In the evolving landscape of Web3 infrastructure, efficiency, security, and scalability often compete for priority. One of the most promising approaches to balancing these goals lies in zero-knowledge proofs (ZKPs)—a cryptographic technique that allows one party to prove the validity of a statement without revealing the underlying information. This is where Succinct, the team behind the PROVE token, comes into play.

Succinct’s mission is to create a universal verification layer for blockchains, making it possible to validate transactions and data across networks in a trustless, lightweight, and scalable manner. By building open-source ZK technology that developers can integrate directly into their projects, Succinct aims to remove the inefficiencies of current interoperability models and set the stage for a new era of decentralized trust.

With PROVE trading at $0.9762 as of August 8, 2025—following a 24-hour decline of 27.5%—the project holds a market capitalization of $189.55 million and a fully diluted valuation approaching $972.07 million. Despite recent volatility, the underlying fundamentals and long-term vision suggest that Succinct could play a central role in blockchain interoperability if adoption accelerates over the next five years.

What is Succinct?

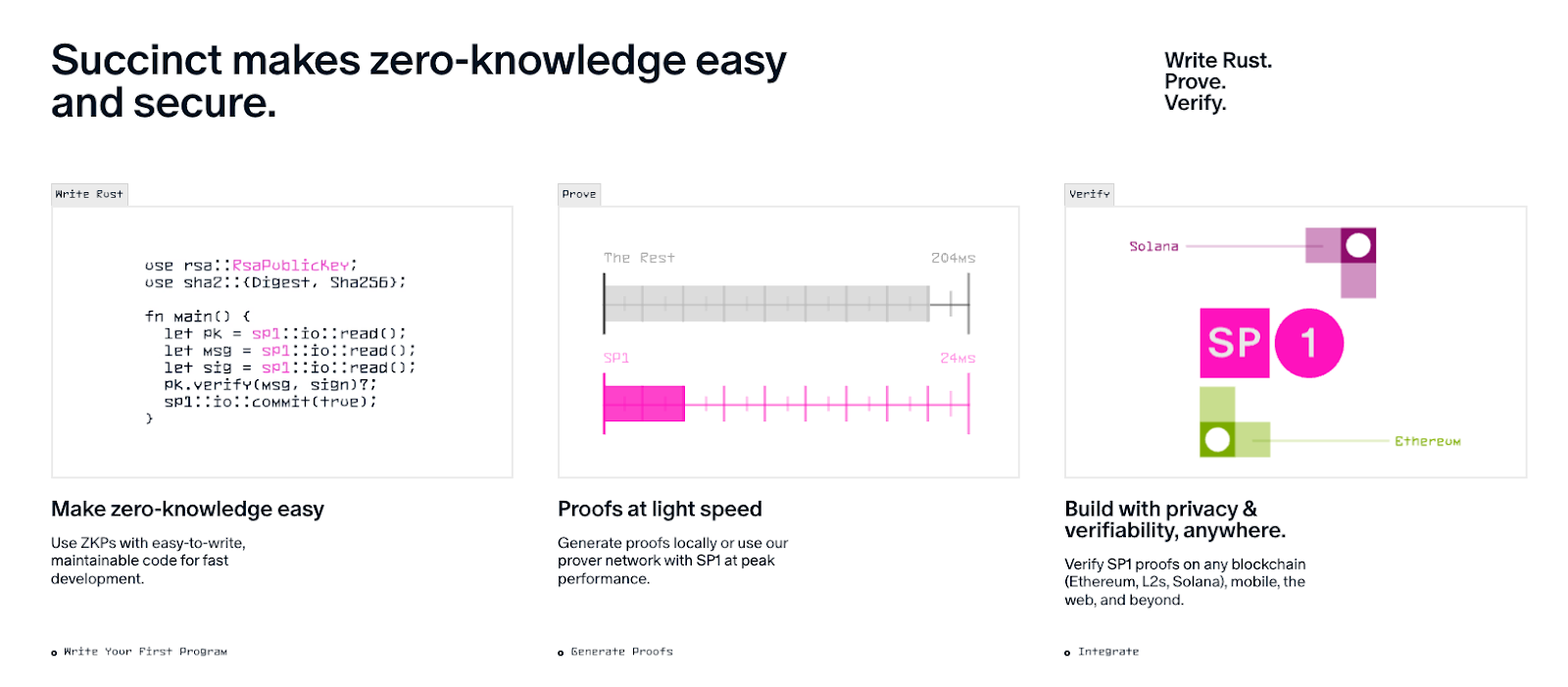

At its core, Succinct is a research-driven development team focused on the implementation of ZKPs to create succinct, verifiable proofs for blockchain data. The name “Succinct” refers to the project’s ability to condense large amounts of computation or historical blockchain data into a compact cryptographic proof, which can then be verified efficiently by other chains or applications.

In traditional blockchain interoperability, cross-chain data verification often requires extensive replication of state information, reliance on trusted intermediaries, or the deployment of complex bridge protocols that carry significant security risks. Succinct’s model eliminates these vulnerabilities by generating a single proof that confirms the correctness of a computation or transaction history—without requiring the verifier to replay the entire computation.

The PROVE token powers this ecosystem, serving as a utility asset for transaction verification, staking incentives, and potentially governance decisions as the protocol matures. The project’s official site, succinct.xyz, outlines its commitment to building fully open-source infrastructure, ensuring transparency and encouraging community-driven innovation.

Succinct (PROVE) Tokenomics and Supply Dynamics

The PROVE token has a maximum supply of 1,000,000,000 tokens, with 195,000,000 currently in circulation. This means less than 20% of the total supply is live on the market, which could influence future price movements as additional tokens are unlocked or distributed.

At the current market price, circulating supply valuation sits at roughly $189.55 million, with a fully diluted market cap nearing the $1 billion mark. This disparity between circulating and total supply valuations suggests that token release schedules, vesting periods, and allocation strategies will have a significant impact on price action in the medium term.

Given the relatively large total supply, PROVE’s tokenomics are designed for broad ecosystem participation rather than extreme scarcity. However, if demand for ZK-powered verification services grows rapidly, the utility-driven nature of the token could support substantial price appreciation even without a deflationary model.

Buy $PROVE

Succinct (PROVE) Market Performance and Volatility

Since its listing, PROVE has experienced a volatile trading pattern, common among early-stage infrastructure tokens that debut with significant attention. The chart over the past 48 hours shows sharp price movements, with an initial peak above $1.40 followed by a pullback to the $0.96 range.

This 27.5% drawdown reflects a combination of profit-taking from early participants and broader market conditions, which have recently seen increased selling pressure across multiple mid-cap altcoins. However, high 24-hour trading volume—approximately $125.38 million—indicates strong liquidity and sustained market interest, even in a corrective phase.

The volatility profile of PROVE suggests it is currently in a price discovery phase, with traders and investors assessing both the project’s immediate roadmap and its long-term adoption potential. Short-term swings are likely to remain pronounced until the market reaches a consensus on valuation relative to competitors in the ZK and interoperability sectors.

Technological Edge and Ecosystem Potential

Succinct’s approach to blockchain interoperability is rooted in efficiency. By leveraging ZKPs, the protocol can verify complex computations across chains without requiring redundant processing. This has significant implications for the scalability of multi-chain ecosystems.

Consider the example of Ethereum rollups: rather than requiring each rollup to independently verify the entire state of another chain, Succinct’s proofs could allow them to trustlessly accept results without rerunning the computations. This reduces latency, minimizes costs, and enhances security.

The project also has the potential to play a role in enterprise blockchain adoption. Large-scale financial institutions, supply chain networks, and government registries could integrate Succinct’s proof systems to ensure verifiable data exchange between siloed blockchain environments.

Partnerships and integrations will be critical in establishing Succinct’s market presence. If the team can secure collaborations with major L1 and L2 networks, the protocol could become a standard layer in blockchain interoperability—similar to how oracles like Chainlink became integral to DeFi.

Succinct (PROVE) Price Analysis and Key Levels

At its current level of $0.9762, PROVE sits just below the psychological $1.00 mark, which may act as a short-term resistance level if sellers continue to dominate. The immediate support appears to be around $0.90, a zone that traders will watch closely in the coming sessions. A sustained break below this level could see the price test the $0.80 area.

On the upside, reclaiming $1.00 and holding above it would be a bullish signal, potentially opening the path toward $1.20 and eventually $1.40—the recent high from its launch period. With trading volume still robust, momentum-driven moves are possible if the broader market sentiment improves or if the team releases significant partnership announcements.

Succinct (PROVE) Price Prediction 2025–2030

2025 – As Succinct builds its developer community and integrates its verification systems with leading blockchain networks, PROVE could stabilize in the $1.20 to $2.00 range, assuming steady market conditions and moderate adoption growth.

2026 – If key integrations with high-volume chains occur, demand for PROVE as a utility token could push the price into the $2.00 to $3.50 range. This would likely coincide with rising recognition of ZKPs as a critical scalability and interoperability solution.

2027 – As multi-chain ecosystems mature and interoperability becomes essential for mainstream dApp performance, PROVE could reach between $3.50 and $5.00, particularly if Succinct becomes a standard verification provider across DeFi and enterprise applications.

2028 – A fully developed ecosystem with recurring enterprise use cases could drive prices to the $5.00 to $8.00 range, especially if transaction volumes using Succinct’s proofs scale significantly.

2029 – In a bullish scenario with widespread adoption of ZK-based interoperability, PROVE could trade in the $8.00 to $12.00 range, reflecting both utility-driven demand and speculative interest.

2030 – By the end of the decade, if Succinct maintains technological leadership and benefits from mass Web3 adoption, PROVE could potentially see prices between $10.00 and $15.00, establishing itself as a core infrastructure token in the blockchain economy.

Risks and Considerations

Despite its potential, Succinct faces several risks. The ZK verification market is highly competitive, with projects like zkSync, StarkWare, and Scroll also vying for dominance. Additionally, reliance on token utility adoption means that any slowdown in ecosystem integrations could weigh heavily on PROVE’s price.

There is also the risk of over-saturation in the interoperability space, where too many solutions fragment the market instead of unifying it. For PROVE to sustain long-term value, the team must secure a clear leadership position and ensure that its technology becomes indispensable.

Conclusion

Succinct’s PROVE token represents a high-potential play on the future of trustless blockchain interoperability through zero-knowledge proofs. By focusing on compact, verifiable proofs, the project addresses a fundamental bottleneck in multi-chain communication, offering a scalable alternative to current cross-chain solutions.

While short-term volatility is inevitable, the long-term trajectory of PROVE will depend on the team’s ability to secure strategic partnerships, expand developer adoption, and maintain technological leadership. For investors and developers looking at the infrastructure side of Web3, Succinct offers a compelling vision of a more efficient and secure multi-chain future.