XRP is entering a pivotal moment, holding firm above key support as fresh ETF inflows bolster short-term confidence despite lingering volatility and steady profit-taking across the market.

RippleNet adoption remains strong, but most participants currently use the messaging layer rather than XRP for liquidity.

XRP price today is hovering near the $2.20–$2.24 range, reflecting tension between short-term bullish momentum and structural selling from long-term holders. While ETF-driven demand signals institutional interest, analysts caution that a confirmed trend reversal has not yet occurred.

Key Takeaways

XRP maintains support above the $2.18 zone after a technical retest on the 100-hour simple moving average (SMA).

XRP has broken and retested a short-term descending trendline above $2.18 support, forming a bullish continuation setup toward $2.3169, invalidated below $2.1374. Source: Nytro1 on TradingView

According to early ETF filings, XRP-linked ETFs recorded over $160 million in inflows in one week, providing short-term market interest.

Glassnode data shows renewed accumulation in one-week to three-month wallets, though long-term holders continue profit-taking.

XRP remains a top-ranked crypto asset by market capitalization, holding the #4 position globally with a market cap of nearly $131 billion.

Why Is XRP Rallying?

The recent recovery appears correlated with institutional exposure following the launch of spot XRP investment products. For example, Grayscale’s XRP Trust and Franklin Templeton’s XRP ETF reported combined first-day inflows exceeding $164 million, one of the largest altcoin ETF debuts to date. Analysts attribute part of XRP’s short-term outperformance relative to Bitcoin and Ethereum to these inflows, though it remains unclear how much represents long-term demand versus initial creation units.

Macro conditions have also turned mildly supportive. With Bitcoin near $87,000 and Ethereum around $2,900, capital rotation into large-cap altcoins such as XRP appears evident.

Holder Dynamics: Short-Term Confidence vs Long-Term Profit-Taking

Glassnode cohort analysis indicates that XRP held in one-week to three-month wallets has increased since mid-November, signaling renewed speculative participation. Conversely, long-term holders continue reducing exposure; approximately 84 million XRP were distributed between November 23 and 25, a 56% rise in selling compared to the prior week.

XRP has stayed a top altcoin by market cap since 2017, outlasting many others in the crypto space. Source: John Squire via X

The Net Unrealized Profit/Loss (NUPL) metric shows long-term wallets remain in the “belief–denial” zone, historically associated with elevated distribution risk. NUPL helps identify whether long-term holders are in profit-taking phases, which can exert downward pressure on price.

ETF Momentum Adds Credibility But Limited Utility

XRP ETFs strengthen regulatory credibility and create a potential price floor. Combined assets under management from Grayscale and Franklin Templeton now exceed $245 million, echoing early Bitcoin and Ethereum ETF stages.

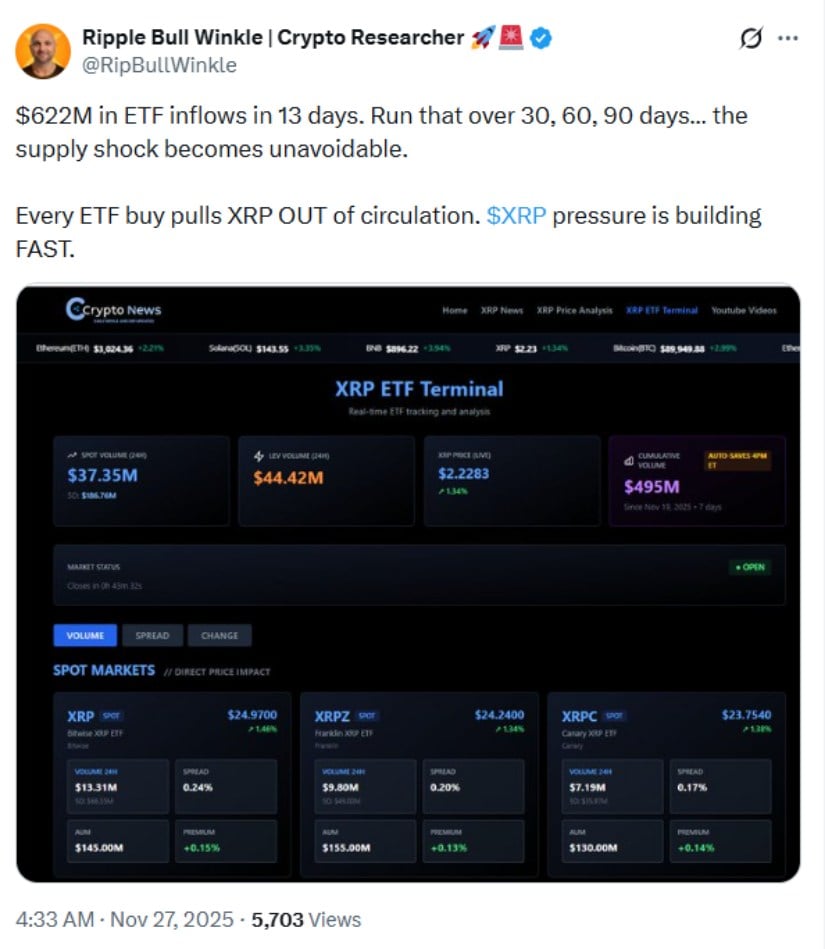

$622M in ETF inflows over 13 days—projected over 30–90 days, XRP supply tightens significantly, creating mounting upward pressure as each ETF purchase removes coins from circulation. Source: Ripple Bull Winkle | Crypto R via X

However, most XRP acquired through ETFs is stored in cold custody, limiting immediate network transaction growth.

Market Position: XRP Maintains Long-Term Dominance

Despite legal and market turbulence, XRP remains a consistently ranked digital asset. Crypto commentator John Squire, who covers large-cap crypto trends, notes:

“XRP never left the top. Seven years staying king while others come and go.”

This longevity reflects Ripple’s focus on enterprise payments and cross-border infrastructure rather than short-term speculative hype.

Final Thoughts

XRP’s price outlook remains delicately balanced. Technical support above $2.18 anchors short-term momentum, while ETF inflows provide early structural backing.

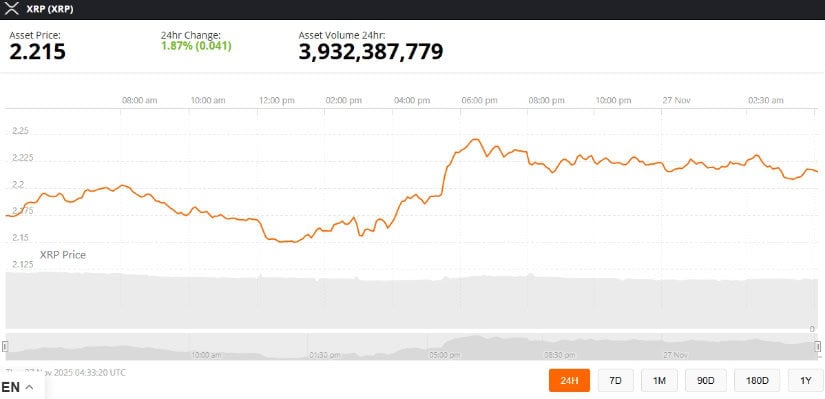

XRP was trading at around 2.21, up 1.87% in the last 24 hours at press time. Source: XRP price via Brave New Coin

At the same time, long-term holder distribution and muted on-chain usage limit immediate upside confidence. Transitioning from volatility-driven recovery to sustained bullish expansion will depend on absorbing profit-taking and converting institutional interest into real-world utility.