VanEck removes BNB staking from ETF filing amid regulatory caution. BNB price prediction targets $861 while DeepSnitch AI could 100x in 2026, with huge returns for early buyers.

VanEck just scrapped staking plans for its BNB ETF, bowing to regulatory pressure. Kevin Hassett is the frontrunner to chair the Fed, and his crypto-friendly stance could shift policy in favor of digital assets.

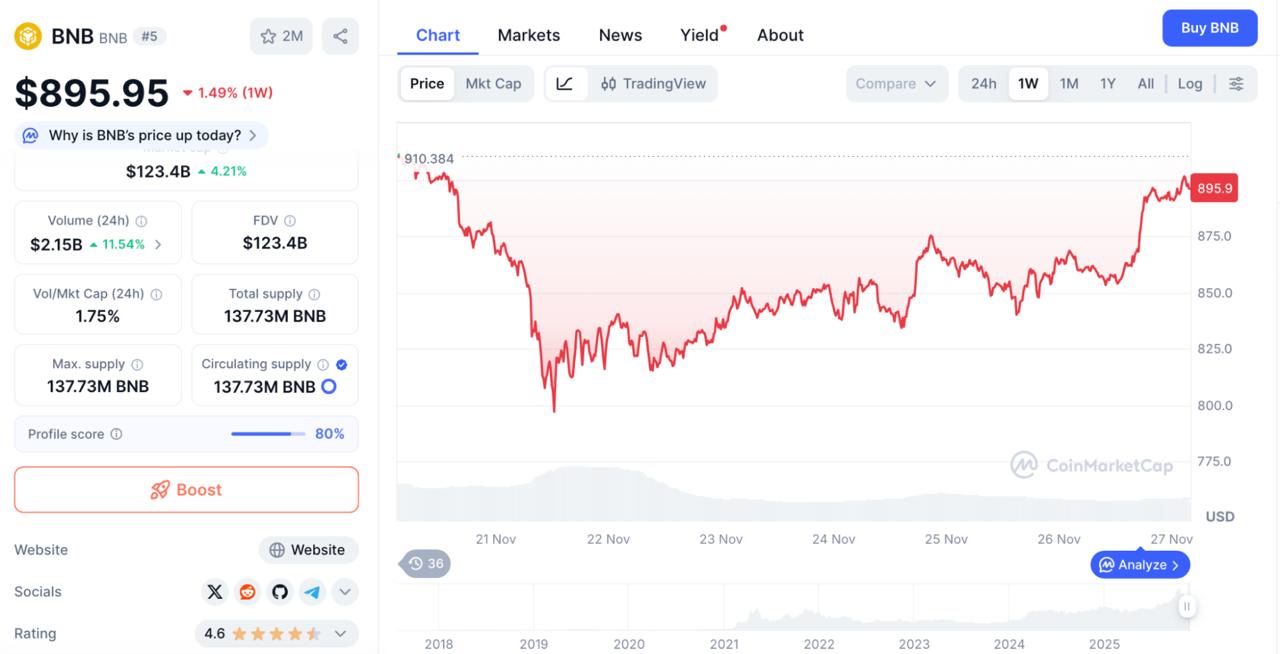

As institutions navigate uncertainty, traders are watching every BNB price prediction while hunting projects with real utility. BNB trades at $857, aiming for $861 by December, but far more significant momentum is in DeepSnitch AI.

The AI surveillance platform has raised over $600,000 at $0.02477, up 64% from launch, with staking and tools already shipping. Early entry could pay off big time.

VanEck’s regulatory pivot and crypto-friendly Fed pick

VanEck’s decision to strip staking from its BNB ETF filing shows just how cautious asset managers still are with crypto products. After initially including staking, the firm furtively removed it, almost certainly in response to SEC concerns that staking rewards could push BNB into security territory. VanEck kept staking in its Solana ETF filing, a clear sign that regulators view different tokens through very different lenses.

On the policy front, Kevin Hassett’s potential appointment as Fed chair could influence monetary policy in ways that favor crypto adoption, from easing bank restrictions on crypto custody to supporting stablecoin frameworks.

Together, these developments point to a maturing regulatory era, only it’s still full of uncertainty. Projects with simple, clear utility and no staking baggage are facing far fewer hurdles. That’s part of why early-stage presales like DeepSnitch AI are going to have so much traction in 2026.

TRON and BNB price prediction unlikely to see 2026 gains as high as DeepSnitch AI

1. DeepSnitch AI

The Binance ecosystem handles enormous daily volume, but it doesn’t protect users from making terrible trades. Thousands of new tokens launch on BSC every day, and most are scams. DeepSnitch AI fixes this with SnitchFeed, SnitchScan (AI agents already internally operating), and another three tools on the way.

The platform offers actionable intelligence that lets traders act before the momentous swings of the market, not after. The presale has raised $600k at $0.02477, and the network is already functioning. SnitchFeed is deployed internally with refined detection logic and a dashboard featuring sentiment visuals, live feed, and global alerts. This is a working intelligence engine, not a concept or illusion.

Consider this alongside the BNB token utility, and there’s almost no comparison. BNB gives trading discounts and governance on Binance. Useful, but only within one ecosystem. DeepSnitch AI delivers chain-agnostic intelligence across every platform, every network, and every trade. It improves decision-making, not just fee structures.

With VanEck softening staking in filings and regulators increasing pressure on yield-bearing tokens, DeepSnitch AI sidesteps the complexity entirely. Staking exists, but the core utility is the intelligence layer. People buy DeepSnitch AI because it has 100x potential and because it makes them smarter traders.

BNB at $857 needs billions in fresh liquidity to make significant gains. DeepSnitch AI at $0.02477 could 10x with a fraction of that demand, with a moonshot anticipated for 2026.

Between November’s historically strong performance window and rate cuts boosting risk appetite, DeepSnitch AI is the fiercer asymmetric bet for traders who want real-time intel rather than ecosystem perks. But for the largest returns, buying now, not later, will make all the difference in the world.

2. BNB price prediction and performance

BNB is trading around $895, and VanEck’s decision to eliminate staking from its ETF filing highlights ongoing regulatory concerns. While this might seem like a setback, it actually removes a potential classification risk that could have complicated BNB’s status with the SEC.

There’s bearish sentiment with only 40% green days over the last month, but the BNB price prediction suggests modest movement. The 2025-2026 forecast shows BNB trading within a range of $810 to as high as nearly $950, meaning potential upside of approximately 10% lies in wait.

For a top-10 token, that’s a reliable and steady upward trend in a best-case scenario, but it’s not exactly explosive. The Binance ecosystem growth continues, but BNB’s massive market cap limits percentage gains for retail traders.

3. TRON

TRON is trading at $0.2746, at the time of writing, holding steady despite broader market volatility. TRX has found support at key demand zones, and if buyers maintain this level, the next target sits around $0.33 to $0.34.

TRX has seen 37% green days over the last month, with mixed tech sentiment. The BNB future value projections suggest TRX could rise around 8% to reach $0.2965 or so by late December, with a six-month target of $0.3520 (a 28% upside) by May 2026.

And at its current market cap, TRX faces similar scaling challenges as BNB. Big percentage shifts require disproportionate capital inflows. DeepSnitch AI targets a different value capture mechanism, that is, utility per user rather than total value locked. Every trader using DeepSnitch AI tools increases network effects without needing billions in liquidity.

Closing thoughts

VanEck’s regulatory caution and Hassett’s potential Fed appointment show crypto is likely entering a more structured phase. BNB is expected to hover around $860, capturing steady value from Binance’s ecosystem.

But DeepSnitch AI has much higher potential, having raised nearly $600K, with launched staking, and deployed intelligence tools in its internal environment. Priced for presale at $0.02477, it has the rare combination of AI utility and seals of approval from audits and its proven platform.

To get involved as early as possible, which is the best way to reap the biggest rewards, visit the website to get involved in the presale.