The latest U.S. consumer spending snapshot shows Americans continued to spend cautiously in September, reinforcing expectations that the Federal Reserve is almost certain to deliver a rate cut at next week’s policy meeting.

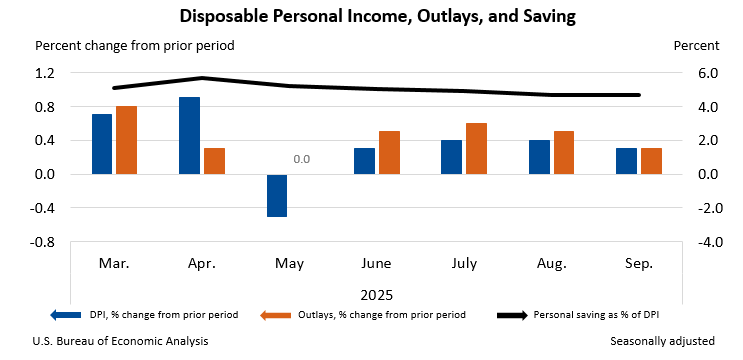

According to figures released by the Bureau of Economic Analysis, personal income rose by $94.5 billion or 0.4 percent month-over-month. After taxes, disposable personal income increased by 0.3 percent, giving households slightly more room to spend. Personal consumption expenditures (PCE) – the government’s preferred inflation tracker – increased by $65.1 billion, also 0.3 percent.

Key Takeaways

U.S. incomes and spending rose modestly in September, with PCE inflation at 2.8 percent year-over-year.

Jobless claims fell sharply, strengthening expectations of a near-certain rate cut next week.

Crypto investors are watching closely, as easier policy historically boosts Bitcoin and broader risk-asset flows.

What Is PCE and Why It Matters?

The PCE price index is the Federal Reserve’s main inflation gauge because it tracks shifting consumer behavior better than standard measures such as CPI. It captures what people actually buy – including substitutions when prices change – making it a cleaner view of real inflation pressure.

In September, headline PCE inflation rose 0.3 percent from the prior month, while core PCE, which strips out food and energy, increased 0.2 percent, within expectations. On a yearly basis, both headline and core PCE ran at 2.8 percent – close enough to the Fed’s 2 percent goal to strengthen the case for policy easing in December.

Consumers Still Spending, But Carefully

Most of the spending momentum came from services, which accounted for $63 billion of the total increase, while goods consumption added just $2.1 billion. Personal saving stood at $1.09 trillion, translating to a 4.7 percent saving rate, indicating households remain selective about spending even as incomes rise.

Real purchasing power was noticeably softer. Real disposable income grew only 0.1 percent, and real consumer spending stagnated – a sign that inflation is still eroding incremental wage gains.

Jobless Claims Strengthen the Outlook for a Fed Cut

Fresh labor-market data added more fuel to rate-cut speculation. Weekly initial jobless claims dropped by 27,000 to 191,000 – their lowest level in months. Continuing claims declined to 1.939 million, while planned corporate layoffs plunged 53 percent in November.

A stable labor market paired with inflation trending toward target gives policymakers political and economic room to loosen monetary conditions. Markets are now pricing next week’s rate cut as effectively a done deal.

Risk Assets Watching Closely – From Stocks to Bitcoin

Equity markets and risk-on assets like Bitcoin typically flourish under lower interest rates, as cheaper borrowing costs push liquidity toward growth and speculative sectors.

Crypto markets in particular have been highly sensitive to monetary policy this cycle. Bitcoin has already seen renewed institutional attention as expectations for easing tightened. If the Fed confirms a cut next week, analysts believe crypto could benefit from new capital flows, softer dollar strength, and renewed appetite for alternative assets.

That said, the muted growth in real spending and income suggests the economy is not running hot, meaning risk assets may face uneven rallies unless liquidity injections are substantial.

Americans are earning and spending a bit more, prices are rising slowly, inflation is cooling toward the Fed’s target, and this increases the likelihood of rate cuts — which could benefit markets like Bitcoin.

Data Revision Coming Before Year End

The BEA will revise July through September income and spending data with the first estimate of Q3 GDP on December 23. Updated PCE and income statistics will be available that day, though a separate September report will not be issued.