Chainlink edges lower for the second consecutive day amid weakening sentiment in the broader crypto market.

Chainlink’s GLNK ETF extends inflows for three straight days, signaling institutional interest.

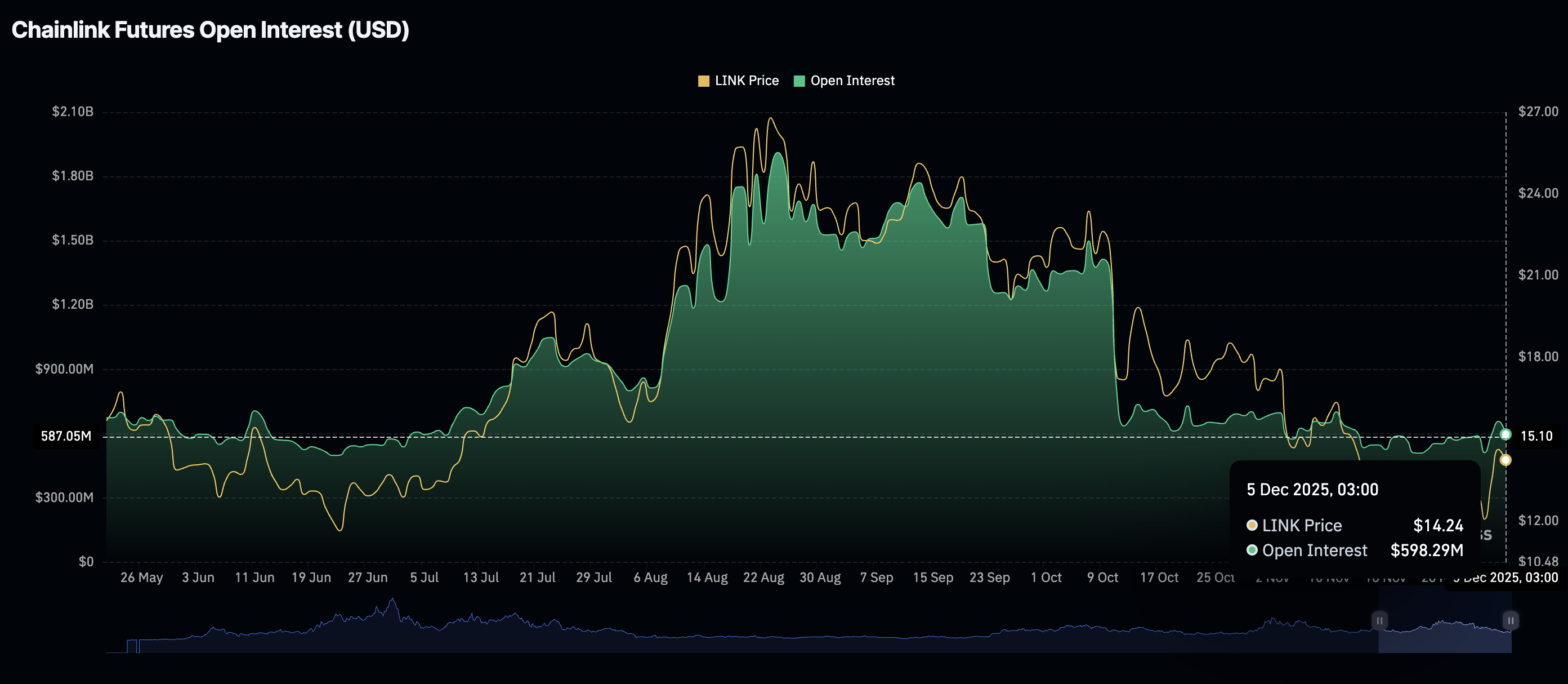

Retail demand for Chainlink derivatives wobbles, with the Open Interest dropping to $598 million.

Chainlink (LINK) is exhibiting weakness, trading at around $13.84 at the time of writing on Friday. The decline marks the second consecutive day under increasing selling pressure. If bulls fail to reclaim key levels and flip them into support, a 16% decline to $12.76 would be on the cards.

Chainlink ETF posts mild inflows post debut

Chainlink spot Exchange Traded Fund (ETH), operated by Grayscale, launched in the United States on Tuesday. On its first day of trading, GNLK recorded $37 million in inflows, and on Wednesday, $3.84 million.

According to SoSoValue data, the LINK ETF extended its positive streak, with $4.46 million in inflows on Thursday. So far, the cumulative inflow volume stands at approximately $45 million, and net assets at $72 million. With time, steady ETF inflows could shift sentiment positively and support price increases.

Meanwhile, demand for Chainlink derivatives has faltered, with futures Open Interest (OI) falling to $598 million on Friday, down from $658 million on the previous day.

After the October 10 flash crash, in which over $19 billion in crypto derivatives was liquidated in a single day, retail interest has remained significantly suppressed.

OI, representing the notional value of outstanding futures contracts, averaged $1.36 billion on October 10 and had reached a record high of almost $2 billion on August 24.

Technical outlook: LINK hovers under pressure as downside risks escalate

Chainlink is trading at $13.82 at the time of writing on Friday, weighed down by the falling 50-day Exponential Moving Average (EMA) at $15.23, the 100-day EMA at $16.85 and the 200-day EMA at $17.45, respectively, reinforcing a bearish bias. The Moving Average Convergence Divergence (MACD) line stands above the signal line on the daily chart, while the positive histogram bars are contracting, suggesting momentum is cooling.

The Relative Strength Index (RSI) at 49 (neutral) eases from recent highs on the same chart. Moreover, the descending trend line from $27.87 caps the upside, with resistance at $18.35.

Parabolic SAR has flipped below price, with the latest marker at $10.35, hinting at tentative stabilization. A rising trend line from $10.93 underpins the market, offering support near $14.30. A daily close above the 50-day EMA would open the path toward the 100-day EMA, while failure to reclaim this support could leave LINK vulnerable to renewed pressure. Momentum would strengthen if MACD expansion resumes and RSI pushes above 50.