Key Takeaways

MEXC is a cryptocurrency exchange that offers spot and copy trading, staking, and futures trading with up to 500x leverage.

MEXC supports over 4,000 crypto assets and 430+ futures contracts, with low fees starting at 0% for makers and 0.05% for takers.

Holders of MX, the platform’s native token, can enjoy up to 50% discounts on fees, besides having access to Launchpad and Launchpool.

The platform employs security measures like cold storage, two-factor authentication (2FA), multi-signature, and complete proof of reserves.

MEXC exchange is renowned for being a high-performance, mega-transaction platform capable of executing 1.4 million transactions per second. The exchange prioritizes enhanced performance and efficiency, while also prioritizing user asset security and ensuring state-of-the-art operational integrity. Our MEXC review dissects the platform to help you decide whether it is the best cryptocurrency exchange for you.

MEXC Exchange Review: At a Glance

| Crypto exchange | MEXC |

| Year Founded | 2018 |

| Headquarters | Seychelles |

| Cryptocurrencies supported | 4000+ |

| Fiat currencies supported | USD, AUD, EUR, TWD, AED, PHP, JPY, CAD & more |

| Deposit methods | Cryptocurrency, Visa/Mastercard, Bank Transfer, Apple Pay, Google Pay |

| Trading fees |

|

| Mobile App | Android and iOS |

| Supported Countries | 170+ countries, except for the US, UK, Canada…. |

| Trading Options | Spot trading, Futures & Margin trading, Copy trading, P2P trading, Demo Trading |

| Security measures | 2FA, Cold Storage, Whitelisting, SSL encryption |

MEXC Review: What Is MEXC?

MEXC Global is a top cryptocurrency exchange with over 40 million users that offers a wide range of services and crypto assets. The platform boasts a user-friendly interface and utilizes state-of-the-art security measures to safeguard user assets. MEXC offers advanced products like copy trading, staking, and spot and futures trading with leverage of up to 500x.

For both beginners and experienced traders, MEXC offers a safe and secure space where users can buy, sell, or trade crypto assets. Its interface is responsive and easy to navigate, designed to facilitate fast and efficient trading without compromising on speed. Moreover, the website offers numerous tutorials that provide step-by-step instructions on using its many features effectively. Apart from the written training materials, some tutorials are available on a dedicated YouTube channel.

Founded in 2018, MEXC has invested in high-performance technology that enables it to handle up to 1.4 million transactions per second. As a top-tier cryptocurrency exchange, MEXC boasts high liquidity and volume, trading an average of $10 billion daily.

MEXC holds several trading licenses, such as an MSB license in the US, from AUSTRAC in Australia, and an Estonian MTR license. Such and other licenses enable the platform to offer exchange, wallet, and remittance services in most parts of the world.

Pros of MEXC

A user-friendly, intuitive interface with beginner-friendly and advanced features

Charges one of the lowest transaction fees in the industry, starting at just 0%

Wide range of crypto assets and trading products (2,600+ Spot pairs & 1,500+ Futures pairs)

Strong security measures and deep liquidity

High leverage of up to 500x on futures trades

Cons of MEXC

Not available in the United States, United Kingdom, and Canada due to regulatory restrictions

Limited customer support options

New users must complete KYC verification

Limited fiat support

MEXC Exchange Review: Trading Features

Our MEXC crypto exchange review can reveal that the platform offers a wide range of trading tools and options. Whether you’re a beginner or an experienced trader, the versatile exchange has something to fit your trading needs.

1. Spot trading

MEXC supports a wide variety of cryptocurrencies you can buy, sell, or invest in. The platform offers over 2,600 trading pairs, making it the largest exchange in terms of supported cryptocurrency assets. With more trading pairs, the MEXC spot trading market provides users with more opportunities.

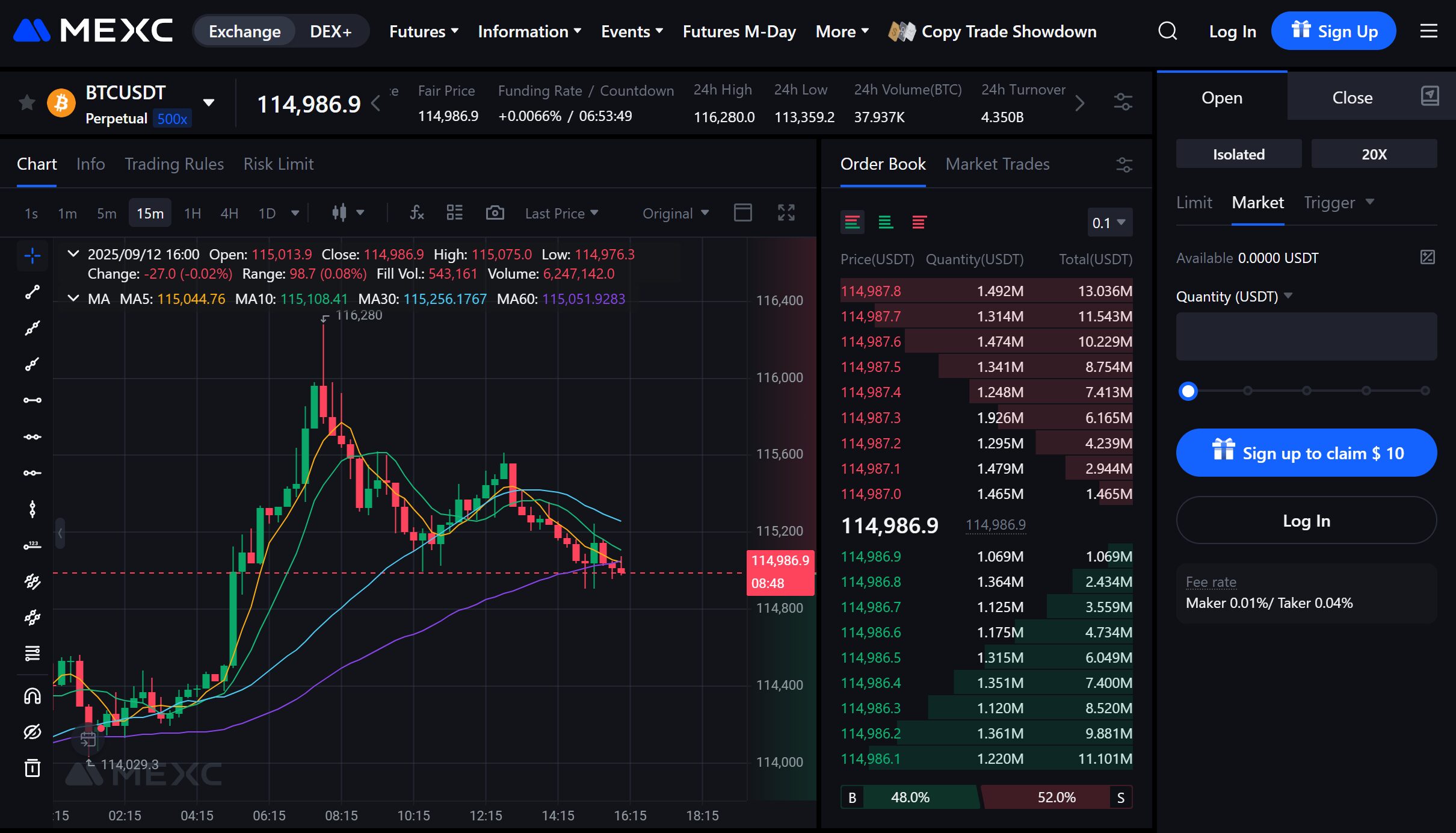

2. Futures & Margin Trading

MEXC operates a futures trading feature. This allows participants to agree to sell or buy crypto assets on a future date at a predetermined price. Investors planning to trade futures on the platform must transfer funds from the spot account to the derivative account.

Its new feature, Multi-Asset Margin mode, is designed to enhance and improve the user experience for Futures traders. The mechanism uses a shared margin pool comprising multiple assets that users can combine into unified collateral for futures options. The risk control mechanism supports 14 tokens, including Ethereum, Bitcoin, Solana, Dogecoin, USDT, and USDC, among other

3. Demo Trading

New users on the MEXC platform can use the free demo account to simulate USDT-M trading. The demo account mimics real-life futures trading, allowing users to get the feeling without risking tangible assets. The demo account offers up to 10 BTC, 50,000 USDT, and 100 ETH in virtual funds for trade every day.

4. Copy Trading

The platform offers futures copy trading, which allows new traders to replicate the positions of experienced traders. The exchange applies regular transaction fees and a profit sharing that is capped at 15%.

5. P2P Trading

With peer-to-peer (P2P) trading, traders can buy and sell crypto, and negotiate prices, trading terms, and payment methods without intermediaries. The MEXC P2P feature facilitates these transactions using security features, such as escrow services, to ensure fair trade and safety.

6. Meme+ Trading Zone

The Meme+ Trading Zone is designed for crypto traders willing to invest in high-risk, high-return Memecoins. Users can trade popular onchain Memecoins on SOL, BASE, BSC, ETH, BERACHAIN, and TRX.

MEXC DEX+

MEXC DEX+ combines the functionalities and user experience of centralized exchanges (CEX) and the liquidity of decentralized exchanges (DEX). It plays the role of a DEX aggregator, routing trades through various decentralized liquidity pools to secure the best possible results and minimize slippage. Users don’t need to create a separate Web3 wallet or manage private keys; they’re integrated directly into their MEXC accounts.

How it works

Fund transfer: Users transfer assets from their MEXC spot wallet to a DEX+ wallet

Trade execution: The DEX+ aggregator automatically scans and sources the best prices when you place an order.

Settlement: The system executes the trade onchain, and tokens are credited to your DEX+ wallet via an automatic process.

MEXC DEX+ simplifies decentralized trading for both beginners and experienced users by removing the need to manage private keys. As a DEX aggregator, it pulls liquidity from multiple decentralized sources to offer optimal pricing and smooth trade execution.

Traders gain access to thousands of on-chain assets, including early-stage tokens not yet listed on centralized exchanges, with features like limit orders and seamless switching between MEXC’s CEX and DEX+.

The platform charges a 1% service fee for every trade in addition to the regular on-chain gas fees. Users interested in accessing MEXC DEX+ must also undergo a compulsory KYC verification process, meaning you can’t trade in complete anonymity. The DEX+ platform aims to bridge the gap between CEX convenience and DEX access.

How to Sign Up and Complete KYC Verification

The MEXC Global signup procedure is straightforward:

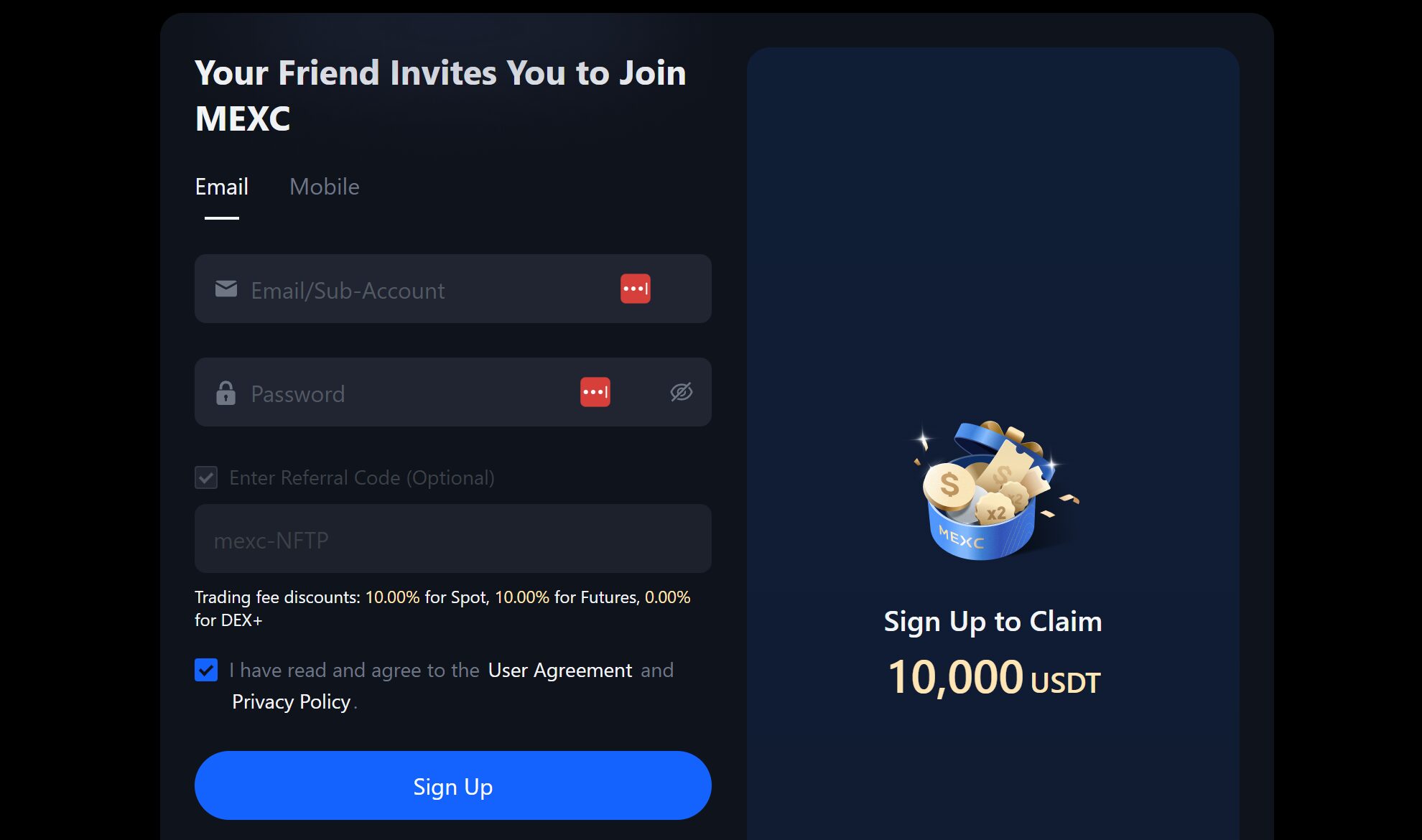

Step 1: Create an MEXC Account

Visit the official MEXC website or visit the App Store (iOS) or Google Play (Android). On the Website’s homepage or on the App’s interface, click the “Sign Up” button.

Enter Your Details: Choose between registering with your email address or mobile phone number. Create a unique and secure password containing uppercase, lowercase, numbers, and symbols. If you have a referral code, enter it in the provided space, as it could bring some extra benefits. Read and agree to the platform’s terms and conditions and click “Register”.

Verify Your Account: MEXC will send you a verification code via SMS or email. Enter the code in the space provided and click “Submit” to finish the initial registration.

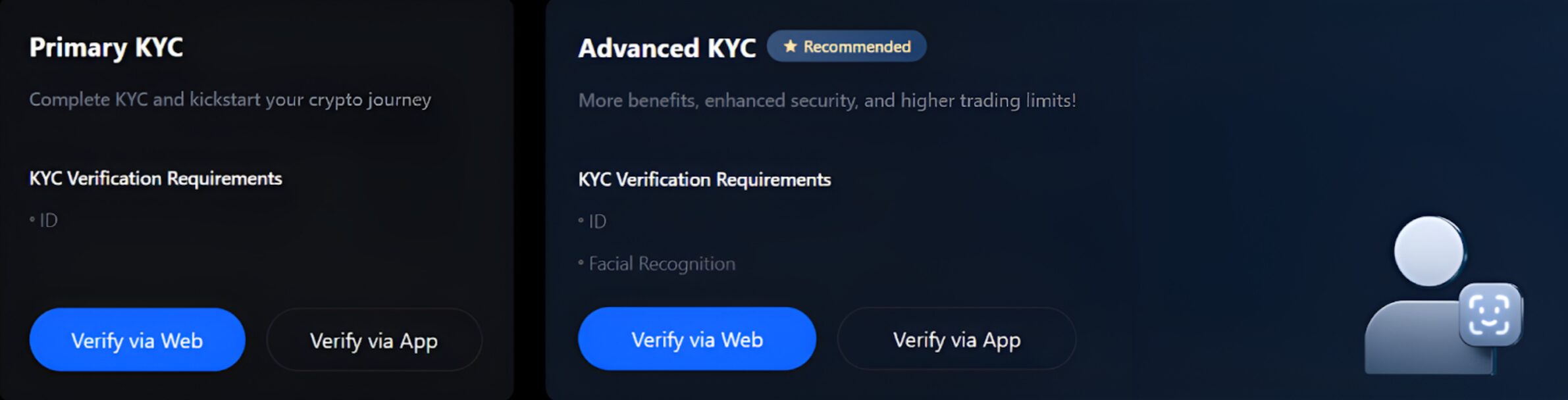

Step 2: Verify Your Identity (KYC)

A new policy change requires all new customers to undergo the Know Your Customer (KYC) verification. You will be asked to upload a valid passport, ID, or driver’s license as well as a selfie to confirm your identity. You could also be asked to provide proof of address, like a recent utility bill.

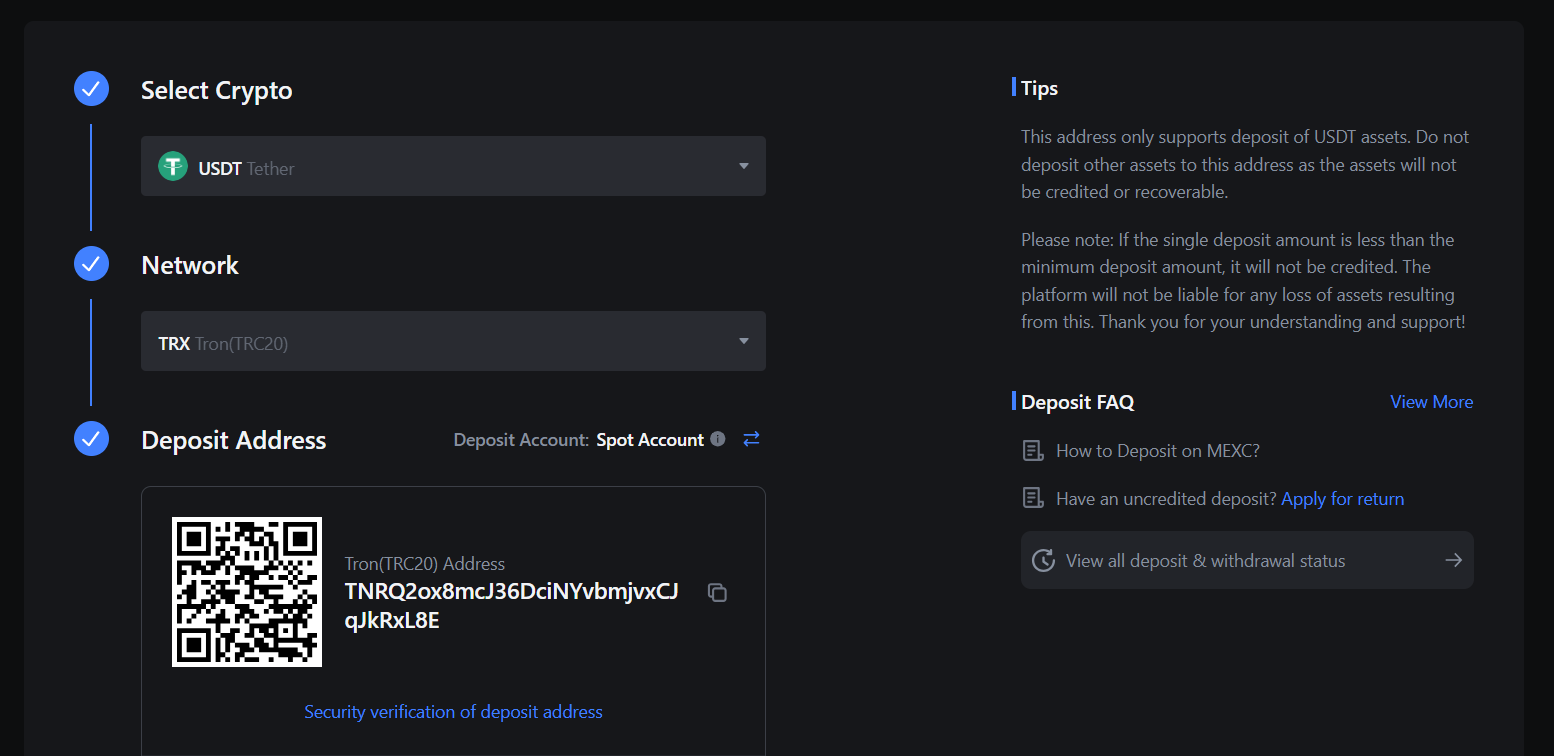

Step 3: Deposit Fiat Currency or Crypto

You can immediately deposit cryptocurrency from your digital wallet or fiat currency using a bank transfer or a credit card. You can choose between global transfer, Express action, and debit/credit card transfers. Navigate to “Wallet” and select “Deposit”. Select the crypto you want to transfer, and then copy the deposit wallet address. Confirm the details and send the amount you wish to transfer.

Step 4: Start Trading Crypto

Navigate to the MEXC homepage and click on “Buy Crypto”. Choose “Quick Buy” as it enables you to buy instantly with minimal steps. Next, choose the currency you want to pay with and select the crypto asset you intend to purchase. Click on “Buy” to finish the transaction.

MEXC Security and Regulation

MEXC’s legitimacy has been verified by multiple auditing and evaluation platforms. MEXC Global holds a 9 out of 10 Trust Score on CoinGecko, the world’s largest crypto data aggregator. This score is calculated using a proprietary algorithm that evaluates various metrics including liquidity, trading volume, cybersecurity, API and operational scale. CertiK also awards MEXC an “AA” security rating with a Skynet Score of 87.95%, ranking the exchange in the top 10% of all cryptocurrency platforms for security.

MEXC implements several security measures, such as two-factor authentication (2FA), to safeguard user data and ensure their funds are safe. While KYC verification was optional in the past, a new policy change demands that all new users undergo it. Users can also add other available security measures, such as SMS authentication, email authentication, and anti-phishing code.

The exchange’s anti-phishing measures enable users to set up personalized codes resembling MEXC communications to prevent attacks and verify authenticity. An added security layer is the withdrawal whitelist feature that only allows withdrawals to pre-approved cryptocurrency wallets. This plays a significant role in restricting withdrawals and reducing the risk of fishy transactions.

The best proof of MEXC’s seriousness in security measures is the fact that the platform has never experienced a security breach. The exchange also provides full evidence of reserves and backs all user funds 1:1 on the exchange.

MEXC exchange adheres to globally accepted regulatory standards and operates in over 170 countries globally. While it is registered in the Seychelles, the exchange follows the regulatory requirements of many other jurisdictions. MEXC follows strict Know Your Customer (KYC) and Anti-Money Laundering (AML) laws to help ensure protection and prevent illegal activities.

Where is MEXC exchange located?

MEXC is officially headquartered in Victoria, Seychelles. The company was founded in 2018 and registered as MEXC Global Ltd under Seychelles’ regulatory framework for virtual asset service providers.

Although many sources state that MEXC is based in Singapore, this is incorrect information. MEXC may have had operational presence in Singapore in its early days, maintained server infrastructure there, or had team members based in Singapore. However, the official corporate registration and headquarters have always been in Seychelles.

Seychelles was chosen as MEXC’s headquarters due to the following benefits:

Crypto-friendly regulatory environment: No specific crypto licensing required (unlike Singapore, the US, and the EU).

No restrictions on crypto-to-crypto trading operations: The Seychelles Financial Services Authority (FSA) allows MEXC to offer a wide range of products, including exchanges, wallets, brokerage, asset management, ICO support, and advisory services.

Crypto tax-free: 0% corporate tax regime, no capital gains tax, no withholding taxes on dividends or interest, and no VAT on cryptocurrency transactions.

Access to international markets: MEXC can serve 170+ countries from a single entity without geographic restrictions that heavily regulated exchanges usually face.

MEXC Review: Fee Structure

MEXC exchange operates on a highly competitive fee structure for spot and futures trading markets.

Trading Fees

Our MEXC crypto exchange review shows that the fees for spot, futures, and copy trading are among the lowest in the entire crypto market. For example, spot trading fees begin at a flat 0% for makers and 0.05% for takers.

Unlike other cryptocurrency exchanges, MEXC doesn’t operate a tiered fee structure that depends on a user’s trading volume. The futures trading platform charges 0.01% for makers and 0.04% for takers, which are relatively low. This makes the exchange a good option for leverage and derivative traders.

Deposit and Withdrawal Fees

For withdrawals and deposits, the fees can vary. While MEXC doesn’t charge fees for making deposits, withdrawal fees will depend on the cryptocurrency you wish to withdraw and the network you choose.

Users can pay lower withdrawal fees by sending USDT using the BEP20 or TRC20 network for $1 for both networks. For other cryptocurrencies like Bitcoin and Ethereum, the costs could be slightly higher. It’s always advisable to compare withdrawal fees for particular cryptocurrencies and networks every time you wish to execute a transaction. Take note also that the exchange may charge a 15% commission.

MEXC Supported Cryptos & Payment Methods

MEXC is one of the most diverse crypto exchanges, supporting over 4,100 coins and 2,700+ trading pairs, including major assets like BTC, ETH, SOL, XRP, BNB, TON and niche tokens in sectors like Memecoins, Layer 2, AI, GameFi, and DeFi.

It’s known for listing new and emerging projects early, such as $TRUMP, Moo Deng, and AI tokens like OPAI and GNON — giving traders access before mainstream listings. With a daily trading volume exceeding $2 billion, MEXC ensures deep liquidity and fast execution.

You can buy crypto using 30+ fiat currencies via Visa, MasterCard, SEPA bank transfers, and Quick Buy/Sell options. Supported currencies include USD, EUR, GBP, VND, BRL, KRW, JPY, and more.

MEXC also offers peer-to-peer (P2P) trading with zero fees, supporting various third-party payment options like Apple Pay, Google Pay, Bankcard, PayPal, Mercuryo, Banxa, and MoonPay via Visa. Note that you must complete the advanced KYV verification to be allowed to buy crypto using SEPA bank transfers. Remember, though, that SEPA doesn’t apply in some European countries apart from 30 of them, including Germany, Hungary, Ireland, Italy, and Spain.

MEXC Earn & Staking

MEXC exchange operates a staking program but uses the term MEXC Earn on its website to describe it. The staking program is divided into two sections, namely MEXC Savings and MEXC Solana (SOL) Staking.

MEXC Savings

Previously referred to as “Staking,” MEXC savings enables users to earn rewards by simply holding their crypto. Users can choose from two available options:

Locked Savings: Users are allowed to lock up their crypto for a specified time during which they cannot trade, transfer, or withdraw. You can compare it to a fixed deposit bank account where withdrawal is not allowed.

Flexible Savings: This option allows users to have access to their locked crypto assets. They can be withdrawn, traded, or transferred and still earn rewards, similar to a regular savings account.

This entire process is referred to as staking on the MEXC platform. The MEXC plan differs from traditional crypto staking, where users lock tokens to support the blockchain and earn rewards. Moreover, the MEXC staking program doesn’t utilize the proof-of-stake consensus mechanism.

MEXC Solana (SOL) Staking

The MEXC Solana staking program is designed to support the Solana exchange via a liquid staking system called MXSOL. Once you stake your SOL on the MEXC platform, you’re given MXSOL tokens in return. MXSOL becomes your receipt for the staked SOL representing the principal and the accrued rewards. Since it’s a liquid staking token, you can hold and move it as your SOL earns interest behind the scenes.

As your rewards accumulate, the value of your MXSOL also continues to grow. Users can redeem their MXSOL back to SOL any time they wish. Users interested in MEXC staking can choose between 30, 60, or 120-day lock-up periods with corresponding interest rates. Staking crypto on MEXC can be a lucrative venture once you understand it.

MEXC Bonuses & Affiliate Program

MEXC regularly creates trading competitions, hosts events, and offers bonuses to attract new customers and maintain active traders.

The MEXC signup bonus is designed to reward and welcome new users. Participants receive this bonus when they register a new account using a referral code from a friend. You will need to complete the Know Your Customer verification and several tasks to receive additional bonus. You can use our 2025 referral code “mexc-NFTP” to claim up to a free $10,000 USDT bonus and enjoy 20% on trading fees.

MEXC also operates an affiliate program under a partnership between marketers, traders, and influencers and MEXC Global exchange. Participants in the affiliate program don’t have to hold any tokens on MEXC to qualify or have a large social media following. The program incentivizes affiliates to use unique referral codes to refer new users to the platform. In return, the affiliates earn a standard 40% commission for spot and futures trading fees. However, the rate could reach as high as 50% in certain areas, such as India, Pakistan, the Philippines, Malaysia, and several others.

MEXC App & User Experience

The MEXC app is available on the App Store and Google Play, or you can download the APK file directly from the official website. It delivers the full functionality of the desktop version, offering all the trading tools including spot trading, futures, staking, as well as real time charts, technical indicators and price alerts.

The interface is user friendly, supports both light and dark themes, and is suitable for both beginners and experienced traders. You can place buy and sell orders, monitor open positions, and customize the layout to match your preferences. The app performs smoothly on mid range smartphones with fast execution and low latency, even during high traffic periods.

For security, MEXC supports two factor authentication, biometric login like fingerprint or face recognition, anti phishing codes, and withdrawal whitelists. The main drawback reported by users is high battery consumption.

The mobile app maintains strong user ratings with a 4.7 rating on App Store based on 13000+ reviews and 4.7 stars on Google Play from over 200,000 ratings. This reflect user satisfaction with the app’s performance, interface design, and trading functionality, placing MEXC among the top-rated cryptocurrency exchange apps globally.

MEXC Customer Service

MEXC offers 24/7 customer support via live chat, email, and phone, with most users reporting fast and helpful responses especially during critical trading moments. For quick self-help, the platform provides a comprehensive Help Center with guides, FAQs, and platform updates. Users can also submit direct inquiries via email at service@mexc.com, or use the chatbot for instant assistance. In case of security issues or fund-related concerns, MEXC offers a dedicated form to report lost or abnormal transactions.

On TrustPilot, MEXC holds a 1.7 rating based on 1100+ reviews, with several users complaining about the slow and generic responses. However, the negative rating is quite common across all major exchanges including Binance, OKX or Coinbase.

MEXC maintains a strong presence across major social platforms, including Telegram, Discord, Twitter (X), YouTube, and more. Among these, the official Telegram channel is often considered the fastest support avenue.

Conclusion: Is MEXC a good exchange?

MEXC ranks as one of the leading cryptocurrency exchanges with systems designed for both beginners and expert traders. The platform provides a comprehensive range of advanced tools and features tailored to the diverse needs and experiences of various traders. The platform is also renowned for delivering relatively low trading fees, making it a cost-effective option in the crypto market. Users can easily enjoy spot, margin, and futures trading.

The security of user data and private keys is ensured through the implementation of stringent security measures. These include secure data encryption, cold storage, and two-factor authentication. Moreover, MEXC Global operates a comprehensive customer care service designed to assist any traders in distress. This makes MEXC a reliable, secure, and effective cryptocurrency exchange for traders looking for a great experience.