Bitcoin holds above $87,000 as bulls push for stability supported by ETF inflows.

Ethereum edges lower on Wednesday, weighed down by two Death Cross patterns.

XRP recovery loses steam below the 50-day EMA despite steady institutional interest.

Bitcoin (BTC) is trading above $87,000 at the time of writing on Wednesday, as bulls push for stability, following weeks of persistent declines. Altcoins, including Ethereum (ETH) and Ripple (XRP), are also holding steady above key support levels.

Recovery continuation this week will depend on institutional and retail demand as well as overall risk sentiment. However, investors must temper their bullish expectations, citing key hurdles and existing macroeconomic uncertainty.

Data spotlight: BTC, ETH, XRP show signs of stability backed by ETF inflows

Crypto Exchange Traded Funds (ETFs) listed in the United States (US) experienced inflows on Tuesday, reflecting improving risk appetite among institutional investors.

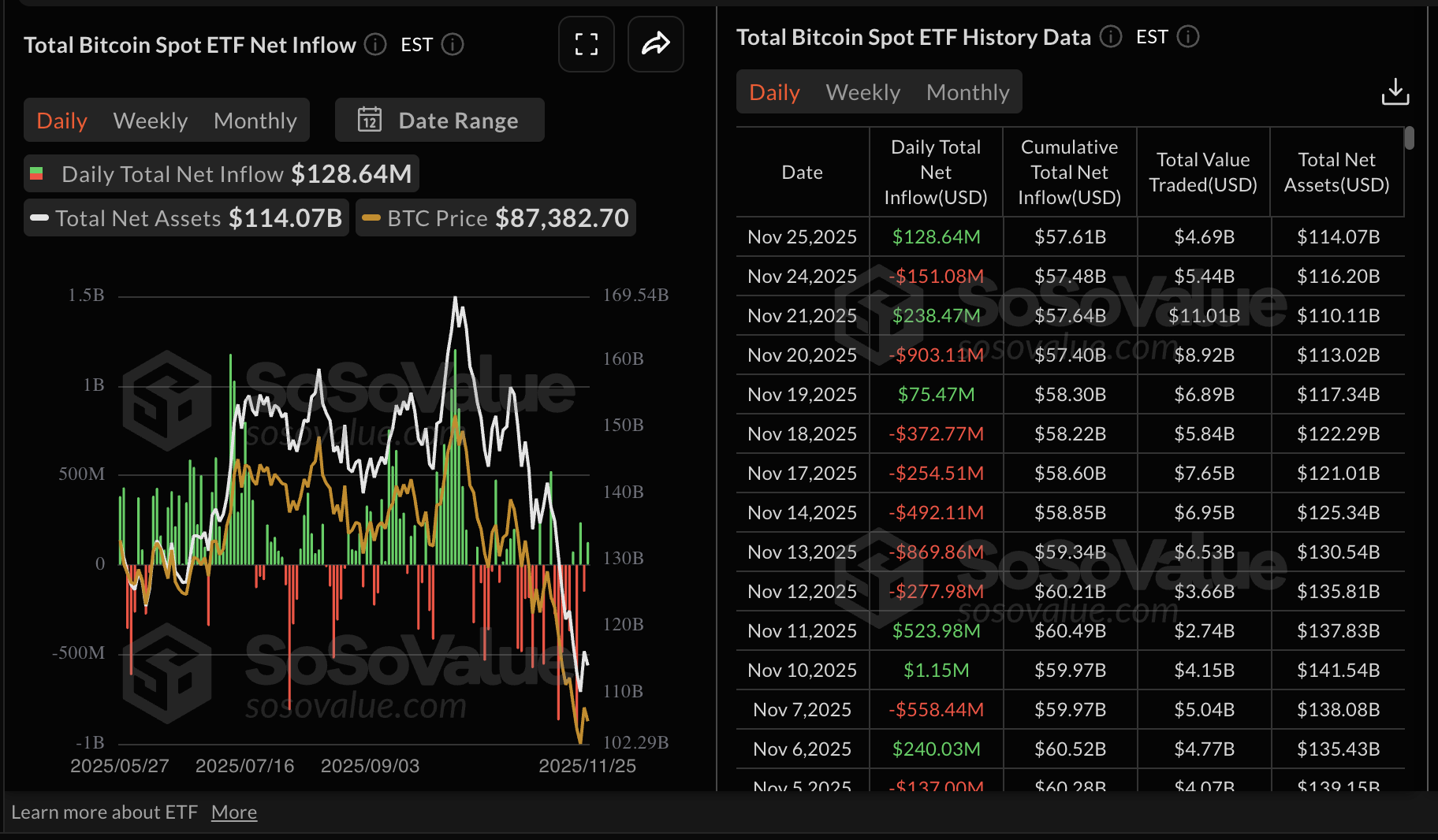

Bitcoin recorded ETF inflows, totaling $128 million on Tuesday, signaling a subtle return of institutional investors. Demand for crypto-related financial products, such as ETFs, had been low for weeks after the October 10 flash crash flopped, apart from a few days of inflows.

Macroeconomic uncertainty, concerns about the Federal Reserve's (Fed) December monetary policy decision, and a lack of conviction in the market's ability to sustain the recovery are among the factors contributing to the deteriorating outlook.

Institutional investors' behaviour in the coming days will help gauge the overall sentiment in the crypto market. Steady ETF inflows would reinforce the bullish outlook. Still, if ETF outflows resume, it will be an uphill task to sustain the recovery toward $90,000.

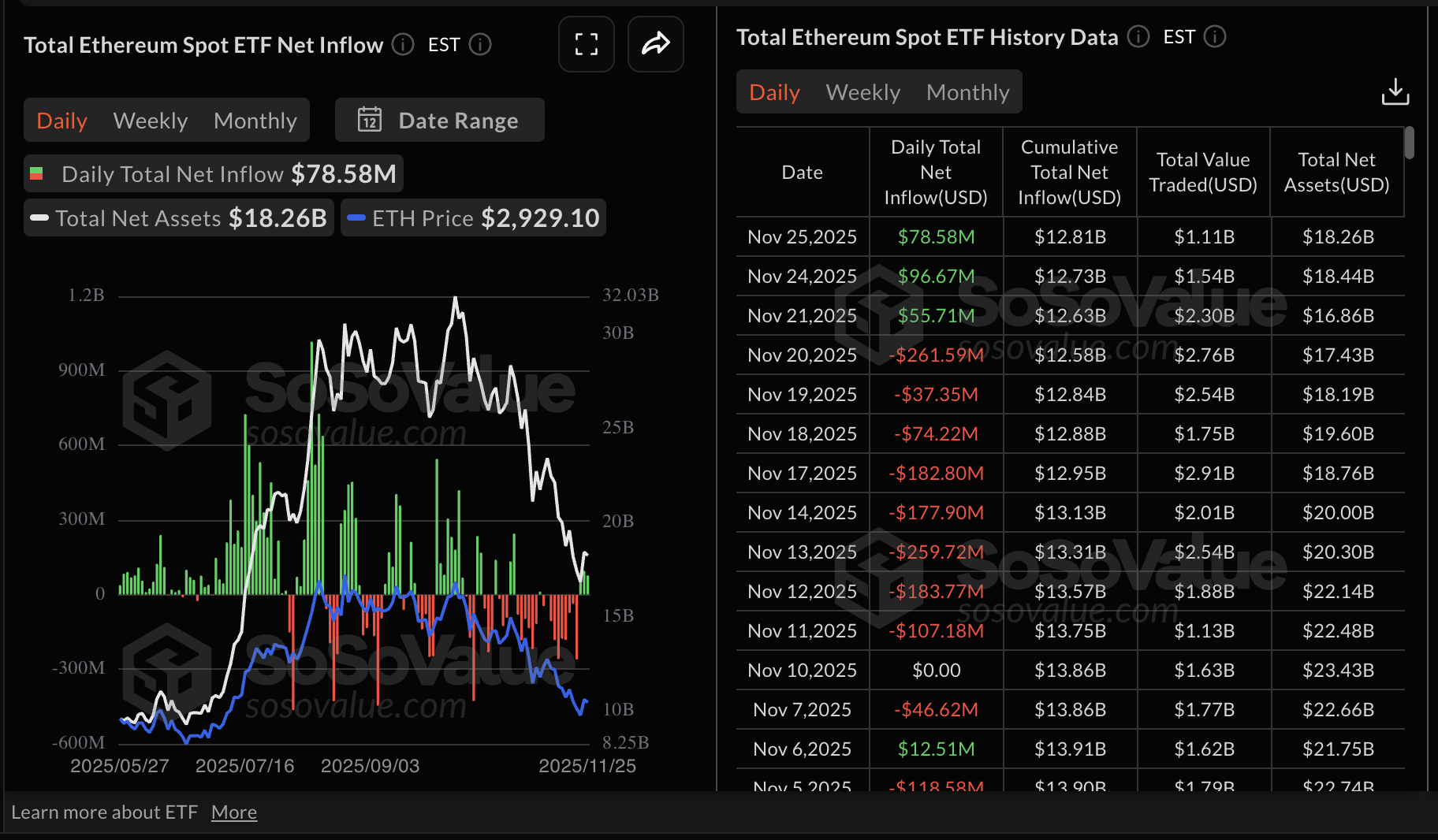

Ethereum ETFs, on the other hand, experienced their third consecutive day of inflows, with nearly $79 million recorded on Tuesday, $97 million on Monday, and $56 million on Friday.

Fidelity's FETH was the best-performing ETF, with almost $48 million in inflows, followed by BlackRock's ETHA with $46 million and Grayscale's ETH with approximately $8 million. The cumulative total net inflow volume as of Tuesday stands at $12.81 billion, with net assets averaging $18.26 billion.

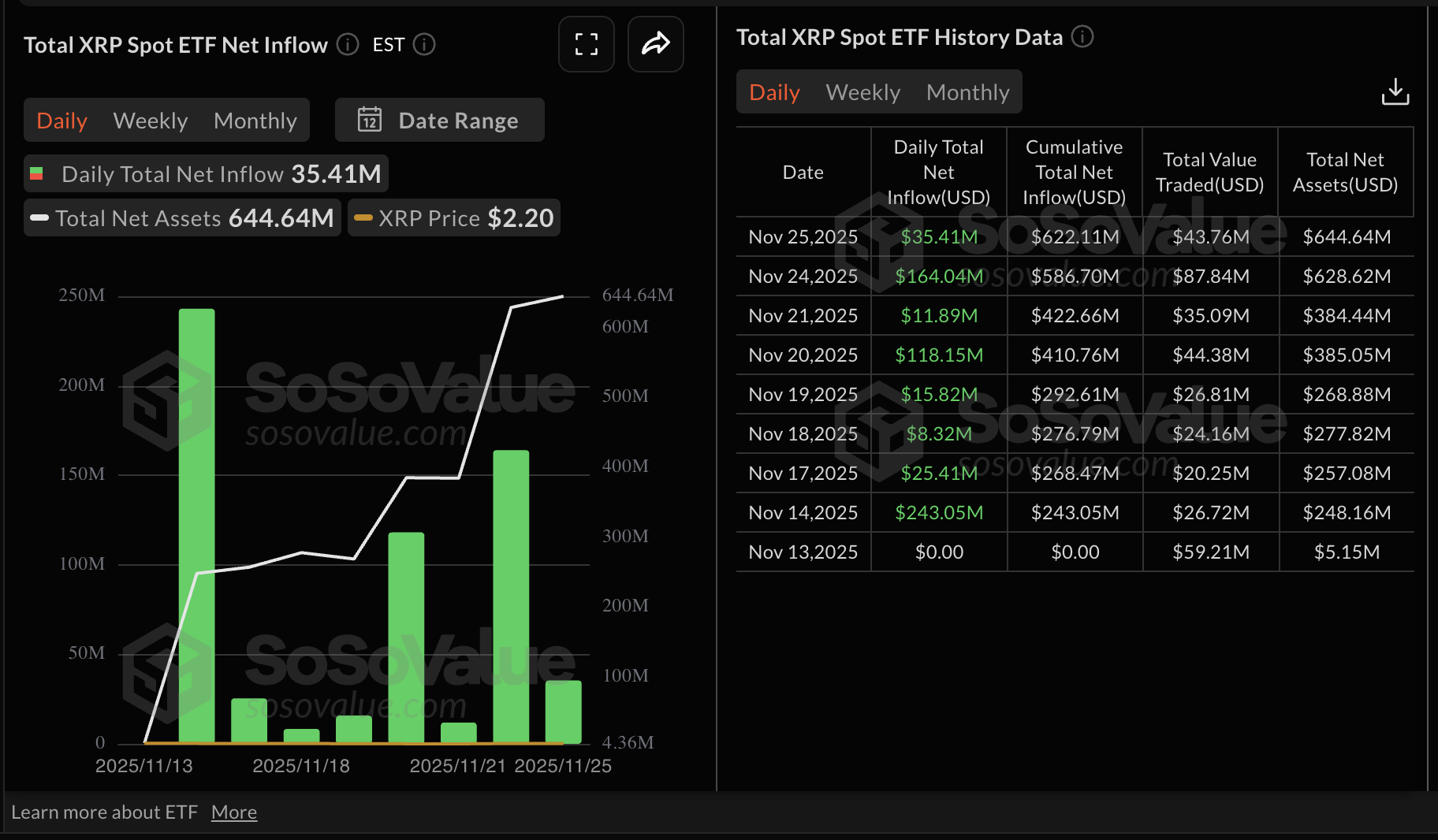

The number of XRP ETFs trading in the US has reached four, including Canary Capital's XRPC, Bitwise's XRP, Grayscale's GXRP, and Franklin Templeton's XRPZ.

In total, XRP ETFs recorded approximately $35 million in inflows on Tuesday, bringing the cumulative net volume to $622 million and net assets to $645 million. The steady inflows indicate that institutional investors are paying attention to altcoin-based ETFs.

Chart of the day: Bitcoin traders under pressure

Bitcoin is showing signs of extending its decline below $87,000 after marking an intraday high of $88,224 on Wednesday. The largest crypto by market capitalization is below the 50-day Exponential Moving Average (EMA) at $101,171, the 200-day EMA at $105,618, and the 100-day EMA at $105,770, reinforcing bearish sentiment.

The Relative Strength Index (RSI) remains above the oversold threshold on the daily chart, indicating bearish momentum. If the RSI extends its decline, selling pressure may drive Bitcoin toward support at $80,600, which was tested on Friday.

Still, traders will watch for a potential buy signal from the Moving Average Convergence Divergence (MACD) indicator, which will manifest when the blue line crosses above the red line.

A daily close above $87,000 is required to affirm the subtle bullish outlook and increase the odds of Bitcoin lifting above $90,000.

Altcoins update: Ethereum, XRP edge lower

Ethereum is trimming gains toward its immediate support at $2,900. The daily chart shows a weak technical structure, characterized by two Death Cross patterns.

The first Death Cross pattern formed after the 50-day EMA crossed below the 100-day EMA in mid-November, while the second was confirmed on Tuesday with the same 50-day EMA crossing beneath the 200-day EMA.

Ethereum will likely trade under pressure, reflecting risk-off sentiment as investors lean bearishly.

Still, the MACD has issued a buy signal on the daily chart, suggesting investors increase their risk exposure. If demand increases and builds a strong tailwind, Ethereum may extend its recovery above $3,000.

XRP, on the other hand, is trading at around $2.18 at the time of writing on Wednesday, while staying below the falling 50-day EMA at $2.37, the 100-day EMA at $2.52 and the 200-day EMA also at $2.52 as they slope lower and continue to cap rebounds.

The MACD histogram turned slightly positive above the zero line, signaling a bullish crossover on the daily chart. A related buy signal was confirmed when the blue MACD line crossed above the red signal line, backing risk-on sentiment.

With RSI holding at 46 and declining, upward momentum could remain subdued, and the broader tone cautious.

On recovery, the 50-day EMA, the 200-day EMA and the 100-day EMA would present interim barriers ahead of a trend line that has been capping recovery since the record high of $3.66 in mid-July.