XRP declines for the second consecutive day, as the crypto market struggles to sustain recovery.

XRP ETFs record steady inflows, but sentiment remains lagging.

A weak derivatives market, as reflected by Open Interest remaining below $4 billion, underlines risk-off sentiment.

Ripple (XRP) is extending its decline, trading at $2.17 at the time of writing on Wednesday. The cross-border remittance token was rejected at $2.30 on Monday, reflecting a sticky bearish sentiment in the broader cryptocurrency market despite steady inflows into Exchange Traded Funds (ETFs).

XRP ETF inflows extend as institutional demand steadies

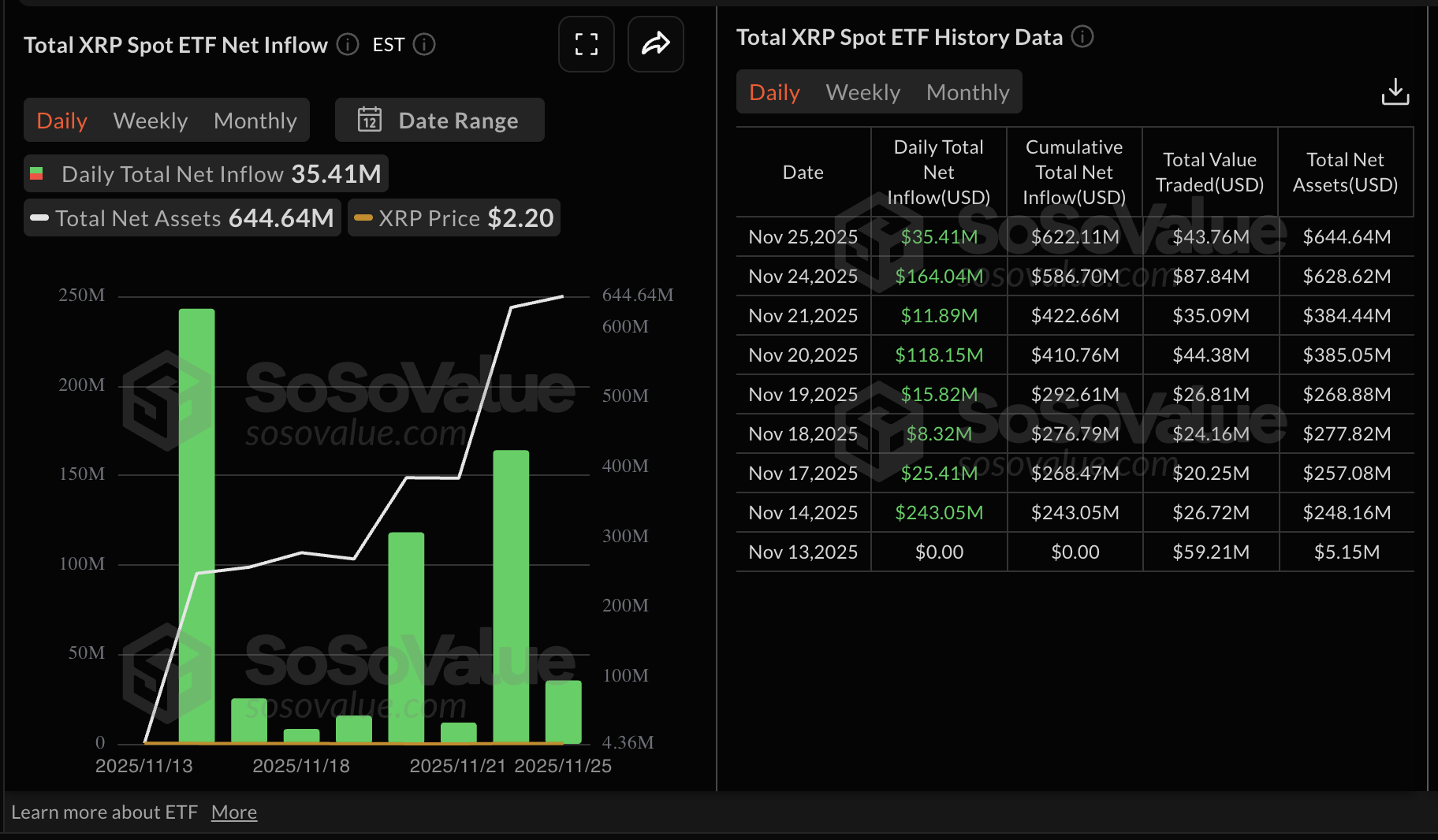

Interest in US-listed XRP ETFs has continued to improve since their initial launch in mid-November. There are currently four XRP ETFs operating in the US, including Canary Capital’s XRPC, Bitwise’s XRP, Grayscale’s GXRP and Franklin Templeton’s XRPZ.

In total, XRP ETFs recorded approximately $35 million in inflows on Tuesday, bringing the cumulative volume to $622 million and net assets to $645 million.

ETF flows help gauge market sentiment, whereby inflows underpin a bullish market, while outflows signal a bearish outlook.

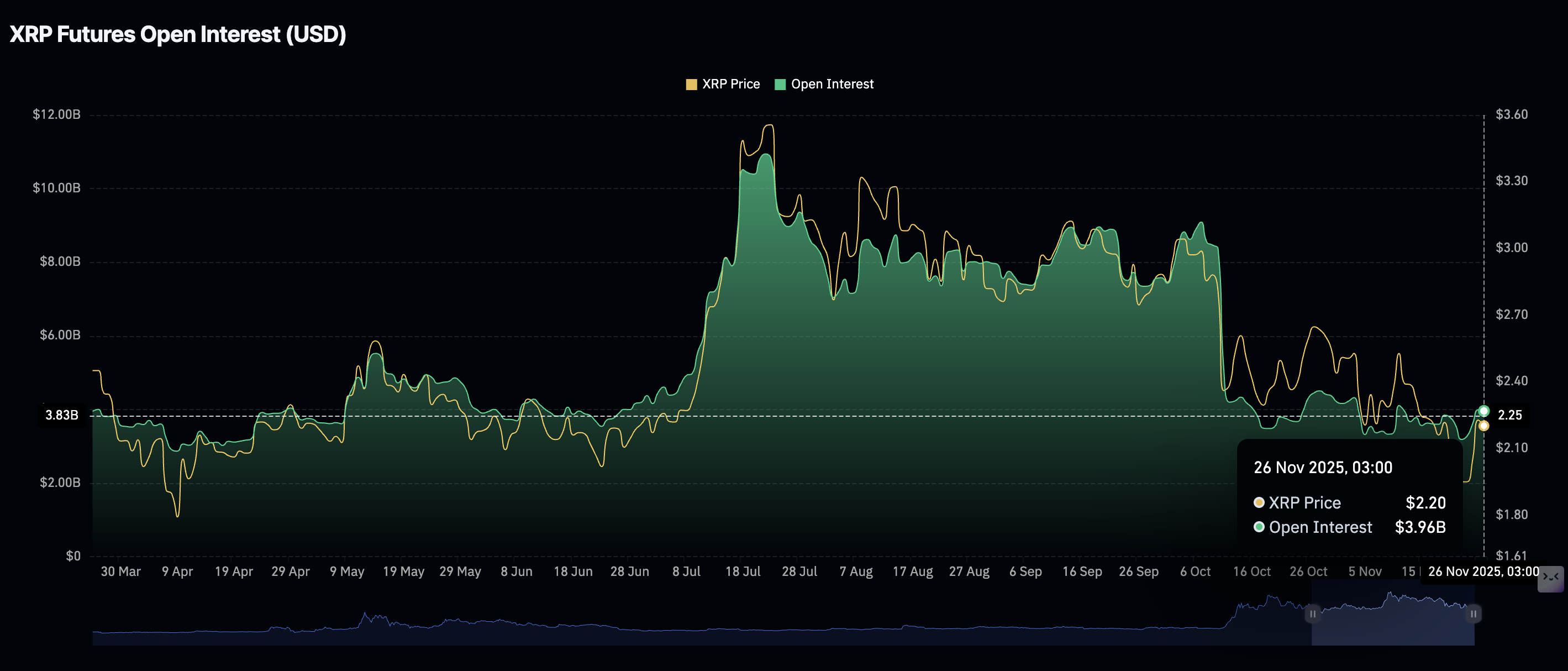

Retail demand, on the other hand, has remained relatively low, with futures Open Interest (OI) unable to steady above $4 billion since November 11. According to CoinGlass data, OI, which tracks the notional value of outstanding futures contracts, averaged $3.96 billion on Wednesday, down from $4 billion the previous day.

XRP futures OI hit a record high of $10.94 billion on July 22, days before the token achieved a record high of $3.66. This highlighted growing risk appetite for XRP derivatives and backed risk-on sentiment.

However, a steady decline in the OI has coincided with the price falling to $1.82 on Friday. If retail demand remains suppressed, it would be difficult to sustain recovery, with XRP likely to trade under pressure.

Chart of the day: XRP offers mixed signals

XRP remains capped below the 50-day Exponential Moving Average (EMA) EMA at $2.37, underscoring a continuous downward slope. The descending trend line from the record high of $3.66 limits rebounds on the daily chart, with resistance seen at $2.68.

The Moving Average Convergence Divergence (MACD) histogram has turned positive and is expanding, suggesting the MACD line has crossed above the signal line. This outlook could sustain a bullish tone in the short to medium term.

Still, the Relative Strength Index (RSI) at 46 leans neutral-to-soft, keeping upside efforts in check. The broader setup stays heavy while price trades beneath the 200-day EMA at $2.51 and the 100-day EMA at $2.52. Momentum holds below the zero line and flattens, indicating fading bearish pressure rather than a directional turn. A bounce would encounter supply into the 50-day EMA, while a daily close above the same level would open a recovery phase.