BitMine expanded its Ethereum holdings this week with nearly $200 million in fresh purchases, deepening its lead as the largest single holder of the asset.

The move comes as ETH trades near a one-month low and follows a period of steady distribution by medium-sized wallets, according to on-chain data.

BitMine’s Acquisition Comes Amid Smaller ETH Holders Offload

Lookonchain, citing Arkham Intelligence, reported that BitMine bought 22,676 ETH from BitGo on December 6 for about $68.7 million. The transaction suggests an average purchase price of roughly $3,028 per token.

Notably, the firm had already acquired 41,946 ETH a day earlier from FalconX and BitGo for about $130.8 million.

These deals build on BitMine’s disclosure last week that it held 3.73 million ETH as of November 30. At current prices, the stash is worth more than $11 billion.

BitMine also reported holdings of 192 BTC, a $36 million position in Eightco Holdings, and $882 million in cash.

Strategy ETH Reserve data shows the company now holds more ETH than its next five peers combined, including SharpLink and the Ethereum Foundation.

The scale of its treasury places BitMine as the second-largest corporate crypto holder by value, behind only Michael Saylor-led Strategy, the largest corporate holder of Bitcoin.

The latest purchases come during a soft stretch for ETH. BeInCrypto data shows the token has fallen more than 10% over the past month to about $3,027.

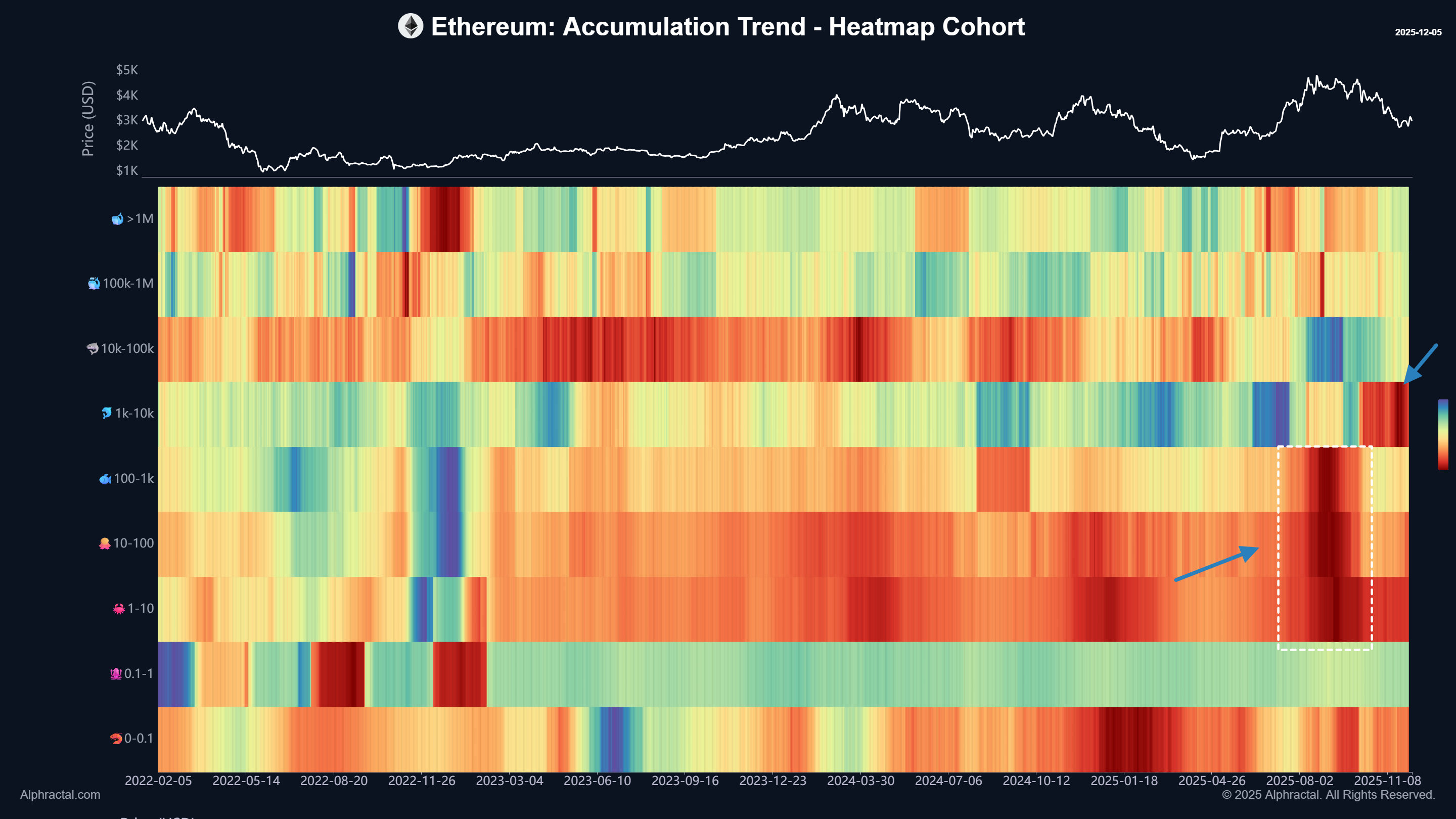

Alphractal’s Ethereum Accumulation Heatmap indicates that wallets holding 1 to 10,000 ETH sold heavily near this cycle’s recent peak. Those addresses continue to offload tokens, adding pressure to the market.

Ethereum Accumulation Trend. Source: Alphractal

However, larger whales with more than 10,000 ETH have shown limited activity, with light distribution but no strong accumulation.

Despite the weakness, several analysts maintain a bullish long-term view.

Fundstrat CEO and BitMine Chair Tom Lee said Ethereum could reach $12,000 if Bitcoin climbs to $250,000, citing the historical relationship between both assets and growing demand for tokenized real-world assets.

He added that ETH could rise as high as $62,000 if its valuation ratio to Bitcoin expands over time.