Coinbase expects the crypto market to enter a recovery phase in December as liquidity improves and selling pressure from long-time Bitcoin holders eases.

On December 5, the US-based crypto trading platform said market conditions have shifted in recent weeks, pointing to fresh capital inflows, tighter spreads, and stronger macro support.

Liquidity Conditions Improve as Fed Cut Odds Rise

The exchange highlighted a jump in expectations for a Federal Reserve rate cut, with CME FedWatch showing odds near 90 percent for the December 10 meeting.

It added that the recovery in liquidity marks a sharp turn from the persistent outflows that defined October and November.

Indeed, broader money-supply data appear to support the thesis. Federal Reserve figures show M2 has climbed to a record $22.3 trillion, topping its early-2022 peak after a rare multiyear contraction.

Analysts often track M2 to understand shifts in liquidity and inflation expectations. Moreover, increased liquidity has historically aligned with stronger Bitcoin performance, given the asset’s fixed supply of 21 million coins.

At the same time, Coinbase said short-dollar positioning looks appealing at current levels, which could draw more risk-seeking investors back into crypto.

Additionally, the firm also argued that the so-called AI trade still has momentum and continues to pull money toward digital-asset sectors tied to automation and computing demand.

Long-Term Bitcoin Holders Pull Back From Selling

Notably, on-chain indicators point in the same direction.

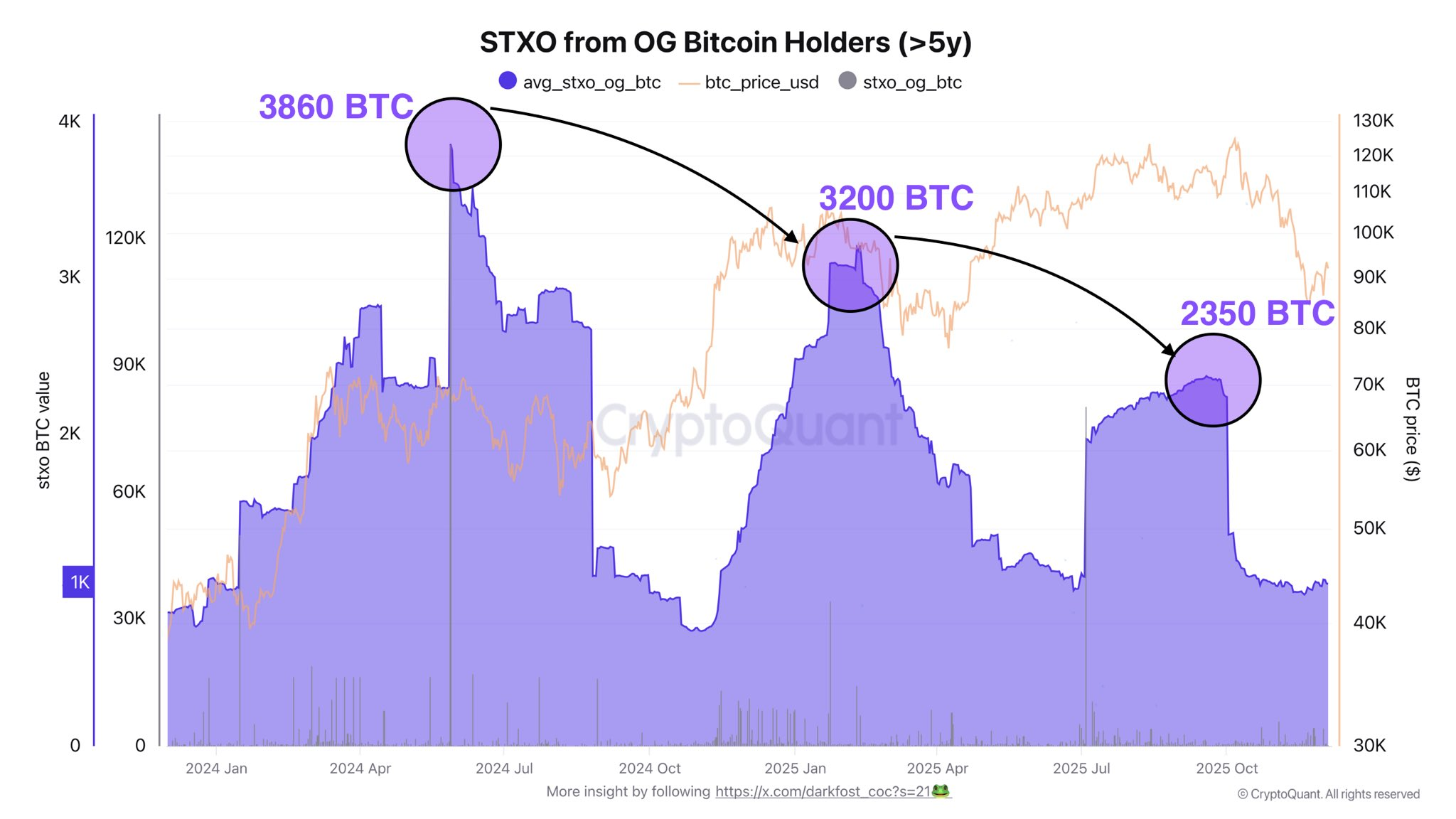

Darkfost, an on-chain researcher at CryptoQuant, said spending from Bitcoin wallets older than five years has fallen sharply after months of elevated activity from this cohort.

Bitcoin Long-Term Holders Selling. Source: CryptoQuant

He noted that average daily sales from these long-term holders have dropped to about 1,000 BTC from roughly 2,350 BTC on a 90-day moving basis. That metric often signals pressure from investors who accumulated coins at lower historical price bands, including around $30,000.

Darkfost added that declines in UTXO and spent-output activity point to easing strain as the market cycle advances. So, the reduced selling from “OG” holders gives Bitcoin more room to consolidate after a volatile autumn.

“This data suggests that selling pressure from OGs is easing, which gives the market a bit more breathing room. It worth noting that their selling pressure appears to be decreasing as the cycle progresses, with the STXO peaks (90-dma) from these OGs becoming lower and lower,” the analyst explained.

Taken together, improving liquidity, supportive macro indicators, and softening supply pressure set the stage for a stronger December. If momentum holds, Bitcoin could record its first positive December finish since 2023.