Strategy’s Bitcoin buying stalls as markets turn defensive, driving attention to the DeepSnitch AI price prediction after DSNT jumped 70% in presale.

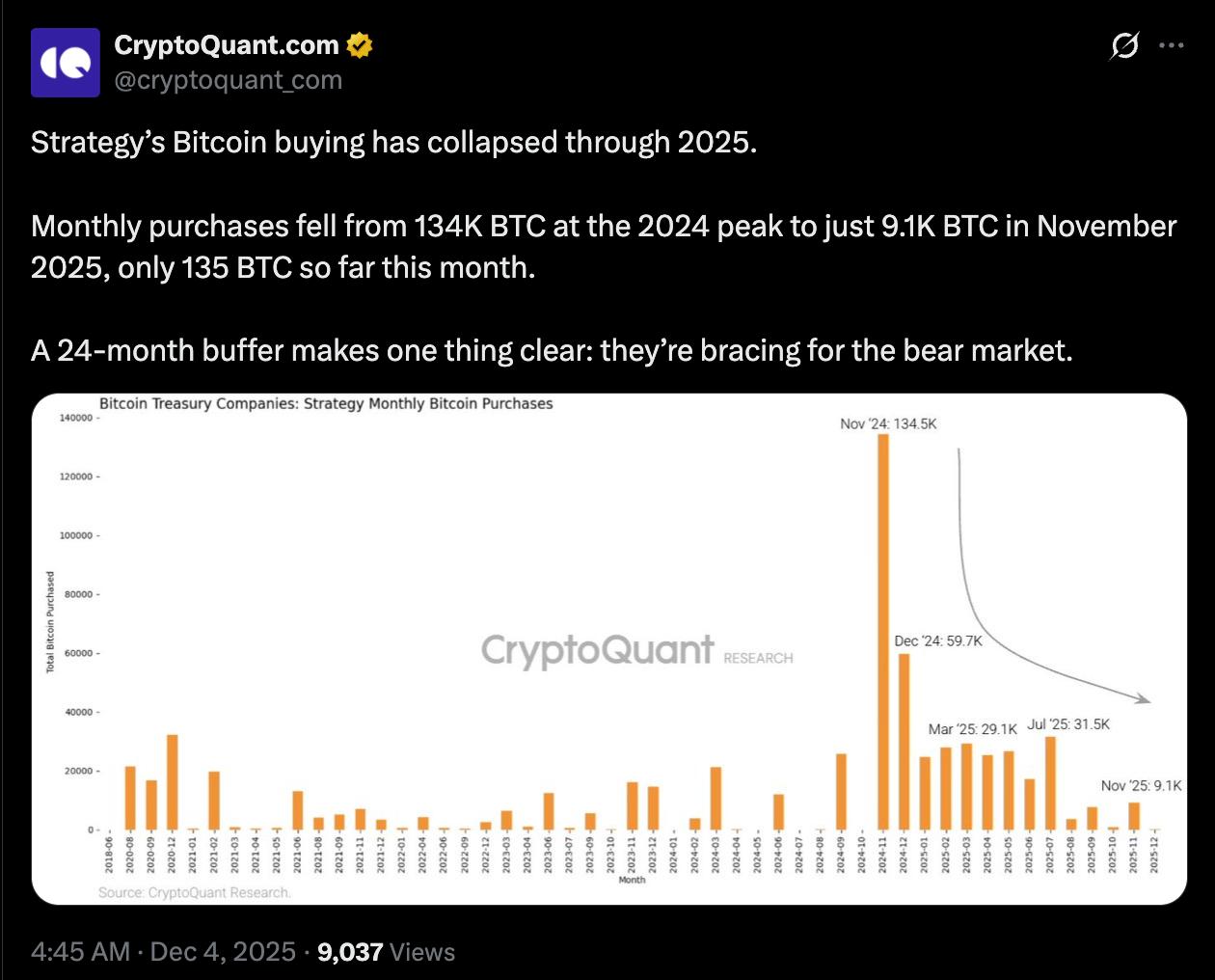

A sharp shift in corporate Bitcoin behavior is unfolding after Strategy reduced its monthly BTC purchases to levels not seen since 2020. CryptoQuant reported that Strategy’s buying fell from a peak of 134,000 BTC at the end of 2024 to only 9,100 BTC in November, with just 135 BTC acquired so far in December. This signals a defensive posture as the company prepares for prolonged market pressure, drawing close attention from traders who view institutional accumulation as a key market indicator.

While Strategy strengthens its reserves and explores ways to navigate its index eligibility challenges, the broader market is reassessing where growth may come from next. That reassessment is steering many toward early-stage projects with measurable momentum. Nowhere is this more evident than in the DeepSnitch AI price prediction, which is rising fast with its presale raising over $666,000 already at a price of just $0.02629.

DeepSnitch AI forecast enters the spotlight as Strategy reduces BTC accumulation

Strategy, the largest corporate holder of Bitcoin, has sharply reduced its monthly BTC purchases, according to a detailed report from CryptoQuant. The data shows a contraction from 134,000 BTC at the late-2024 peak to 9,100 BTC in November. Only 135 BTC have been recorded so far this month, which analysts interpret as preparation for a drawn-out downturn in the crypto treasury market.

The company still completed a significant acquisition on Nov. 17, adding 8,178 BTC valued at roughly $835.5 million. Strategy now holds 649,870 BTC, worth about $58.7 billion at current estimates. The firm has also established a $1.4 billion cash reserve to manage dividend and debt obligations, with plans to extend this reserve to create a 24-month buffer.

This defensive stance has shifted trader attention toward projects that are still in growth phases rather than companies tightening balance sheets. That shift is part of what drives new interest in the DeepSnitch AI forecast, especially as presale activity rises while the broader market braces for slower institutional accumulation.

Best crypto to invest in December 2025: Deepsnitch AI’s price prediction makes it a top pick

1. DeepSnitch AI (DSNT): DSNT long-term outlook strengthens amid market volatility

DeepSnitch AI is an AI trading toolkit built to give you direct, verifiable trading information before you enter the market. Its five AI agents study contract age, developer activity, LP conditions, and on-chain behavior that often signals risk, helping users avoid guesswork and make better decisions.

Traders use it to filter out projects that could drain capital, which is why interest in the DeepSnitch AI price prediction has grown during a period marked by defensive positioning from major firms.

The presale has already raised over $666,000 in Stage 2 at a price of $0.02629 (up 70%). Many see this as early confirmation that demand is forming ahead of launch. As more investors search for tools with real utility, the DeepSnitch AI forecast is quickly gaining weight, since the project focuses on safety features that benefit any market condition.

There are two core factors that support the DSNT long-term outlook. First, AI tokens with limited utility have already shown strong performance in previous cycles, so imagine what an AI token with actual utility will do when it goes live.

Second, DeepSnitch AI offers constant monitoring inside Telegram, whose 1 billion users give DeepSnitch AI a very wide potential user base. These factors shape ongoing DeepSnitch AI price prediction as buyers prepare for the tokens’ launch in January 2026.

2. Pudgy Penguins (PENGU): Current performance and price outlook

Pudgy Penguins (PENGU) has held steady after a volatile stretch, trading near $0.01068. The token gained 2.1% at the start of December, outperforming the broader market but trailing the stronger performance seen across the wider Ethereum ecosystem. Market cap sits around $672 million with a circulating supply above 62 billion tokens.

Recent gains followed a 37% rally from December 1-2 tied to new partnerships and growing cultural visibility. That momentum has weakened as large holders reduced positions and perpetual traders shifted net-short. This creates a mixed setup for the next move. PENGU remains far below its peak of $0.06845 from last year, which guides a cautious near-term outlook, though community sentiment continues to lean positive.

The glaring issue with a token like PENGU is that most of its upside is likely already priced in, unlike a smaller early-stage token like the DeepSnitch AI price prediction.

PENGU: 1-Year Market Structure Analysis

The 1-year chart of Pudgy Penguins’ PENGU token reveals a pronounced cyclical pattern marked by two major distribution phases and extended periods of consolidation. Early in the year, the token traded near the $0.04–$0.05 range before entering a steep decline that bottomed out around $0.01 in late Q1, forming a broad accumulation base that lasted through April and May.

A strong mid-year breakout followed, propelling PENGU back toward the $0.03–$0.04 resistance region, where multiple rejections signaled heavy supply and weakening bullish momentum. From late summer into early autumn, the chart shows a series of lower highs, indicating progressive seller dominance and a shift into a sustained downtrend. By November, the price had returned to the critical $0.01–$0.015 support zone, reflecting a full retracement of the mid-year rally. Trading volume during this decline remained relatively muted, suggesting gradual distribution rather than capitulation. Overall, PENGU’s yearly structure signals a market that has completed a full boom-and-bust cycle, with current levels representing long-term support but no confirmed reversal pattern yet in place.

3. Pepe (PEPE): Firm activity but weak momentum compared to DeepSnitch AI’s price prediction

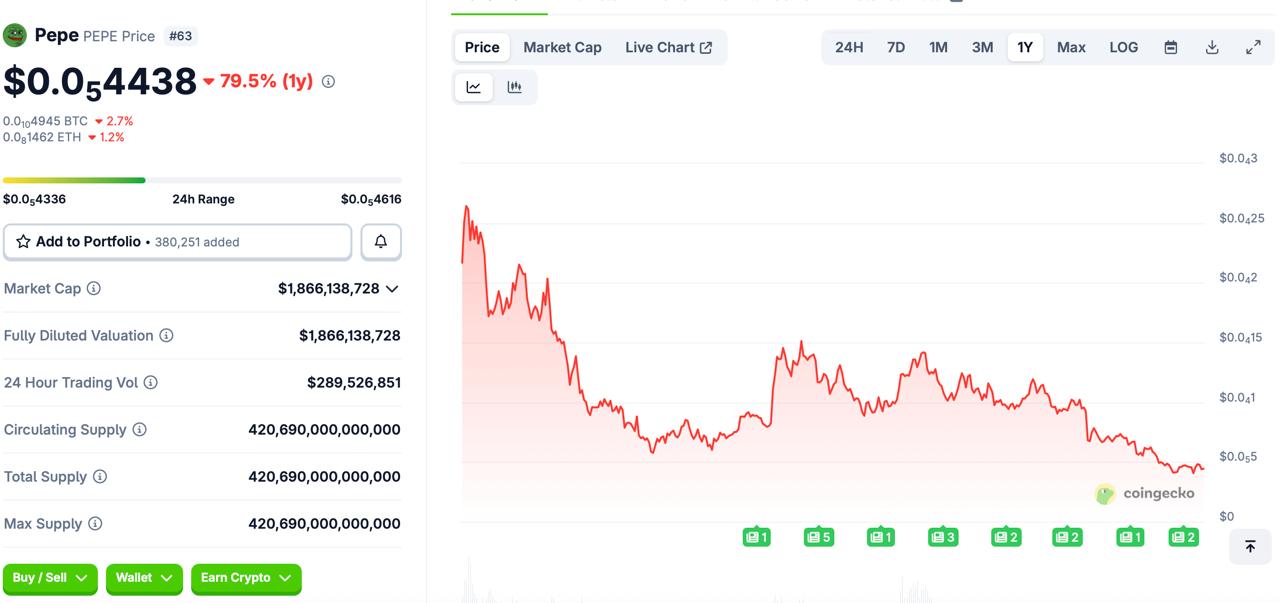

Pepe (PEPE) continues to show firm activity in the meme-coin sector, trading near $0.0000044436 with a daily volume above $289 million. The token lost about 3% this week. Its market cap stands at $1.86 billion, with the full supply already in circulation.

Recent reports highlight weakening momentum following an extended drawdown. Analysts noted rising exchange inflows and patterns that could extend the decline, with some suggesting the token remains vulnerable after falling more than 80% from last year’s peak.

At the same time, community sentiment remains positive, and integration updates, such as support from Teller Lending Protocol, have helped stabilize short-term trading. Again, traders looking for 100x upside or more will likely be better off looking into DeepSnitch AI’s price prediction, as its presale momentum appears likely to drive it to great success.

PEPE – 1-Year Market Structure Analysis

The 1-year chart of PEPE shows a persistent macro downtrend, characterized by a series of lower highs and lower lows that have steadily pushed the token from the $0.00043 region down toward the $0.000055 zone. Early in the year, PEPE attempted several relief rallies, but each upward move failed to break its descending resistance structure, confirming continuous seller control.

By mid-year, the token entered a prolonged consolidation phase between roughly $0.00009 and $0.00013, marking a temporary stabilization but not a true accumulation pattern. A brief breakout attempt late in the summer lifted price back toward $0.00015, yet this move was quickly rejected, reinforcing a broader bearish market structure. Through autumn and into winter, PEPE’s price gradually bled lower, losing key support levels and trending toward the lower boundary of its yearly range. Trading volume has remained relatively soft during the decline, suggesting a slow, structural unwind rather than capitulation. Overall, the chart highlights a year defined by relentless downward pressure, with no confirmed reversal signals yet emerging from the current price action.

What’s the verdict?

DeepSnitch AI stands out in a market where large firms are moving cautiously, and traders are searching for early entries with room to grow.

At its current presale size of just $666,000, even moderate demand can influence pricing, which is something large-cap tokens like PENGU and PEPE cannot match. The project’s 70% rise so far shows clear interest is forming ahead of launch.