KEY TAKEAWAYS

The Succinct Mainnet went live on Aug.5.

Its native token PROVE, was airdropped

How will the PROVE price fare after launch?

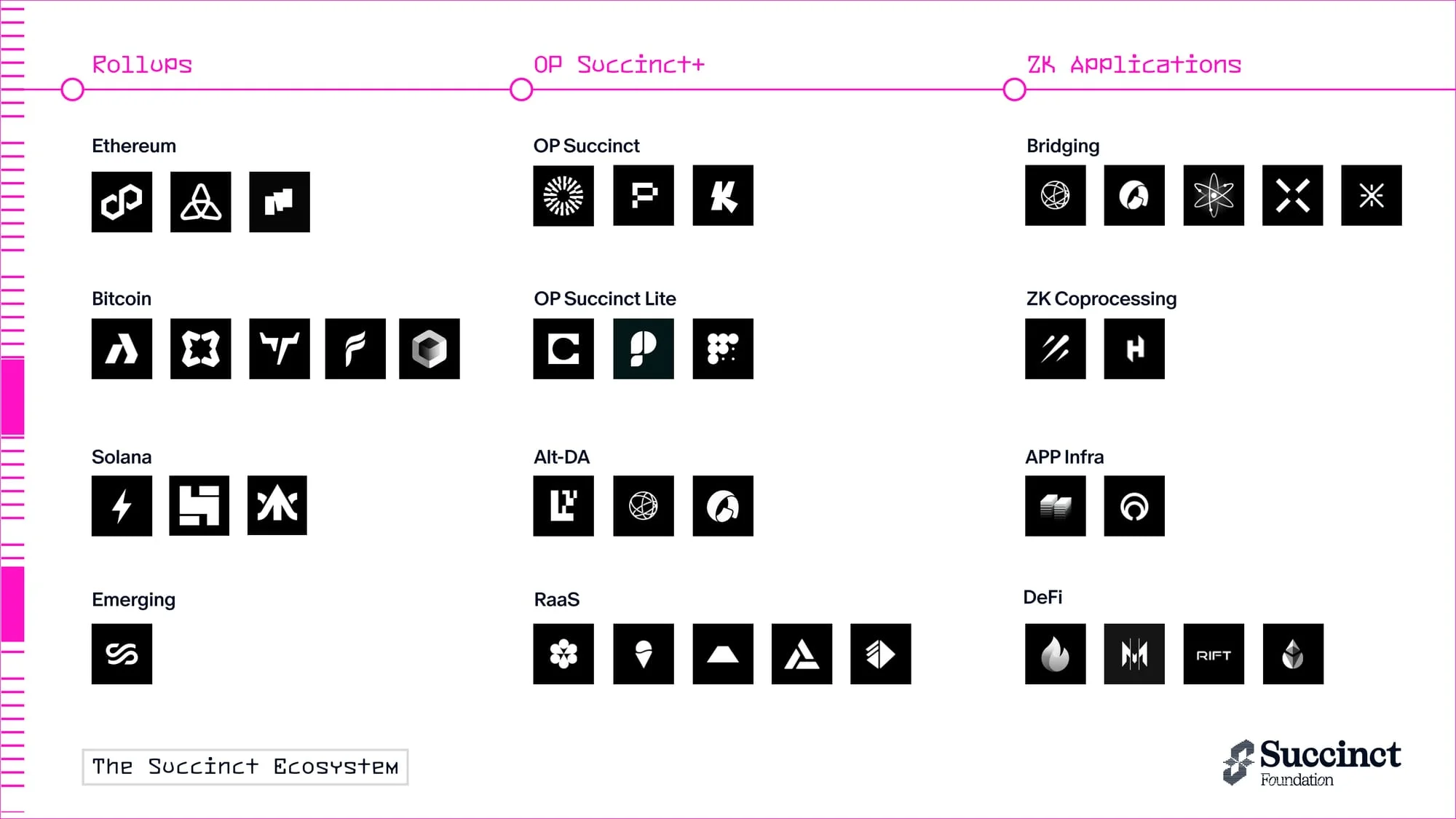

Succinct officially launched its mainnet on Aug. 5, marking a major step forward for decentralized zero-knowledge (ZK) infrastructure.

The launch introduced a network of distributed provers powered by its native PROVE token.

ZK-proofs are already a key part of privacy-focused cryptocurrencies like Zcash and Monero, as well as Ethereum Layer-2s such as zkSync and Starknet.

At the heart of Succinct’s new ecosystem is the PROVE token, which rolled out via an airdrop that sparked both excitement and debate across the community.

Succinct Mainnet

In contrast to traditional, centralized systems, Succinct’s mainnet distributes the task of generating ZK proofs across multiple independent provers.

These proofs allow parties to verify data or transactions without revealing the underlying information.

At the core of the ecosystem is the PROVE token, which compensates provers for their work and acts as a security mechanism.

Participants must stake PROVE tokens to operate as provers, creating a financial disincentive for malicious behavior, similar to how Chainlink secures its oracle network.

With Ethereum and other major chains increasingly adopting ZK tech for scalability and fast finality—as signaled in July—the role of decentralized prover networks like Succinct’s is expected to become even more critical.

Community Reaction

The Succinct airdrop generated plenty of buzz, and for some, serious gains.

A few lucky recipients walked away with six-figure payouts, while others who bought PROVE after its Binance debut also saw major upside, especially following the token’s listing on Upbit.

But the celebration wasn’t universal.

Early testnet participants voiced frustration over being excluded from the airdrop criteria altogether.

Many felt overlooked, especially as badge holders and Binance Alpha users reportedly received a larger share of the token supply.

Adding to the tension, the unclaimed portion of the airdrop wasn’t redirected to testnet users but was instead allocated to staking incentives, sparking even more backlash from those who contributed to early development and testing.

So while the PROVE token’s price resilience post-launch has pleased investors, testnet users view their exclusion as a snub in an otherwise successful rollout.

PROVE Price Analysis

PROVE has barely any price history to conduct a technical analysis, so the crypto predictions should be taken with a grain of salt.

Considering that the price broke out from an ascending parallel channel, this is a sign of impulsive upward movement.

After the breakout, PROVE created a symmetrical triangle. While this is a neutral pattern, it usually leads to trend continuation.

Therefore, since it transpires after an upward movement, a breakout from it is likely, taking the price to $1.56.

On the other hand, a breakdown from the triangle will invalidate this PROVE prediction and could take the price to the channel’s midline at $1.20.

Succinct Airdrop

PROVE has shown resilience post-launch, triggering a notable upward trend.

However, its long-term price performance will depend heavily on adoption, market sentiment, and technical development.

As Ethereum and others move deeper into ZK rollups, PROVE’s role in the prover network market could grow substantially.