What to Know:

Circle’s climb toward a potential $100 valuation reflects recovering crypto sentiment, renewed USDC activity, and stronger demand for regulated on-chain liquidity exposure.

As risk appetite returns, capital often rotates from infrastructure equities and large caps into earlier-stage narratives with more asymmetric upside potential.

AI-powered content platforms aim to fix Web2 creator pain points: high fees, opaque moderation, fragmented tools, and limited global payment options.

SUBBD Token merges Web3 payments and integrated AI tools so creators can keep more earnings, automate fan engagement, and control content inside a transparent, tokenized ecosystem.

Is Circle’s stock an indicator of a market rebound?

Circle’s march toward a potential $100 valuation is becoming a barometer for how quickly crypto is healing after a brutal risk-off stretch.

As sentiment improves and on-chain activity picks up, equity investors are treating Circle less like a speculative bet and more like an infrastructure proxy for stable, regulated liquidity.

$USDC flows tell the same story. After periods of redemptions and market anxiety, on-chain volumes and stablecoin usage have started to normalize. This signals that traders want transparent, compliant rails to move capital across exchanges and DeFi.

When that kind of infrastructure trade starts working again, it usually means risk appetite is quietly returning underneath.

We’re already seeing that shift at the edges. Flows are rotating from ‘safe beta’ exposure like listed crypto firms and large-cap coins into earlier-stage narratives where the upside is more asymmetric. That’s especially true in sectors where real-world demand already exists.

That’s the lane SUBBD Token ($SUBBD) is trying to occupy. As a Web3 and AI-powered content platform built on Ethereum, SUBBD is pitching itself as a higher-upside play on the same structural forces driving Circle.

Why On-Chain Liquidity Plays Are Back in Focus

Circle’s rise as a de facto equity proxy for on-chain liquidity reflects a simple narrative: if stablecoin volumes and institutional interest keep climbing, the pipes carrying that value should benefit most. That’s why regulated infrastructure names often rally first when the market starts to believe a new crypto cycle is forming.

From there, capital tends to move outward along the risk curve. After stablecoin and Layer 1 exposure comes sector plays like AI-augmented creator tools, fan platforms, and tokenized media. Competing projects in this space are racing to combine AI assistants, subscription rails, and NFT access into a single, streamlined experience for creators.

The problem they’re all solving is familiar. Web2 creator platforms can charge up to 70% in fees, enforce arbitrary bans, fragment AI tools across multiple subscriptions, and limit payment options based on geography.

In that field, SUBBD Token ($SUBBD) is shining as a contender, positioning AI automation and Web3 payments as the upgrade path for creators who want more control and better economics.

Already sold? We’ve got you covered in our ‘How to Buy SUBBD Token’ guide.

How SUBBD Token Turns AI and Web3 Into Creator Infrastructure

Where SUBBD Token leans in hardest is its promise to merge Web3 rails with integrated AI in one stack. Instead of creators juggling multiple apps and tools, SUBBD’s Ethereum-based ecosystem aims to bundle AI personal assistants, voice cloning, token-gated content, and NFT sales under a single token-powered model.

The platform’s AI personal assistant is designed to automate interactions with fans, handle routine questions, and scale engagement without burning out the creator. On top of that, AI voice cloning and full AI influencer creation give studios and solo creators new revenue lines that are native to digital-first audiences, while token-gated access and NFTs turn exclusivity into programmable assets.

Economics are central to the pitch. SUBBD targets platforms that currently take up to 70% in fees, offering crypto-native payments, global access, and on-chain governance instead. The presale has already raised over $1.3M and tokens are priced at $0.0571. See what our experts’ price prediction is for SUBBD Token.

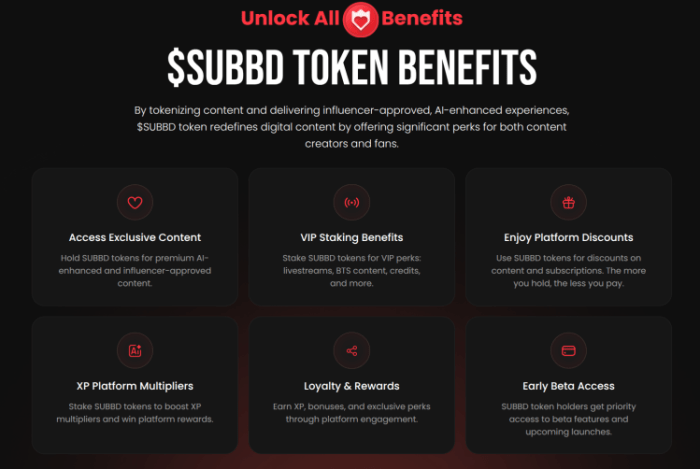

Staking rewards of 20% APY are on offer for early adopters of $SUBBD. But that’s not the only benefit for $SUBBD holders. You also get access to exclusive content, platform multipliers, discounts, and a whole heap more.

If you believe the next leg of crypto growth will be driven by real products rather than pure speculation, SUBBD is framing itself as an infrastructure bet on tokenized content, AI-driven engagement, and user-owned economics. If you’re rotating out along the risk curve as Circle grinds higher, it’s one of the better plays.

Join the $SUBBD presale today.

Remember, this isn’t intended as financial advice, and you should always do your own research before investing.

Authored by Aaron Walker , NewsBTC — https://www.newsbtc.com/news/circle-stock–eyes-100-as-crypto-sentiment-rebounds-traders-choose-subbd