Ripple has spent $4 billion this year expanding its payments and digital asset ecosystem, winning approvals in Singapore and the UAE.

Yet, the XRP price remains stubbornly low, leaving investors puzzled as adoption accelerates behind the scenes.

Ripple Strengthens Global Footprint with Strategic Acquisitions and Regulatory Wins

On December 4, Ripple outlined four major acquisitions aimed at creating an end-to-end infrastructure for payments and digital assets. The deals include:

GTreasury – $1 billion

Rail – ($200 million,

Palisade, and

Ripple Prime.

According to Ripple, these acquisitions integrate corporate treasury intelligence, stablecoin payments, high-speed custody, and institutional-grade liquidity into Ripple’s Payments Solutions.

The goal is to achieve a unified platform that enables businesses to move, manage, and optimize money in real-time.

“Ripple is delivering a complete payments stack backed by enterprise-grade digital asset services that give institutions everything they need to engage in, benefit from, and scale with the on-chain economy,” read an excerpt in the announcement, citing Ripple President Monica Long.

Ripple has also made headlines with approvals in Asia and the Middle East. Singapore’s Monetary Authority granted Ripple an expanded Major Payment Institution license, allowing broader regulated payment operations. Fiona Murray, VP & Managing Director for APAC, emphasized the region’s leadership in real digital asset usage.

In the UAE, RLUSD, Ripple’s fiat-referenced stablecoin, received FSRA approval for institutional use, covering collateral, lending, and prime brokerage activities. Jack McDonald, SVP of Stablecoins, called this a “signal of trust” that reinforces Ripple’s compliance and market credibility.

XRP Price Lagging Despite Positive Developments

Despite these strategic moves, the XRP price remains muted. Over the past two months, XRP has declined by 31%, with social sentiment indicating extreme fear, according to Santiment.

CryptoQuant data also highlights rising network velocity, indicating rapid trading and low long-term holding.

Short positions in derivatives markets, particularly among Korean investors, add further pressure. Upbit alone held 6.18 billion XRP as of December 4, the highest level of 2025, potentially signaling future selling.

Against this backdrop, analysts warn that while early-December gains align with broader market recovery, the XRP price could retest lows near $1.9–$2.0 if selling pressure continues.

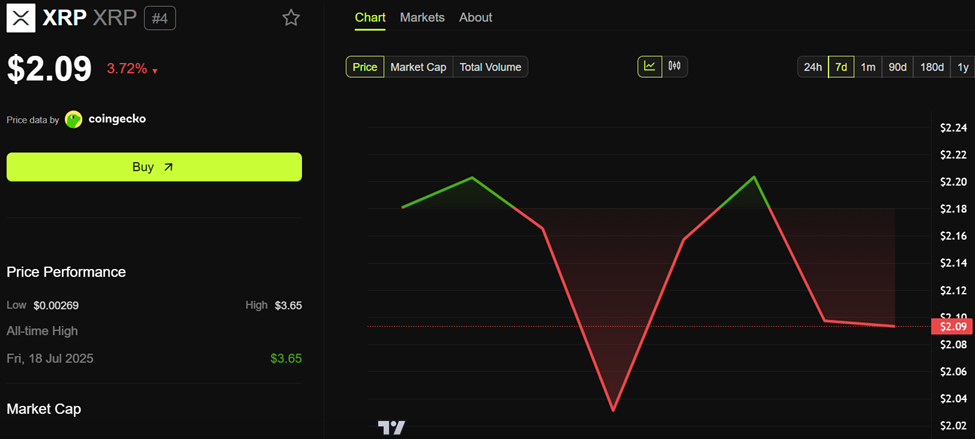

XRP Price Performance. Source: BeInCrypto

As of this writing, XRP was trading for $2.09, down by almost 4% in the last 24 hours. Market observers suggest focusing on adoption rather than charts.

“I stopped looking at the XRP chart a long time ago. The candles mean nothing without context. I watch who is adopting what, why they are adopting it, and which systems are being rebuilt behind the curtain,” said Black Swan Capitalist in a post.

This sentiment highlights Ripple’s increasing role in the enterprise payments ecosystem, where strategic acquisitions and regulatory clarity are creating tangible long-term value.

Ripple’s 2026 roadmap points to further integration of acquired assets, expanded corporate treasury services, and deeper institutional adoption.

XRP ETFs, including new inflows from Vanguard, could mitigate short-term selling pressure, even as the financial instrument races for the $1 billion milestone.

With infrastructure strengthening globally, Ripple’s vision as a one-stop shop for digital assets could reshape real-time finance, and XRP may yet catch up.