Arbitrum (ARB) is approaching a crucial support zone near $0.20, with oversold technicals and rising ecosystem activity hinting at a potential early-stage recovery.

Arbitrum is trading near $0.20 after another sharp weekly decline, but the broader market is beginning to identify early signs of stabilization in both technical structure and ecosystem fundamentals. Even as sentiment remains weak, ARB’s current compression around the $0.20 support level is starting to draw speculative interest from participants.

Fundamentals Strengthen Despite Price Weakness

Bledi notes that Arbitrum’s fundamentals remain solid, rising DEX volume, strong TVL, and steady ecosystem activity, yet the token continues to trade weakly. That disconnect suggests ARB may be undervalued, but it also reflects broader market risk-off sentiment that has kept buyers cautious despite improving metrics.

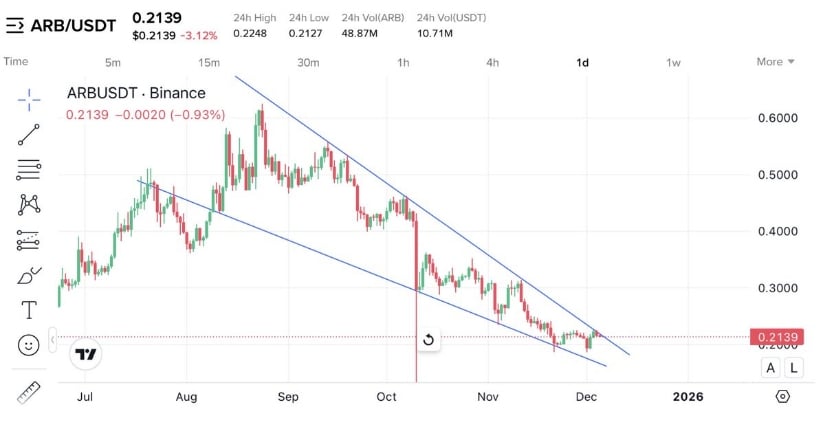

Arbitrum’s on-chain activity, rising DEX volume, and tightening falling-wedge structure highlight growing recovery potential despite the ongoing price slump. Source: Bledi via X

At the same time, ARB’s chart shows this weakness isn’t chaotic, it’s been moving neatly inside a falling wedge, a structure that typically forms during the final phases of a downtrend. Price is now sitting near the lower boundary around $0.21, where reactions have repeatedly appeared. If ARB can break out above the upper trendline near $0.24 to $0.25, it would be the first real sign of strength and a potential shift towards a recovery phase.

Accumulation Structures and Weekly Oversold Signals Emerge

On the weekly chart, Degen Sosa’s market structure highlights long-term Bollinger Band compression, historically a precursor to volatility expansions. ARB’s price is sitting at the lower band with diminishing sell volume, conditions that often align with accumulation phases.

ARB’s weekly structure, tightening Bollinger Bands, and fading sell volume point toward a classic accumulation zone forming at long-term support. Source: Degen Sosa via X

Momentum indicators from weekly RSI and volatility measures show ARB approaching oversold territory, while realized volume readings cluster around a long-standing demand zone. Traders monitoring this structure argue that the market may be entering a late-stage exhaustion phase, where downside becomes limited unless a macro shock occurs.

Luci’s chart strengthens this argument by outlining a multi-month accumulation box stretching roughly from $0.18 at the base to about $0.26 at the upper boundary. His structure suggests that if ARB maintains support above the lower range and reclaims the mid-band near $0.22, the price could start working its way toward the liquidity shelf around $0.28–$0.30, which would be the first real confirmation of a shift in trend. From there, his projected pathway shows a possible extension towards $0.55–$0.60 over the next one to two months.

The accumulation range highlights ARB’s potential path toward $0.28–$0.30, with a broader breakout eyeing $0.55–$0.60 if momentum returns. Source: Luci via X

ARB Short-Term Technical Analysis

Short-term movements remain highly volatile. The Moon Show highlighted a key inflection level between $0.19 and $0.194, labeling it as a must-hold support. If this zone breaks, ARB risks making new lows, potentially sliding into the $0.185–$0.190 liquidity pocket.

ARB’s must-hold support at $0.19, with rebound targets towards $0.205–$0.225 if buyers step in. Source: The Moon Show via X

However, if price consolidates and rebounds from this support, the short-term structure allows for a corrective bounce towards:

$0.205

$0.215

$0.225

These levels align with previous supply blocks that triggered strong rejections, meaning ARB will need meaningful volume to push through them. The Moon Show’s scenario paints a balanced picture: short-term risk remains high, but so does the possibility of a relief rally if buyers defend critical support.

Final Thoughts

Arbitrum sits at a defining moment: while price remains under pressure, the network’s fundamentals, from TVL growth to builder activity, continue to strengthen beneath the surface. Historically, such divergences often precede recovery phases, provided key supports hold, and broader market sentiment improves.

If buyers defend the critical $0.19–$0.20 level, ARB could begin transitioning from capitulation into accumulation, setting the stage for a potential multi-month recovery.