Pi Network is expanding its presence in Web3 gaming through a new partnership with CiDi Games. It aims to enhance Pi Coin’s real-world utility ahead of its first regulated trading debut in the European Union (EU).

Yet, despite the strategic move and recent regulatory progress, exchange holdings of Pi coin continue to climb, indicating persistent sell pressure in the market.

Pi Network’s GameFi Gamble Deepens, but Why Are Exchange Balances Surging?

The partnership, announced on November 26, 2025, positions CiDi Games as a core developer within Pi’s ecosystem. According to Pi Network, the collaboration:

Expands Pi’s real-world use cases,

Signals commitment to gaming at scale, and

Creates new opportunities for its tens of millions of users, known as Pioneers, to transact with Pi daily.

By combining Pi’s global reach with CiDi’s development capabilities, the two parties aim to anchor Pi at the center of Web3 gaming.

CiDi Games is building a suite of Pi-integrated titles, including a lightweight HTML5 game platform scheduled for testing in Q1 2026.

The company is also developing APIs and infrastructure to facilitate easier integration with Pi for third-party game studios. This mirrors models used by established blockchain gaming platforms.

Pi Network Ventures, the project’s investment arm, has taken an equity stake in CiDi, signaling internal confidence despite the developer’s limited public track record. CiDi’s website contains little more than a logo, raising questions about transparency.

Still, Pi argues that gaming is a “natural fit” for its social, interactive, crypto-enabled community. Analysts say the strategy appears pragmatic, with casual gameplay known to drive transaction growth in emerging blockchain ecosystems.

The push into GameFi comes just as Pi Network moves toward formal market entry in Europe. In October, the project published a MiCA-compliant white paper. This fulfills regulatory requirements ahead of trading on Malta-licensed exchanges, such as OKX and OKCoin, beginning November 28.

The 27-page document:

Outlines security standards, consumer protections, and compliance procedures for the EU.

Reaffirms that Pi was never issued via an ICO but earned through community mining.

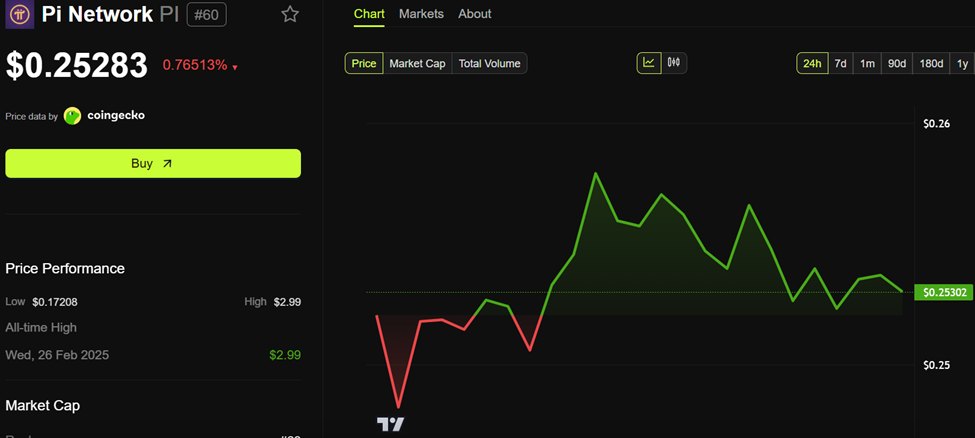

The news lifted Pi’s price by 10%, while also reinforcing its shift from a closed mobile mining platform to a regulated digital asset. Pi previously gained institutional exposure through the Valour Pi ETP listed in Sweden.

Rising Exchange Balances Threaten to Outpace Pi’s Ecosystem Growth

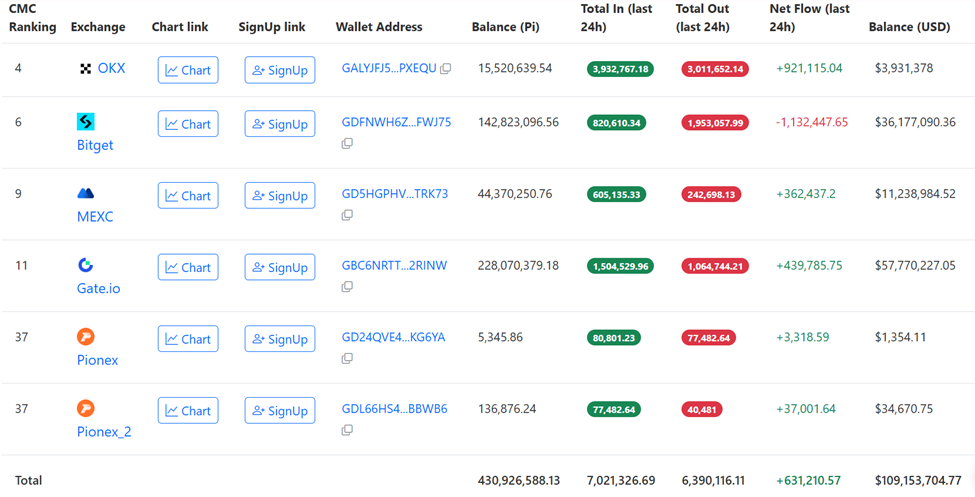

However, despite the positive momentum, supply dynamics continue to pose a challenge. Exchange balances reached 430.8 million Pi as of November 27, equivalent to approximately $109 million at current prices.

Gate.io holds the largest share at 228 million, followed by Bitget and the MEXC exchange. Net inflows added more than 631,200 Pi in the past 24 hours, suggesting more holders are preparing to sell.

Pi Coin Exchange Balances. Source: PiScan.io

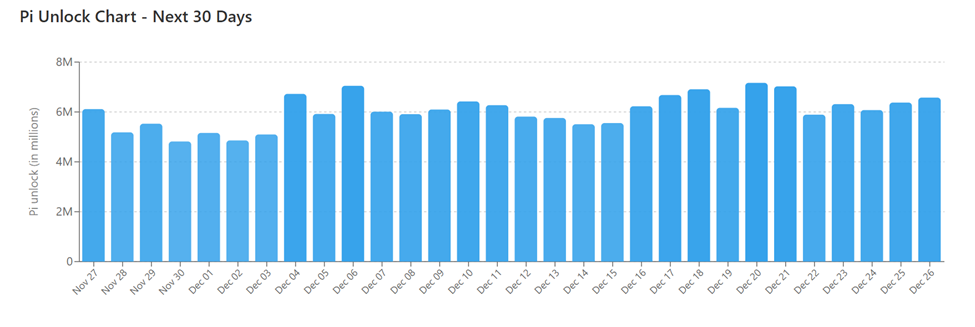

The surge in supply coincides with Pi’s aggressive unlock schedule. November unlock totalled 145 million Pi, while December is set to release 173 million, the largest monthly unlock until late 2027.

Pi Unlock Schedule. Source: PiScan.io

Meanwhile, daily trading volume remains modest at around $30 million. Pi Core Team wallets, which collectively hold more than 71 billion tokens, have shown no significant movement and do not appear to be contributing to the selling pressure.

However, with only an estimated 3 billion Pi circulating in practice, the rising exchange balances place continued downward pressure on price.

Pi Network (PI) Price Performance. Source: BeInCrypto

Whether GameFi adoption and EU trading access can absorb this supply remains an open question, even as Pi Network’s ecosystem growth accelerates in the face of the market’s sell-side liquidity.