Pudgy Penguins (PENGU) is holding tightly above a crucial yearly support zone, with buyers and sellers preparing for the next decisive move that could shape its 2026 trajectory.

Pudgy Penguins (PENGU) is attempting to hold its market structure as price trades directly above a long-standing support area that has shaped every major reversal. After a steady decline earlier this month, PENGU is now reacting from the $0.0100–$0.0110 zone, showing early signs of stabilization despite broader market uncertainty.

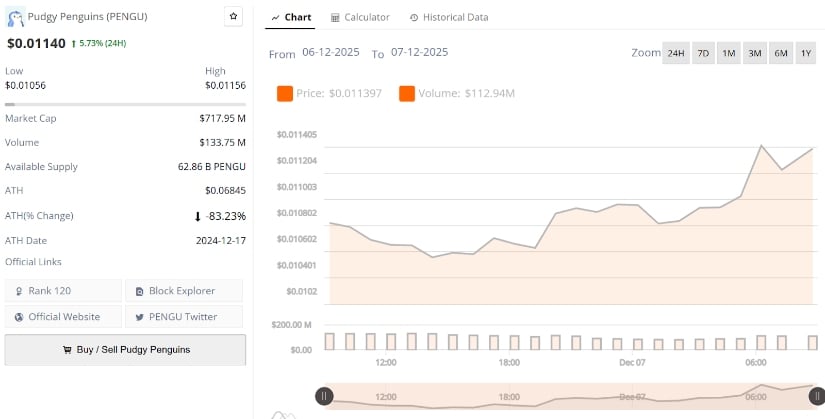

Recent Brave New Coin data shows PENGU trading around $0.01140, up 5.73% in the past 24 hours. Although the recovery remains shallow, the asset is beginning to show intraday strength after finding bids at the same zone that triggered several rallies this year. This has turned the current region into a pivotal battleground between buyers defending structure and sellers pressing for continuation.

Pudgy Penguins’ current price is $0.01140, up 5.73% in the last 24 hours. Source: Brave New Coin

Support at $0.010 Holds as Bulls Attempt a First Reaction

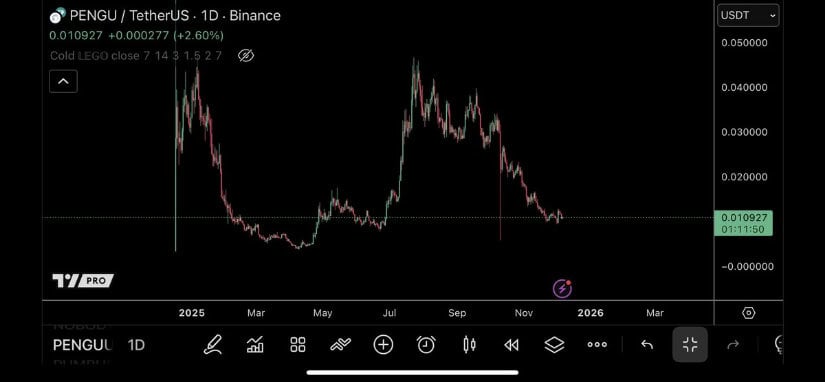

TraderSZ’s chart has shown that PENGU’s price has repeatedly reacted from the $0.0100–$0.0105 region throughout 2025, forming a multi-touch demand zone. Notably, daily candles have not closed significantly below this area during the past several major pullbacks, reinforcing its importance.

PENGU shows early reaction signs at the same support level that has held throughout the year. Source: TraderSZ via X

Richie’s chart adds further context, showing a clean reaction from the golden pocket (0.618–0.65 Fib), an area known for producing strong reversal attempts when defended. Despite weekend volume being lower than usual, the response from this Fib region has been encouraging, with initial intraday pushes attempting to reclaim momentum.

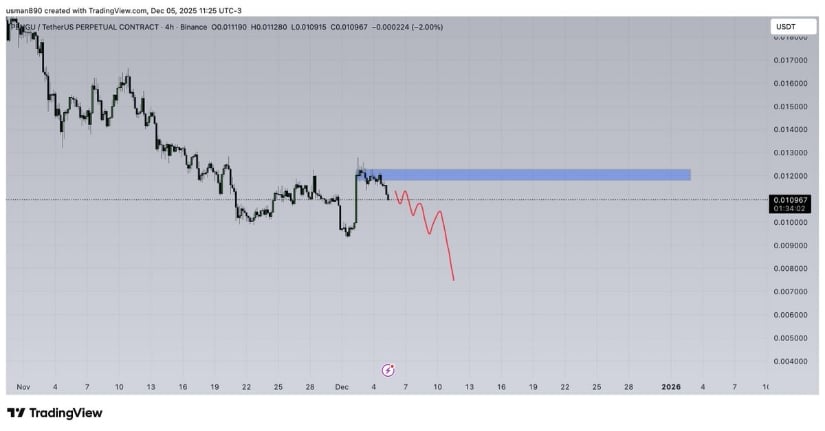

However, the broader context remains mixed. Knight’s bearish structure outlines a scenario where Pudgy Penguins could revisit $0.0090 to $0.0080 pockets if buyers fail to maintain the current defense. This dynamic has created a tense but balanced structure where both outcomes remain firmly possible.

Analyst’s outlook warns that a breakdown could send PENGU back towards the $0.0090–$0.0080 zone if bulls lose control at support. Source: Knight via X

Market Sentiment Improves as Analyst Highlights Key Technical Level

Market sentiment around PENGU has started improving modestly as on-chain analyst and chartist points to early signs of stabilization. Richie notes that the weekend reaction from the golden pocket remains intact, provided Bitcoin does not produce new volatility shocks.

A potential higher-low structure emerges as PENGU reacts to the golden pocket support. Source: Richie via X

Richie notes that this reclaim attempt remains valid as long as Bitcoin does not trigger fresh volatility shocks. He also highlights that PENGU’s next important challenge sits at $0.0125 and $0.0135 levels. Clearing this region with healthy volume would mark Pudgy Penguins’ first meaningful momentum shift since the November decline. While the asset is not yet in a confirmed trend reversal, the reaction at support, combined with the higher-low formation, suggests that sentiment is slowly leaning towards cautious optimism.

PENGU Technical Outlook

PENGU’s technical structure has tightened significantly over the past two weeks, compressing the range and setting up a potential larger move. The daily chart shows price forming a horizontal base along the support zone while repeatedly rejecting from short-term resistance levels.

Momentum indicators are showing slight improvements:

RSI is stabilizing after approaching oversold territory.

Volume spikes coincide with reactions at support, indicating buyers remain active.

Still, none of these indicators confirms a trend reversal yet. PENGU remains highly sensitive to Bitcoin’s intraday fluctuations, and any breakdown in BTC could drag Pudgy Penguins back towards its lower liquidity zones.

Key support:

$0.0100–$0.0105

Key resistance:

$0.0125–$0.0135

Major breakout level:

$0.0160, which would mark a structural shift and open targets towards the mid-range zone.

PENGU Price Predictions for 2026

Vuori Trading’s projection, which targets a dramatic rise toward $0.40+ in 2026, represents the most aggressive bullish scenario for PENGU currently on the table. That trajectory, while speculative, is technically valid only under a chain of confirmations:

First, the current support at $0.010–$0.011 must hold decisively. If PENGU fails to defend this zone, the entire bullish chain becomes invalid.

Second, PENGU needs a confirmed breakout above short-term resistance in the $0.0125–$0.0135 range, ideally followed by a retest and bounce.

Thirdly, the broader market conditions must improve.

If those conditions align, PENGU could follow this path: a rebound to $0.016–$0.020, then a mid-cycle move towards $0.025 to $0.030, before attacking higher liquidity bands, ultimately reaching $0.35 to $0.45 levels as liquidity returns and broader cycle momentum support the rise.

PENGU could aim for $0.40+, but only if key supports hold, and resistance breaks are confirmed. Source: Vuori Trading via X

Final Thoughts

Pudgy Penguins is sitting at one of its most important levels of the year. Support continues to hold, but resistance remains firm, leaving the asset in a tight, undecided range. The next break from this equilibrium will likely determine whether PENGU begins a meaningful recovery or falls into a deeper support zone.