Takeaways:

Over 2K $BTC worth about $185M left Binance in minutes, reinforcing a pattern of whales shifting coins off-exchange into long-term storage.

Lower exchange balances and stronger long-term holder behavior can create a tighter supply backdrop, often benefiting high-beta Bitcoin-adjacent infrastructure and scaling projects.

Bitcoin’s base layer still struggles with throughput, fees, and limited programmability, driving a competitive rush among Layer 2s and sidechains to unlock DeFi and application utility.

Bitcoin Hyper targets those gaps as a Bitcoin Layer 2 with SVM integration, aiming to deliver sub-second, low-fee smart contracts and turn idle $BTC into active capital.

More than 2K $BTC, worth roughly $185M, exited Binance within minutes in a single surge of outflows.

Instead of rushing to sell, large holders appear to be moving coins into cold storage, a classic signal that whales are positioning for higher prices rather than a near-term dump.

You’ve seen this move before. When spot balances on major exchanges trend lower, it often precedes a supply squeeze.

With fewer coins available to sell and long-term holders locking in their stacks, Bitcoin’s backdrop looks increasingly constructive, especially if macro conditions stay supportive and ETF demand persists.

In that environment, high-beta Bitcoin-adjacent plays tend to catch an outsized bid. Capital rotates from Bitcoin itself into infrastructure and scaling narratives that could amplify upside.

That’s where Bitcoin Hyper ($HYPER) is starting to attract attention as its token sale approaches the $30M mark.

If whales are telegraphing confidence in the next leg of the Bitcoin cycle, the projects solving Bitcoin’s oldest constraints (e.g., slow transactions, high fees, and limited programmability) stand to benefit most.

Bitcoin Hyper pitches itself squarely in that lane, aiming to turn dormant $BTC into active capital across payments, DeFi, and gaming.

Why Bitcoin’s Layer 2 Race is Accelerating

The renewed whale accumulation comes as Bitcoin again runs into a familiar ceiling: the base layer can only push so many transactions through the mempool before fees spike and confirmation times stretch.

? During peak congestion, fees have historically blown past $20 per transaction, making simple payments and on-chain DeFi experiments uneconomical.

That bottleneck has triggered an arms race among Bitcoin scaling solutions, with each trying to tap Bitcoin’s trust while escaping its throughput limitations.

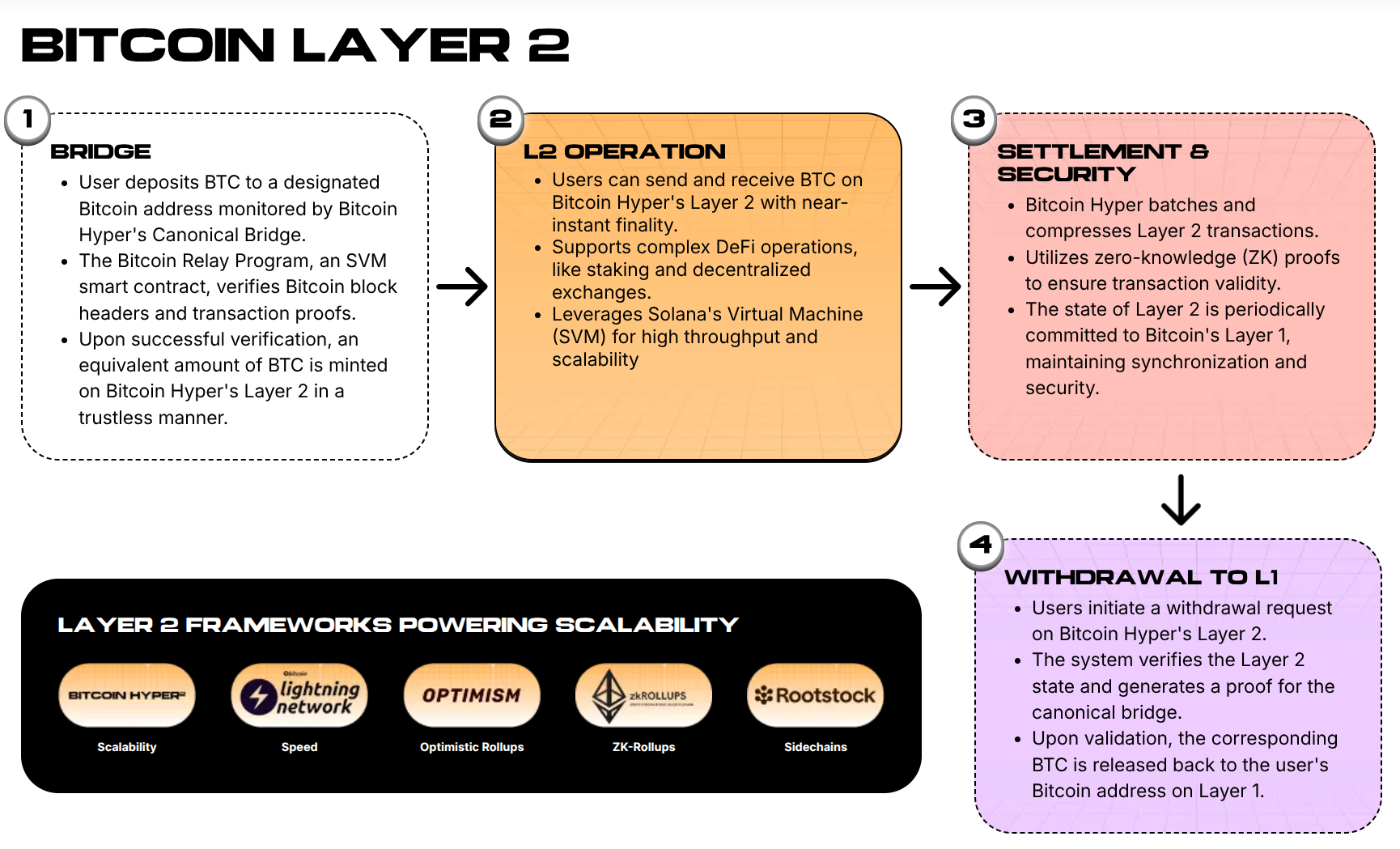

In that broader landscape, Bitcoin Hyper is one of several new attempts to fuse Bitcoin’s settlement guarantees with high-performance execution environments more common in the Solana and Cosmos ecosystems.

If you’re an investor rotating out of exchange balances into longer-term bets, these Layer 2 and sidechain experiments become a leveraged way to express a structurally bullish view on Bitcoin’s future utility, not just its store-of-value role.

How Bitcoin Hyper Aims to Turn Idle $BTC Into Active Capital

Where Bitcoin Hyper leans in is performance. The project positions itself as the fastest Bitcoin Layer 2 to integrate the Solana Virtual Machine (SVM), targeting smart-contract execution that it claims can outpace Solana’s own mainnet.

In practice, that means sub-second confirmation targets and extremely low-latency processing designed for high-frequency DeFi, gaming, and payment flows.

Under the hood, Bitcoin Hyper uses a modular architecture: Bitcoin L1 for settlement and security, and a real-time SVM Layer 2 for execution.

A single sequencer batches transactions and periodically anchors state back to Bitcoin, while a decentralized canonical bridge is planned for moving $BTC in and out.

If you’re a Bitcoin Hyper user, the narrative is straightforward: wrap $BTC, pay near-zero fees, and interact with swaps, lending, staking, NFTs, or games without waiting on ten-minute blocks.

The Bitcoin Hyper presale reflects that pitch. The raise stands at a little over $29M, with tokens priced at $0.013375, positioning $HYPER as a high-beta way to express conviction in Bitcoin’s Layer 2 evolution.

Smart money appears to be tracking the story as well. Whale tracker data reveals a massive purchase worth over $500K in $HYPER tokens happened just a few weeks ago, hinting that larger players are starting to build exposure alongside retail.

⚡ The good news is that you don’t need to be a whale to participate in the token presale. Simply follow the instructions in our Bitcoin Hyper buying guide to learn how to get your share of $HYPER tokens.

If $BTC’s constructive setup holds, that combination of scaling narrative, SVM performance, and early capital inflows could keep attention on Bitcoin Hyper into its next phases of development.

But hurry, because there are a few hours left before the next price increase.