

The second theme focuses on specialized exchanges and trading terminals, with Proprietary Automated Market Makers (Prop-AMMs) rising across Solana. These models protect liquidity providers from harmful flows.

According to Messari, proprietary AMMs handled 13% to 24% of Solana’s total DEX volume through 2025. Moreover, in September, they surpassed traditional AMMs in Solana’s DEX volume for the first time. HumidiFi alone generated nearly 50% of all SOL–stablecoin DEX trading volume that month.

“This prop-driven approach could meaningfully advance market structure innovation ahead of base-layer improvements and has potential applications beyond Solana’s spot markets,” Coinbase Ventures added.

Meanwhile, the firm emphasized that prediction market aggregators could emerge as a “dominant interface layer,” combining fragmented liquidity. They could offer tools currently missing from the sector, such as advanced orders, cross-venue routing, arbitrage insights, and unified analytics. These trends mark greater market sophistication.

3. Next-Gen DeFi Elevates Composability and Privacy

DeFi’s next chapter, according to Coinbase Ventures, revolves around deeper integration between protocols and more sophisticated financial tooling. Perp platforms are beginning to connect with lending markets, allowing collateral to generate yield while also backing leveraged positions.

With monthly on-chain derivatives volume reaching $1.4 trillion, the firm expects more systems that let users hedge, earn, and leverage simultaneously without fragmenting capital. Unsecured lending is another area with significant potential, potentially tapping into the $1.3 trillion US credit market.

“Unsecured credit-based money markets are DeFi’s next frontier, and 2026 may see breakthrough models that blend onchain reputation with offchain data to unlock unsecured lending at scale. For builders in this sector, the challenge is designing sustainable risk models that scale. Success here turns DeFi into genuine financial infrastructure that can outcompete traditional banking rails,” Coinbase wrote.

For wider institutional adoption of DeFi, privacy is crucial. Coinbase Ventures highlighted the need for cryptographic tools that enable confidential transactions. The firm sees momentum behind technologies like zero-knowledge proofs, fully homomorphic encryption, multiparty computation, and specialized privacy chains.

4. AI Integration Positions Crypto for Next-Gen Coordination

The final category expands beyond finance, exploring how crypto may support the next generation of AI and robotics. Robotic systems suffer from a shortage of real-world interaction data, especially for tasks involving precision or deformable objects.

Coinbase Ventures suggested that crypto-native incentive models, similar to Decentralized Physical Infrastructure Networks (DePIN), could help collect the volume of data needed to train embodied AI at scale.

Proof-of-humanity protocols are also gathering traction. As AI-generated content spreads, it is more important than ever to distinguish humans from machines.

“We believe a combination of biometrics, cryptographic signing, and open source developer standards will be crucial to establishing a “proof of humanity” solution that complements AI in the new human/computer interface model. Worldcoin (portfolio company) has been ahead of the curve on seeing and working against this problem,” the blog stated.

Lastly, the firm also anticipates that AI agents will become central to on-chain development, writing contracts, checking them for vulnerabilities, and monitoring them after deployment. This could dramatically reduce the barrier to launching new on-chain projects and accelerate experimentation across the ecosystem.

“As we look ahead to 2026, we’re energized by the builders taking big swings and pushing the onchain economy forward. These ideas reflect where we see huge potential,” the team remarked.

While the four categories reflect current conviction, the firm stresses that many of crypto’s most transformative ideas often emerge from unexpected directions.