Bitcoin slipped below key levels after a sharp rejection at $94,000, raising fresh questions about bullish momentum as traders evaluate whether the latest dip signals weakness or opportunity.

Despite the recent pullback, market analysts note that Bitcoin remains within a broader uptrend, with strong buyer interest emerging near the lower support zones. As volatility rises and the crypto sector experiences renewed uncertainty, investors are closely monitoring whether BTC can stabilize above $90,000 and maintain its bullish trajectory.

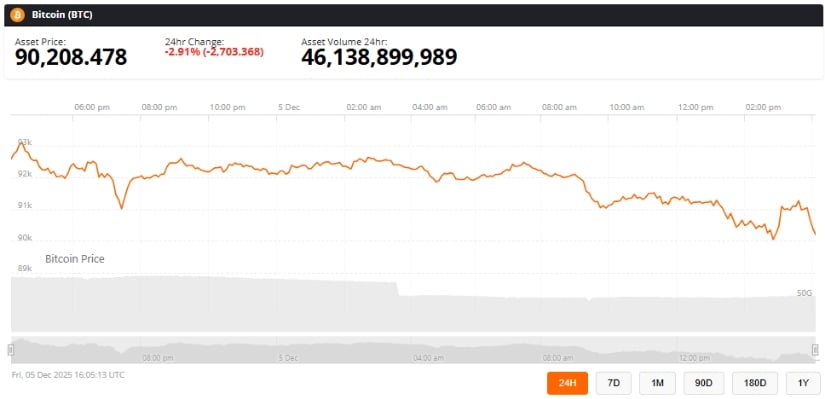

Bitcoin Price Today

Bitcoin continues to trade under pressure after failing to reclaim the $94,000 resistance zone earlier this week. According to the latest market data, Bitcoin (BTC) is priced around $90,208, down nearly 3% over the last 24 hours, with a daily trading volume exceeding $46 billion.

Bitcoin was trading at around 90,208, down 2.91 in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

This decline reflects broader weakness across the crypto market, raising questions about whether the latest pullback is simply part of a healthy consolidation or the beginning of a deeper correction. Many traders are closely watching BTC market cap, liquidity behavior, and ETF inflow trends to understand Bitcoin’s next direction.

BTC Price Rejected at $94K

On X, trader @TedPillows highlighted that Bitcoin has been “struggling to reclaim the $94,000 level,” adding that the market structure suggests a deeper move before any meaningful recovery.

Bitcoin struggles below $94K, eyeing a potential retest of $88K–$89K support before attempting another bullish bounce. Source: @TedPillows via X

He noted: “Maybe a retest of the $88,000–$89,000 support zone before another bounceback could happen.”

This view aligns with current readings from the BTC liquidation heatmap, which show liquidity pools stacked just below the current price—making a sweep toward the high-$80K range more likely. Traders describe the move as a healthy reset rather than the start of a bitcoin crash, emphasizing that large pullbacks remain common during extended bull phases.

Market Sentiment Remains Split

Market conversation across X and TradingView shows mixed expectations. Optimists believe profit-taking is temporary and argue that Bitcoin still has room to move higher, especially as institutional exposure grows through instruments like the BlackRock Bitcoin ETF, Fidelity Bitcoin ETF, and Grayscale Bitcoin Trust.

Others remain cautious, pointing to the absence of major macro catalysts and slowing momentum indicators such as the Bitcoin RSI. Skeptics note that consolidation near resistance is typical and may delay any immediate attempt toward the psychological $100,000 level.

Long-Term Outlook: All-Time High Expectations

Well-followed analyst @ali_charts shared a long-term Bitcoin chart covering 2014 to 2026, highlighting historical “Buy” and “Sell” signals. The model suggests potential upside toward $140,000–$180,000 by mid-2026, although projected peaks could occur soon after.

Bitcoin setup hints at a possible run toward new all-time highs by January 2026, but market caution remains. Source: @ali_charts via X

Ali asked his audience: “Does this setup look like Bitcoin will hit new all-time highs by January 2026?”

While some traders believe a new Bitcoin all-time high is possible early next year, others argue that such levels usually appear after halving cycles mature, suggesting a broader rally may not accelerate until later in 2026. Discussions also referenced past predictions—including higher targets—that traders debated throughout the thread.

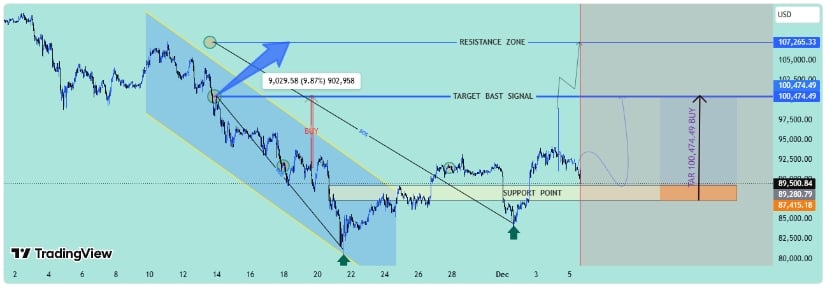

Technical Analysis: Bulls Defend the $90K–$88K Zone

Technical analysis continues to show strong support clustering around $90,243–$89,080. TradingView analyst MrStellanSight describes this region as a key demand zone where buyers often step in during trending markets.

Bitcoin finds strong support at $89K–$90K, setting up potential bullish moves toward $95.5K and $98K resistance levels.Source: MrStellanSight on TradingView

He explained: “Price often bounces from this area, making it a good spot for bullish continuation.”

Within the current ascending channel, small pullbacks are considered normal. After retesting support, BTC typically attempts another move toward higher resistance levels. His chart outlines the following targets:

First resistance: $95,567–$95,628

Second resistance: $98,000–$98,933

While these zones could cap the next rally, the overall outlook remains constructive as long as Bitcoin maintains the $88,000 support band. Long-term investors watching Bitcoin price prediction, bitcoin future, and broader adoption trends remain focused on whether BTC can hold this critical area before attempting higher levels.

Final Thoughts

Bitcoin’s rejection at $94K highlights the market’s current caution, but the strong support near $90K suggests bulls are ready to defend key levels. Traders and investors should watch these zones closely, as a sustained hold could pave the way for the next upward leg.

Even with short-term volatility, the combination of institutional activity, ETF inflows, and historical market cycles points to continued long-term optimism. As always, monitoring key indicators such as BTC liquidation heatmaps, resistance targets, and support levels will be essential for assessing whether Bitcoin can resume its bullish trajectory.