Key Notes

DOGE faces a heavy 11.72B token supply wall near the twenty cent zone.

Active addresses surge to the highest level since September.

ETF flows reach a combined $2.85M, though inflows paused on December 4.

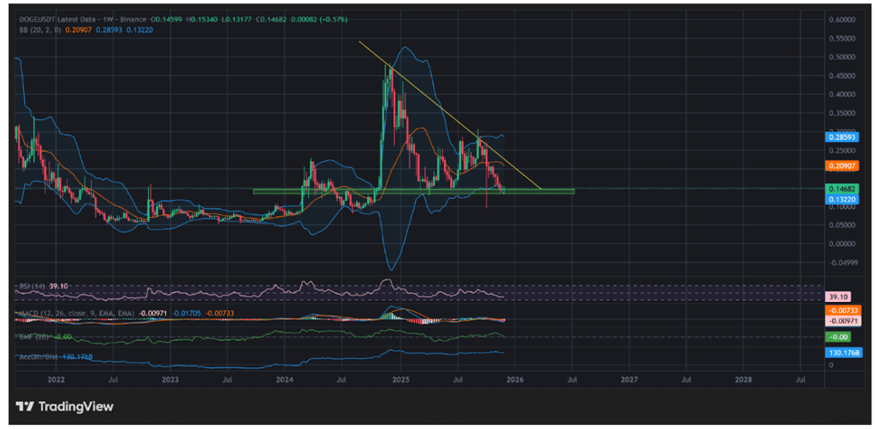

Dogecoin price remains trapped under a long descending trendline on the weekly chart, which shows a clear and massive accumulation around the twenty cent mark.

A massive 11.72 billion tokens remain concentrated in the $0.2028–$0.2044 band, as per prominent analyst Ali Martinez. This zone forms a heavy barrier because many participants who bought there still wait for a chance to exit at breakeven.

$0.20 is the key resistance for Dogecoin. That’s where 11.72 billion $DOGE were accumulated. pic.twitter.com/HZEsZSkf0Y

— Ali (@ali_charts) December 5, 2025

As a result, once price climbs toward that zone, the DOGE price momentum could slow down significantly. However, Dogecoin still remains one of the best meme coins to buy with many analysts targeting the $1 price tag in the longer term.

Strength From Network Activity and ETF Flows

Martinez pointed out that network participation has jumped to 71,589 active addresses which is the highest count since September. Despite the absence of a strong breakout on the chart, on-chain data confirms renewed user involvement and growing interest.

Dogecoin $DOGE just saw 71,589 active addresses. The biggest spike since September. pic.twitter.com/UCgC0CbLe2

— Ali (@ali_charts) December 4, 2025

According to SoSoValue data, Grayscale’s GDOG and Bitwise’s BWOW saw $177,250 in net inflows on Dec. 3. The combined total flows stand at $2.85 million since launch. However, no new inflows were recorded for Dogecoin ETFs on Dec. 4 as institutional positioning remains cautious.

DOGE Price Analysis: Bullish and Bearish Targets

On the weekly chart, DOGE holds above horizontal support near $0.13–$0.14. Repeated tests of that region show that buyers still defend it. Price remains inside the Bollinger structure, though candles hover close to the lower band. It means bears currently dominate.

For any bullish move, DOGE needs to break above the descending trendline which has capped rallies from the early 2025 peak. However, if DOGE secures a close above the descending trendline and reclaims $0.17, the 20 cent barrier with the heavy supply cluster remains the main test.

Related article: Dogecoin (DOGE) ETF Rakes in $2M: Two Key Levels Emerge

DOGE price jumps capped by descending trendline | Source: TradingView

On the other hand, if price fails to hold the $0.13–$0.14 support region, a deeper pullback to $0.10, below the lower Bollinger, is likely. According to CoinMarketCap data, DOGE currently trades at $0.1469, holding the $23.8 billion valuation as the world’s largest meme token.