Bitcoin is trading around $91,000 after a minor dip earlier today, and uncertainty continues to dominate sentiment. The market sits at a crossroads: a small but vocal group of analysts argues that the recent correction served as a healthy reset before a continuation of the broader uptrend, while the majority of traders believe the first leg of a new bear market is already underway. With price action still showing hesitation, the debate grows louder by the day.

According to top analyst Darkfost, a critical threshold will help determine Bitcoin’s next major direction. He highlights the importance of the Realized Price of the youngest Long-Term Holder (LTH) band, which currently sits at $96,956. This metric marks the transition point between short-term and long-term holders and is viewed as a psychological and structural barrier for market stability.

Reclaiming this level would push these young LTHs back into a comfortable profit zone, reducing their incentive to sell and helping to restore confidence across the market. Until Bitcoin closes decisively above $97K, Darkfost warns that caution is warranted, as volatility remains high and the risk of further downside persists.

Why the $97K Threshold Matters for Bitcoin’s Next Major Move

Darkfost emphasizes that the $96,956–$97,000 zone plays a crucial role in shaping Bitcoin’s next phase. This level represents the Realized Price of the youngest Long-Term Holder band, meaning it reflects the average cost basis of investors who recently transitioned from short-term to long-term holding behavior. When Bitcoin trades below this threshold, these holders sit at an unrealized loss, increasing the likelihood of panic selling and adding pressure to the market.

Breaking above this zone would flip sentiment for this group almost immediately. Darkfost explains that reclaiming $97K would place these investors back into a comfortable profit position, restoring their confidence and expectations of potential gains. Once this psychological weight lifts, these holders typically choose to keep accumulating rather than selling, which naturally brings more stability to the market.

However, he cautions that Bitcoin’s failure to close above $97,000 keeps the risk tilted to the downside. As long as the price remains below this band, the market stays vulnerable, and volatility may continue.

Even if BTC successfully reclaims $97K, Darkfost reminds that this is only the first step. The market would still need stronger structural confirmation—such as reclaiming key moving averages and rebuilding demand—to validate a true bullish reversal that could eventually lead to a new all-time high.

BTC Weekly Structure Shows Early Signs of Stabilization

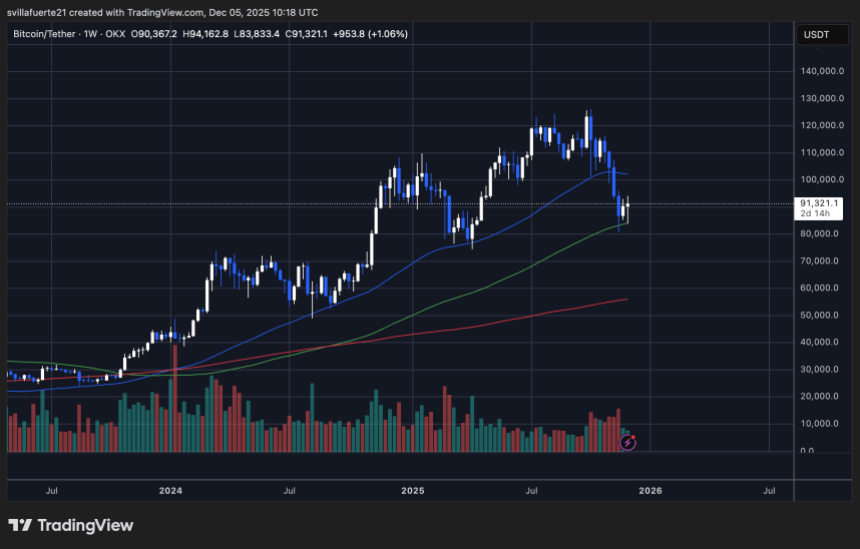

Bitcoin’s weekly chart reflects a market trying to stabilize after a sharp multi-week correction that dragged the price from above $115,000 down toward the mid-$80,000s. The latest weekly candle shows a firm rebound from the 100-week moving average (green line), now acting as dynamic support around the $84,000–$86,000 region. This level historically attracts long-term buyers, and the strong wick rejection confirms renewed demand.

BTC is currently trading near $91,300, sitting just below the 50-week moving average (blue line), which now acts as resistance. A clean reclaim of this moving average—currently positioned around $95K–$97K—would significantly improve the technical outlook and align with on-chain signals calling for a recovery. Until then, the trend remains neutral-to-bearish on higher timeframes.

Volume during the recent bounce stands out, showing one of the strongest buying reactions since early 2025. This suggests that long-term holders and institutional buyers may be stepping in as the price approaches key value zones.

However, Bitcoin is not out of danger. Failures to break above $97K would leave the structure vulnerable to another leg down, potentially retesting $86K or even deeper liquidity pockets around $80K.

Featured image from ChatGPT, chart from TradingView.com