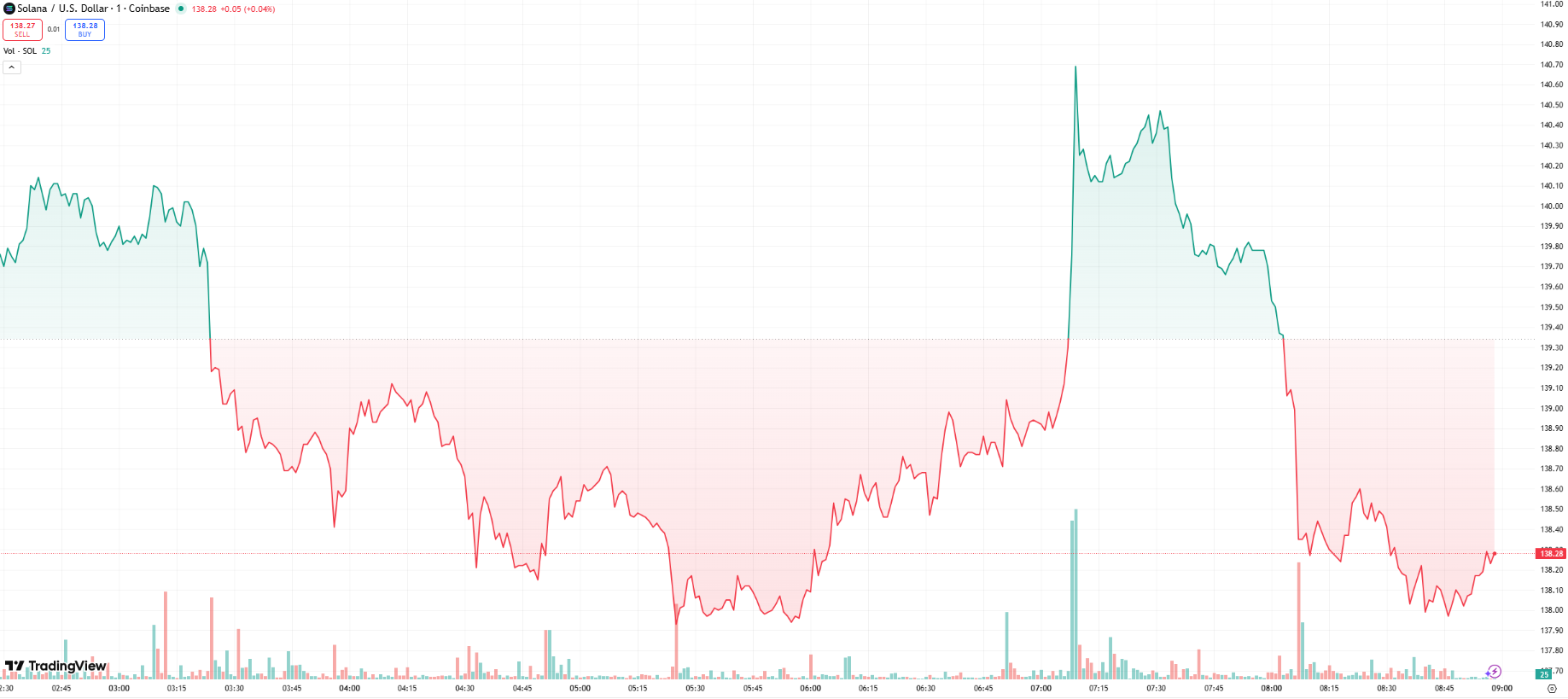

Solana price prediction is once again heating up as SOL climbs back to $138.05 after a volatile dip, regaining critical support amid fresh institutional inflows.

Despite a -3.63% dip in the last 24 hours, traders remain focused on the ETF inflow surge, technical reversal signals, and continued DEX activity.

But while Solana recovers, early-stage investors are moving fast into Bitcoin Hyper, a new Bitcoin Layer 2 project that just passed $29M raised in presale with under 10 hours until the next price jump.

Solana Price Recovers $140 Zone After ETF Catalyst

After falling to $123, SOL rebounded sharply, following a broader crypto rally. The move came just as Solana ETF products attracted a net $45.77 million on Tuesday alone, pushing cumulative inflows to $650 million.

That erased the outflow from the previous session and marked a renewed vote of confidence from institutional players.

Behind this bounce was a shift in market sentiment: Vanguard and Bank of America both moved in favor of crypto ETFs, which helped trigger a rally in major altcoins. Solana, in particular, held its spot as a top gainer among the top 10 by market cap.

The Solana price prediction has turned cautiously bullish as technicals signal a possible double-bottom pattern, with a neckline around $145 and next resistance near $170.

If SOL clears the 50-DMA and maintains momentum, some analysts see a potential run toward $200. But caution remains – it’s still trading 43% below its September high.

Key Technicals: RSI, MACD, and the $145 Breakout Test

SOL is currently trading near $138, supported by a 24-hour volume of $4.05 billion and a market cap of $77.29 billion. Technical analysts are closely watching several key indicators. The Relative Strength Index (RSI) stands at 48.20, signaling a gradual recovery while remaining in neutral territory.

The MACD shows an early bullish crossover, although momentum confirmation is still pending. On the chart, a strong support zone has formed between $123 and $126, where buyers have consistently stepped in.

The critical resistance level sits near $145, which marks the neckline of a developing double-bottom pattern.

A confirmed breakout above this zone could open the path toward $170, with a potential move to $200 if momentum accelerates. However, if the $145 resistance holds, SOL may retreat toward the $130 range for another test.

Bitcoin Hyper: $29M Raised as Investors Chase Layer 2 Breakout

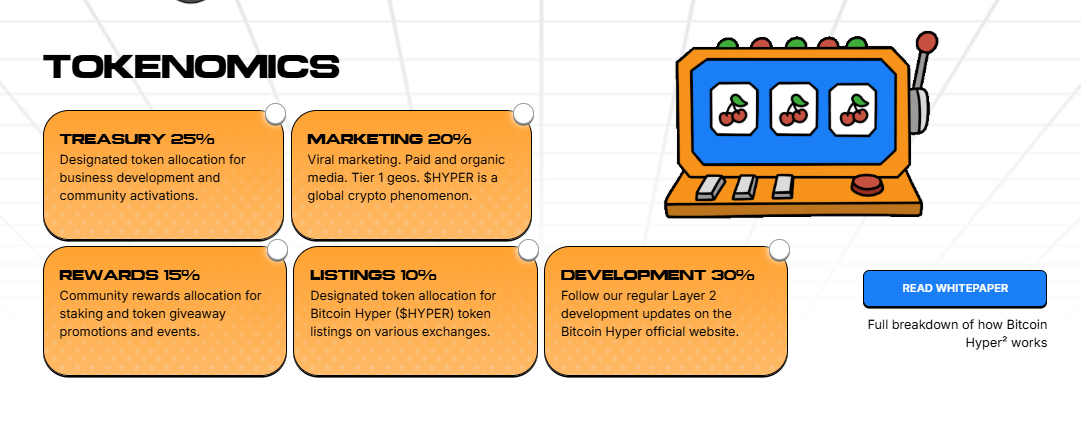

While Solana price prediction continues to recover, Bitcoin Hyper is capturing serious early-stage attention. The Layer 2 Bitcoin chain has already raised $29,032,602, with just under $300K left before the next price hike.

$HYPER, priced at $0.013375, offers:

A Solana Virtual Machine (SVM) architecture for speed and dev compatibility

A canonical bridge that wraps BTC for DeFi use cases

Up to 40% staking rewards for presale investors

Total supply of 635M tokens, with over 635M already sold

The project solves Bitcoin’s biggest limitations – low TPS and lack of smart contract support – by bringing Solana’s infrastructure to Bitcoin’s security layer. This lets $HYPER run dApps, payments, games, and DeFi tools directly within a BTC-secured environment.

Security audits by Coinsult and Spywolf, plus a massive $2T market opportunity, have added to the buzz. And with under 10 hours left until the next stage, momentum is building fast.

Analysts Say $HYPER Could Rival Solana’s Use Case in 2025

With Solana now a base layer for ETFs, tokenized real-world assets, and stablecoins, Bitcoin Hyper is aiming to serve the same high-value use cases – but for the Bitcoin ecosystem.

Using Solana’s tech stack and adding BTC compatibility via its bridge, $HYPER could unlock a wave of applications previously impossible on Bitcoin.

For early buyers, this combination of timing, traction, and discounted entry has made it one of the most talked-about infrastructure plays this month.