Mask Network (MASK) is a blockchain-based platform designed to bridge Web2 and Web3 by enabling encrypted interactions on popular social media platforms. Launched in July 2020, Mask Network allows users to send encrypted messages, transfer cryptocurrencies , and access decentralized applications (dApps) directly within traditional social media ecosystems like Twitter and Facebook. The MASK token serves as the platform’s native utility token, powering governance, transactions, and rewards.

Core Features of Mask Network

Notably, Mask Network integrates privacy and decentralization into mainstream internet usage. Its encryption feature ensures that only the intended recipients can view messages, enhancing user privacy. Additionally, the platform supports seamless peer-to-peer cryptocurrency transactions, enabling tipping, donations, and payments directly on social media. Mask Network also connects users to the world of decentralized finance ( DeFi ) by providing access to token swaps, NFTs, and crowdfunding campaigns without leaving social platforms.

Market Position and Potential

Furthermore, MASK has gained significant traction within the cryptocurrency community due to its unique approach to blending Web2 accessibility with Web3 innovation. As of now, the token is listed on major exchanges, including Binance and Coinbase , enhancing its liquidity and adoption.

More so, the project aligns with the growing demand for decentralized, privacy-centric solutions, making it a promising contender in the blockchain ecosystem. Mask Network’s focus on usability and integration into everyday platforms positions it as a key player in bridging traditional and decentralized digital environments.

Mask Network (MASK) Technical Price Analysis

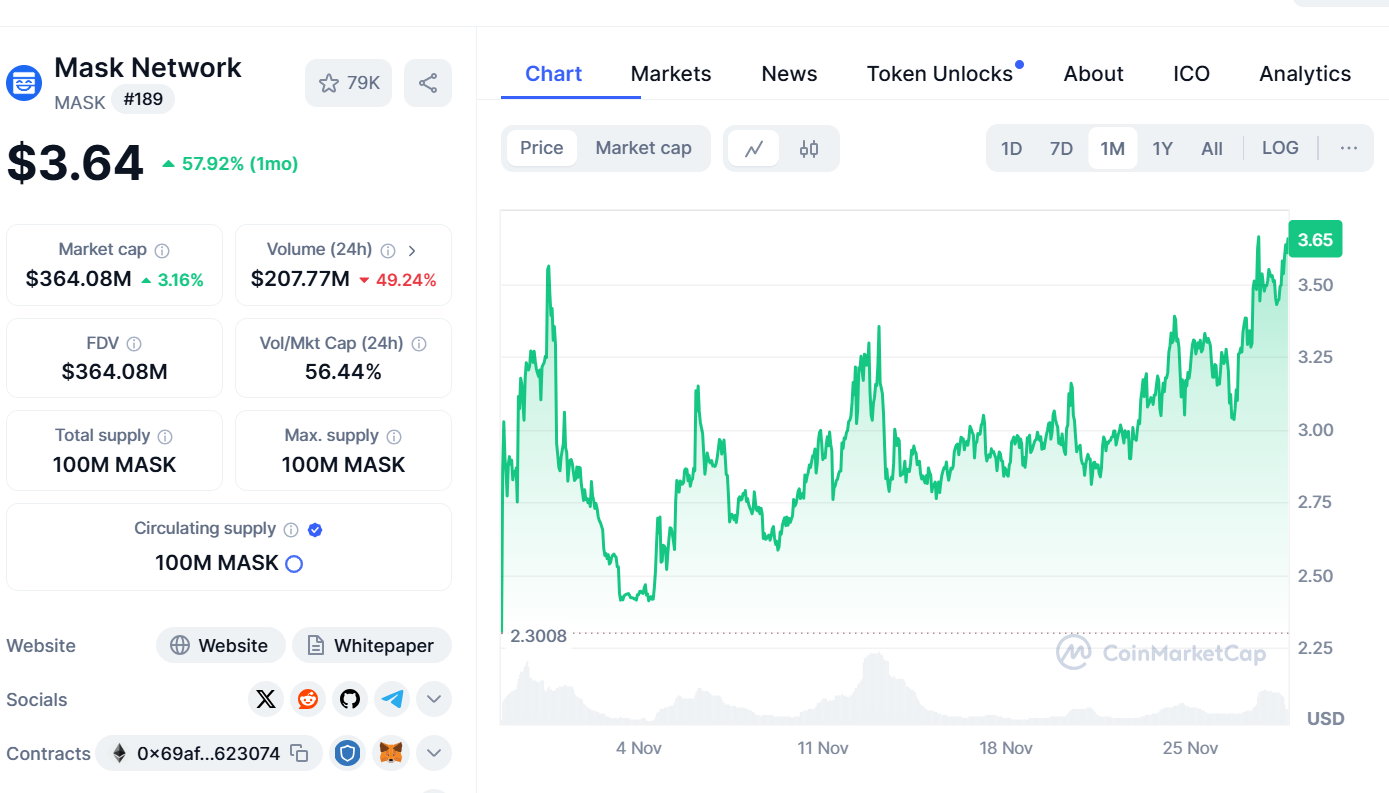

Notably, MASK saw a 6.10% price increase in the past 24 hours, trading at $2.94. Market cap stands at $293.68M, with 24-hour trading volume dropping by 31.25% to $97.28M, indicating reduced activity despite the price rise. A steady uptrend shows bullish sentiment, with resistance near $2.95 and support around $2.77.Volume changes might confirm a breakout momentum.

Conversely, over the past 7 days, MASK has gained 9.99%, rising from a low of $2.67 to its current $2.94. A mid-week peak around $3.50 saw profit-taking, leading to a pullback. The market cap increased by 5.98%, signaling steady interest. Trading volume dropped 31.21%, indicating reduced momentum. The price shows strong support near $2.75, with resistance at $3.25, suggesting consolidation before the next move.

Similarly, in the past month, MASK surged 57%, climbing from $2.25 to $2.94. A peak near $3.50 indicated strong bullish sentiment before a pullback. Support was evident around $2.50, with resistance at $3.25. Trading volume dropped by 30.97%, signaling consolidation after significant upward momentum. The current price trend suggests steady growth, with the potential for another test of the $3.25 resistance.

Mask Network (MASK) 1 month Price Chart (Source: Coinmarketcap )

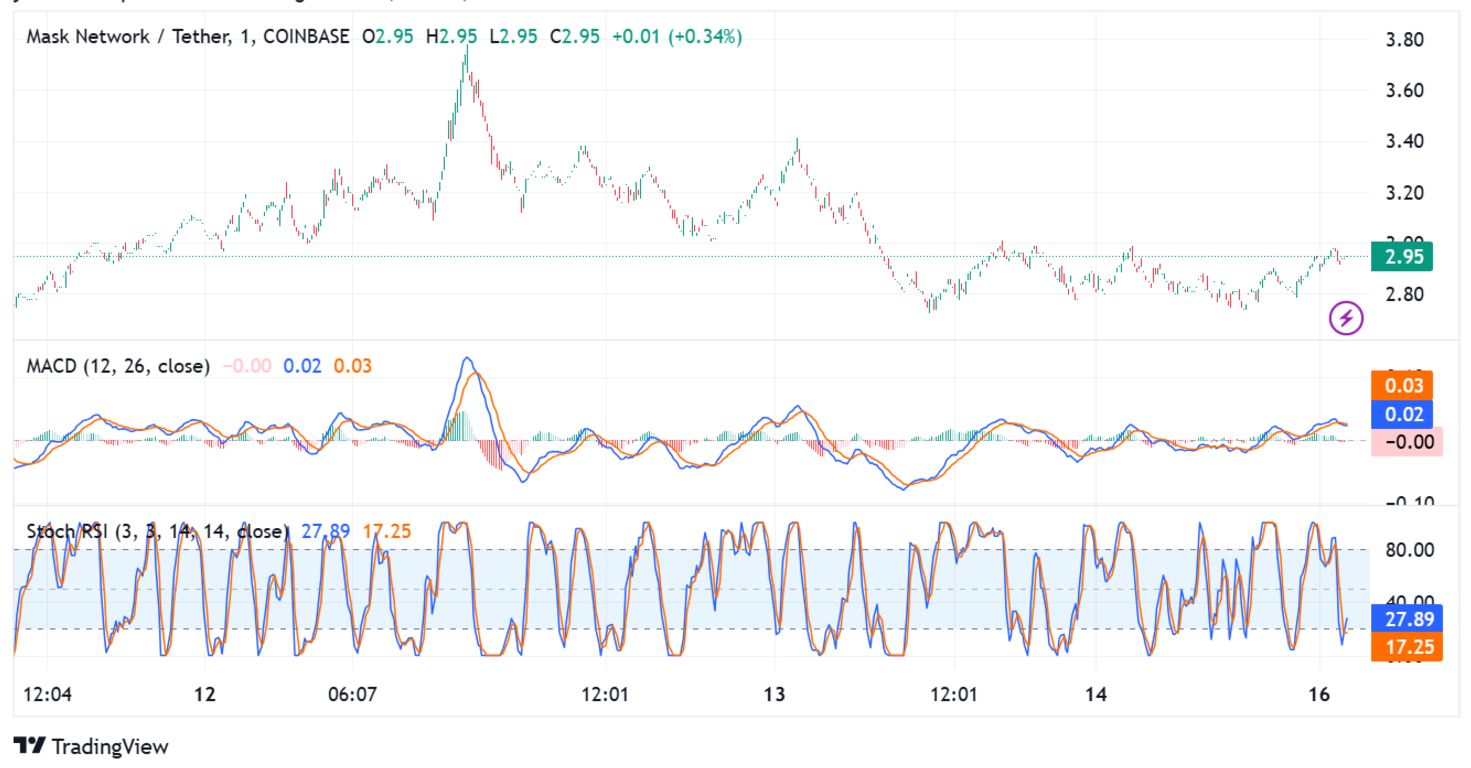

For technical price indicators, the Stochastic RSI for MASK shows a reading of 27.89, indicating oversold conditions. The value crossing the 20 thresholds could suggest potential bullish momentum. However, the lack of sharp upward movement implies weak buying pressure. A reversal is likely if the stochastic lines cross and maintain an upward trajectory.

Additionally, the MACD shows the signal line slightly above the MACD line, indicating mild bearish momentum. The histogram is near neutral, suggesting a consolidation phase. A bullish crossover, where the MACD line moves above the signal line, could signal a potential upward breakout if supported by volume.

Hence, both indicators suggest consolidation, with MACD leaning toward neutral momentum and Stochastic RSI pointing to oversold conditions. While Stochastic RSI hints at potential bullish movement, the MACD’s lack of a strong crossover aligns with muted momentum. Together, they highlight a wait-and-see scenario for traders.

Mask Network (MASK) 24hr Price Chart (Source: Trading View )

Mask Network (MASK) Price Prediction

Mask Network (MASK) Price Prediction 2024-2030

| Year | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2024 | 2.18 | 2.97 | 3.81 |

| 2025 | 4.57 | 4.74 | 5.96 |

| 2026 | 6.57 | 7.67 | 7.93 |

| 2027 | 9.48 | 9.81 | 11.64 |

| 2028 | 13.77 | 14.26 | 16.95 |

| 2029 | 19.94 | 20.51 | 23.96 |

| 2030 | 30.57 | 31.59 | 34.84 |

Mask Network Price Prediction 2024

Mask Network price is forecast to reach the lowest possible level of $2.18 in 2024. As per research, MASK price could reach a maximum level of $3.81 with an average forecast price of $2.97.

Mask Network Price Prediction 2025

The price of Mask Network is predicted to reach a minimum value of $4.57 in 2025. The Mask Network price could reach a maximum value of $5.66 with the average trading price of $4.74 throughout 2025.

Mask Network Price Prediction 2026

Mask Network price is forecast to reach the lowest possible level of $6.57 in 2026. As per our findings, the MASK price could reach the maximum possible level of $7.93 with the average forecast price of $6.76.

Mask Network Price Prediction 2027

According to our deep technical analysis of past price data of MASK, In 2027 the price of Mask Network is forecasted to be at around a minimum value of $9.48. The Mask Network price value can reach a maximum of $11.64 with the average trading value of $9.81 in USD.

Mask Network Price Prediction 2028

As per the forecast price and technical analysis, In 2028 the price of Mask Network is predicted to reach a minimum level of $13.77. The MASK price can reach a maximum level of $16.95 with an average trading price of $14.26.

Mask Network Price Prediction 2029

The price of 1 Mask Network is expected to reach a minimum level of $19.94 in 2029. The MASK price can reach a maximum level of $23.96 with an average price of $20.51 throughout 2029.

Mask Network Price Prediction 2030

The price of Mask Network is predicted to reach a minimum level of $30.57 in 2030. The Mask Network price can reach a maximum level of $34.84 with an average price of $31.59 throughout 2030.