TRON (TRX) is rebounding strongly from the $0.27 support, approaching key resistance levels as participants watch whether momentum can finally push price beyond the critical $0.30 barrier.

TRX crypto is holding after defending the important $0.27 support region, with early signs of strengthening momentum appearing across multiple technical indicators. As broader market conditions remain mixed, TRX has begun forming a tightening structure that could set the stage for a breakout if buyers continue to step in.

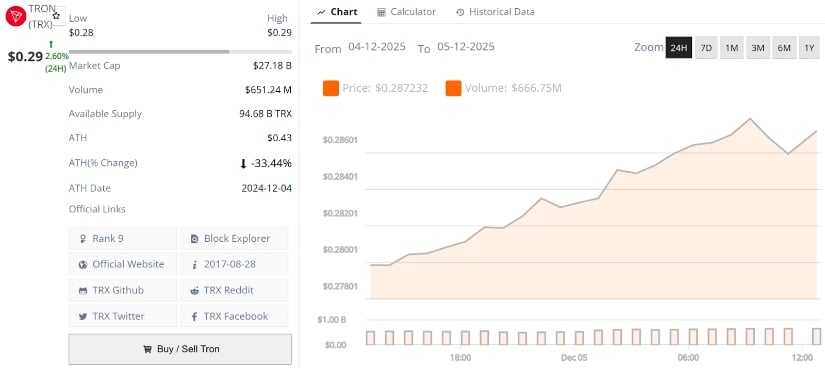

TRON (TRX) is trading at around $0.29, up 2.60% in the last 24 hours. Source: Brave New Coin

TRX crypto is currently trading near $0.29, up modestly in the last 24 hours, as the market reacts to a clean rebound from $0.27 and rising on-chain activity. Recent chart behavior suggests that TRX is once again approaching a decisive moment, particularly around the $0.285–$0.293 resistance band, which has capped upside attempts throughout the week.

This emerging stability has kept the TRX price prediction outlook focused on whether momentum can build above these critical regions or whether the price will stall and revisit lower supports.

Volume-Backed Rebound From $0.27 Adds Early Strength

Technical signals show encouraging behavior at local support. Umair Crypto tracks TRX structure closely, noting that the $0.27 reaction “did exactly what it was supposed to do,” delivering a controlled rebound accompanied by rising volume, historically one of the first conditions that precedes a trend inflection.

TRON’s rebound from the $0.27 demand zone shows rising volume support, signaling early strength as the market waits for a decisive flip of the $0.285 pivot. Source: Umair Crypto via X

This type of price-volume behavior is typical during early reversal phases, especially when the bounce forms near a previously accumulated level. TRX formed a clear demand block at $0.27–$0.275, and buyers have defended this zone consistently across multiple retests. However, as Umair highlighted, the chart remains “stuck until it flips $0.285.”

This $0.285 pivot is structurally important, a former support turned resistance, and TRX must reclaim it to validate any meaningful upward trend shift. A daily close above $0.285 opens the door towards the next liquidity cluster near $0.293–$0.30, while rejection would likely send price back towards $0.276 or even $0.27 for another retest.

Ascending Trendline Support Strengthens Bullish Case

A second widely discussed factor is TRX’s ascending trendline, highlighted by analyst Aman. According to his chart, TRX continues to respect its rising diagonal support, creating a sequence of higher lows since late November. This rising structure often implies gradual buyer accumulation.

TRX continues to build higher lows along its ascending trendline, reinforcing steady buyer accumulation and keeping the bullish structure intact. Source: Aman via X

TRX outlook suggests a clear roadmap:

Hold above the trendline (~$0.278–$0.281)

Retest overhead resistance at $0.285–$0.293

Break and flip it into support

Push towards the $0.30–$0.315 zone

This trendline continues to act as TRX’s structural backbone. As long as TRX price stays above it, the medium-term bias slightly favors upside scenarios.

On-Chain Growth Adds Fundamental Tailwind

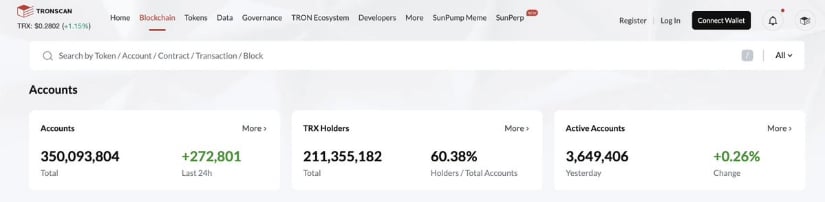

Beyond technicals, TRON’s ecosystem continues to expand significantly. Daddy ZeeJay reported that TRON has now surpassed 350 million total accounts, an impressive milestone that reinforces its position as one of the largest active blockchain networks globally.

More importantly, TRX recorded +272,801 new accounts in the last 24 hours, showing strong organic network participation even during market consolidation phases. This surge in ecosystem activity serves as a supportive backdrop for the TRX price prediction outlook going into 2026.

TRON surpasses 350M total accounts, adding 272k new users in 24 hours, showing powerful on-chain growth. Source: Daddy ZeeJay via X

Fibonacci Suggests $0.2936 and $0.3012 as Key Upside Levels

Bull Bear Trades highlighted a short-term Fibonacci structure that aligns closely with existing resistance zones on the TRX chart. According to his projection, the first significant upside checkpoint sits at the 0.75 Fibonacci level near $0.2936, which also matches prior liquidity clusters observed during previous rebounds. If TRX manages to reclaim the $0.285 pivot, a move into this zone becomes increasingly probable.

Fibonacci levels at $0.2936 and $0.3012 now align with TRX’s key resistance zones, marking the next major targets if price reclaims $0.285. Source: Bull Bear Trades via X

Beyond that, the full 1.0 Fib extension around $0.3012 acts as the next critical target. A breakout above this threshold would represent more than a routine relief rally; it would signal a shift into a fresh recovery phase with room for TRX to explore higher regions. In such a scenario, the TRX crypto could begin moving towards the $0.315–$0.322 resistance band.

TRON Price Prediction: Can TRX Target $0.40? (Speculative Outlook)

Given the improving momentum, stronger trendline structure, and expanding on-chain activity, TRX crypto’s next phase of price discovery could extend beyond the immediate $0.30 barrier and begin working towards the broader $0.40 region. For this scenario to materialize, TRX first needs to secure a sustained reclaim of $0.285, followed by a clean break through the Fibonacci cluster between $0.2936 and $0.3012. These levels remain the gateway to any mid-range expansion.

If momentum continues to build, TRX could work its way into the $0.315–$0.322 liquidity band, an area that historically attracts strong reactions. A bullish continuation above that zone would open the door towards $0.35 and, under favorable market conditions, a speculative extension into the $0.38 to $0.40 region.